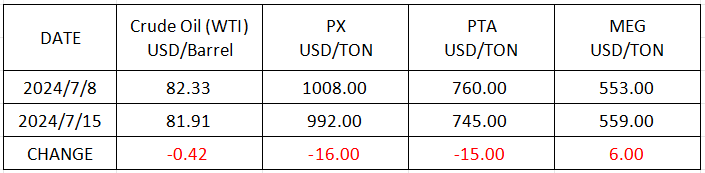

Market Trend (Jul.1st - Jul. 15th, 2024)

Market Trend

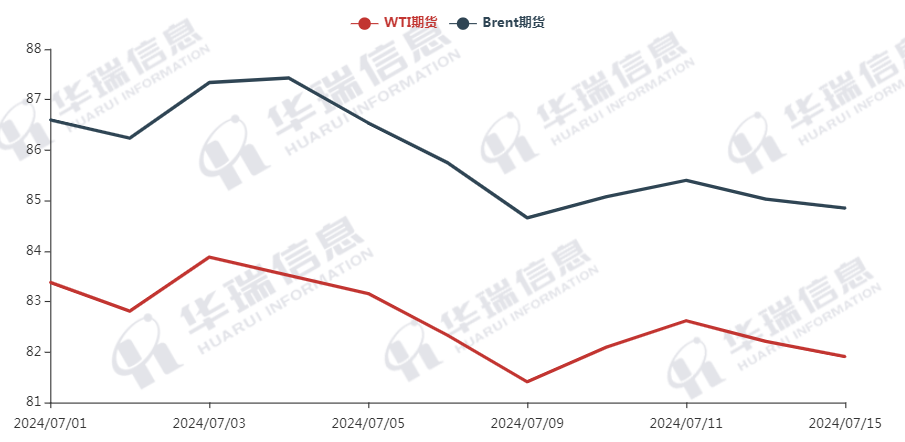

WTI/Brent ( July 1st - July 15th, 2024 )

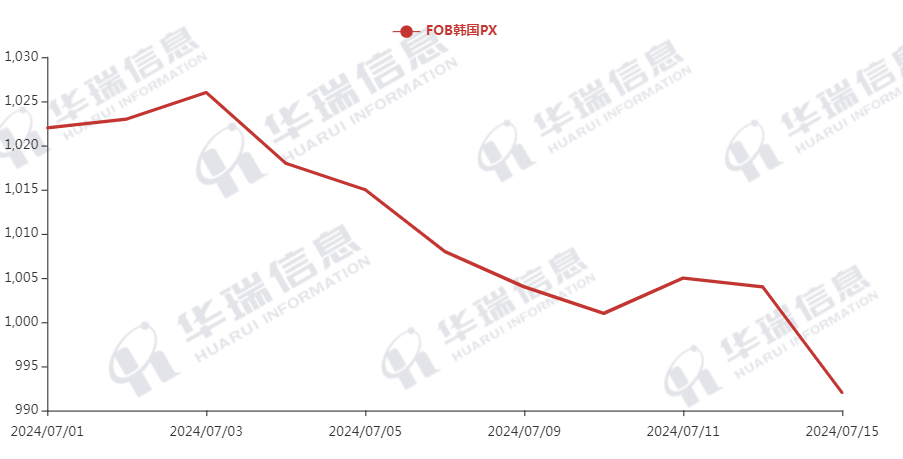

PX ( July 1st - July 15th, 2024 )

