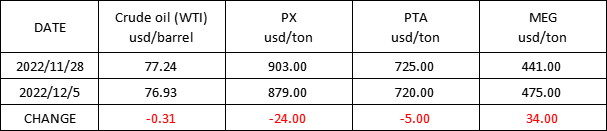

Market Trend (21ST NOV.,2022- 05TH DEC.,2022)

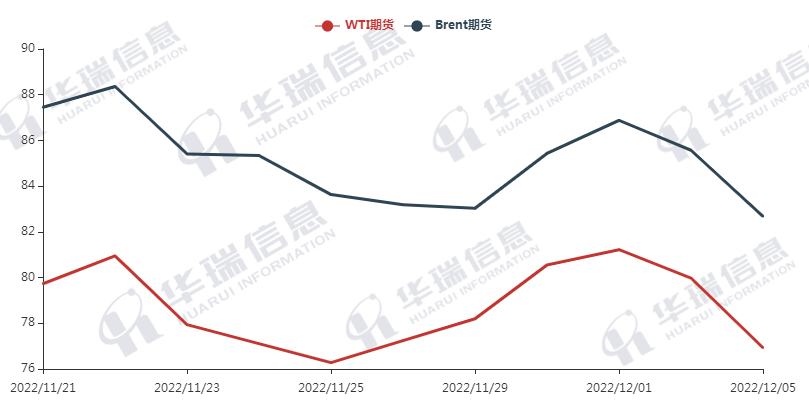

WTI /Brent (21ST NOV.,2022- 05TH DEC.,2022)

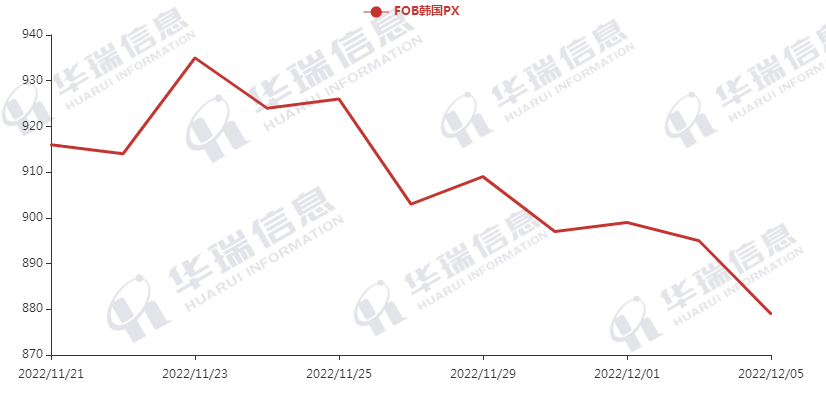

PX (21ST NOV.,2022- 05TH DEC.,2022)

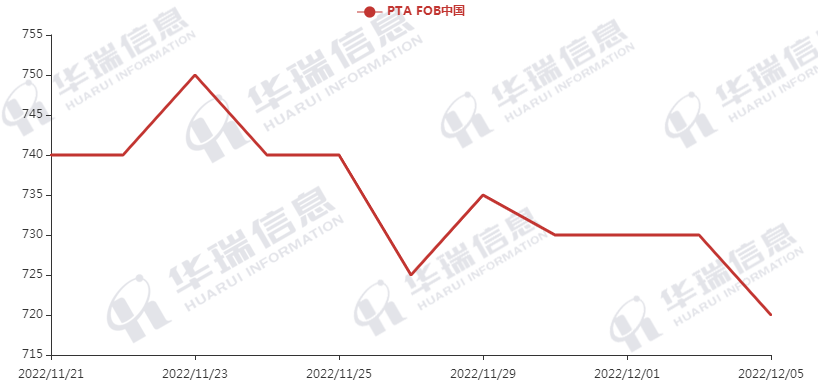

PTA (21ST NOV.,2022- 05TH DEC.,2022)

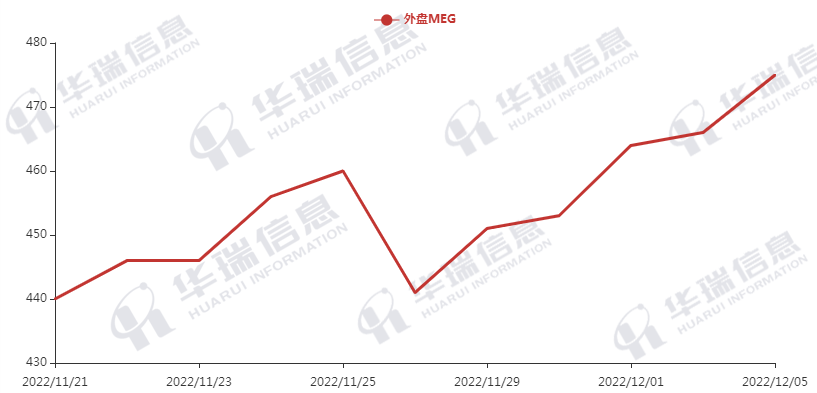

MEG (21ST NOV.,2022- 05TH DEC.,2022)

1. Polyester filament

With the relaxation of Chinese epidemic prevention policy and the improvement of domestic macro atmosphere, which drove polyester sales to rise in a stage.

On production side, polyester capacity has dropped to a low level and factories are still willing to reduce capacity or even stop production, plus their cash flow loss, and downstream stocked up moderately, then factories increased prices around 50-100 cny/kg, the overall production and sales situation was not bad. Today’s price tends to be stable. It’s expected that polyester products prices keep fluctuating. But for long-term, still need to focus on the crude oil price, terminal demand and the situation of factories’ reduction of output.

2. PSF

The PSF mainly keep stable and transaction is based on negotiation. The futures of PSF dropped, but there are no major changes in the spot market because the low output.

3.VSF

Currently, the VSF transaction atmosphere is general. The demand for downstream markets is average, and it is mainly based on just needing orders. The whole market is keeping watch-and-see attitude and see if there are any sales policies to carry out and consider if they need to prepare for stock before the New Year.

4.Spandex

There is no significant changes in spandex market.The market still stays in a buyer-oriented market and the deal of firm demand is based on negotiation.

5. Nylon

At present, under the weakening of downstream demand, the price of CPL and CHIPS spot decreased. On the whole, the transactions of the nylon market are still dominated by just-need to purchase.