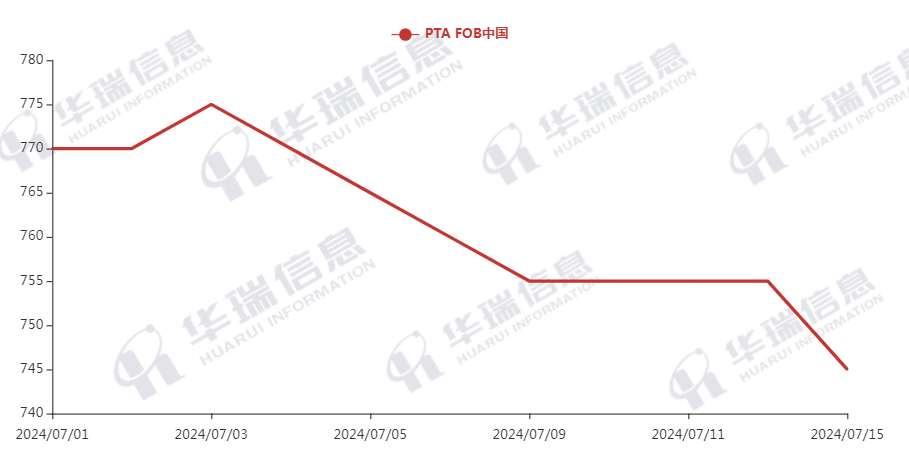

PTA ( July 1st - July 15th, 2024 )

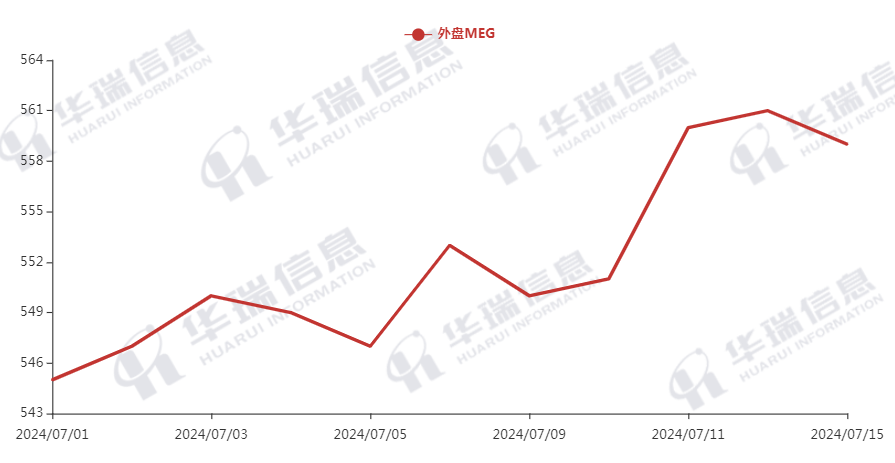

MEG ( July 1st - July 15th, 2024 )

1. Polyester Filament

There was no news guidance in the market, and overnight crude oil saw minor volatility with a slowdown in trading volume. The cost of polyester raw material behaves oscillation accordingly.

On production side, most factories have already running with loss, plus the hot weather’s coming, the cost, like production and labor, is rising, so the mainstream factories are still willing to maintain price with the operation of production cuts. Just yesterday, several major factories hold a meeting to jointly reduce production and maintain prices. On the whole,the market proceeds according to rigid demand and deal is based on negotiation. It’s recommended that consider an on-demand purchasing strategy to reduce inventory holding costs.

2. PSF

The recent PSF market was general. In the spot market, most early morning quotations remained stable, with transactions conducted based on negotiated orders.It’s recommended that continuously monitor market trends and price fluctuations to respond to market changes.

3.VSF

The VSF market is operating moderately, with fewer low-price offerings from traders. Factories are delivering normally and are not currently pursuing excessive transactions,they prefer remain price firm. It’s recommended that maintain a normal inventory of raw materials and replenish monthly usage as usual during promotional periods.

4. Spandex

The spandex market keeps stable. It’s recommended that buyers follow up based on orders and demand.

5. Nylon

Pure benzene is weakly declining, CPL prices are temporarily stable but chips remain weak, which will continue to pressure CPL. Nylon filament transactions are relatively light, but operations remain stable. The weak trend in the Nylon 66 industry chain remains unchanged. It is recommended that consider stocking up appropriately when prices are low.