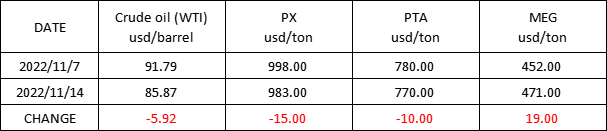

Market Trend(31ST OCT.,2022- 14TH NOV.,2022)

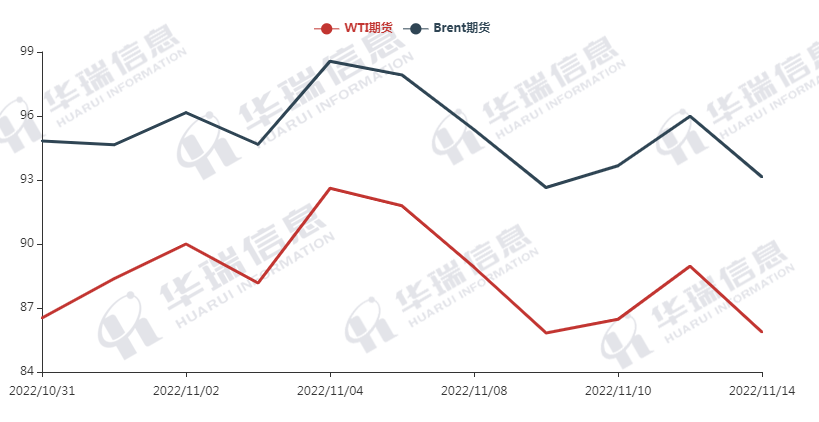

WTI /Brent (31ST OCT.,2022- 14TH NOV.,2022)

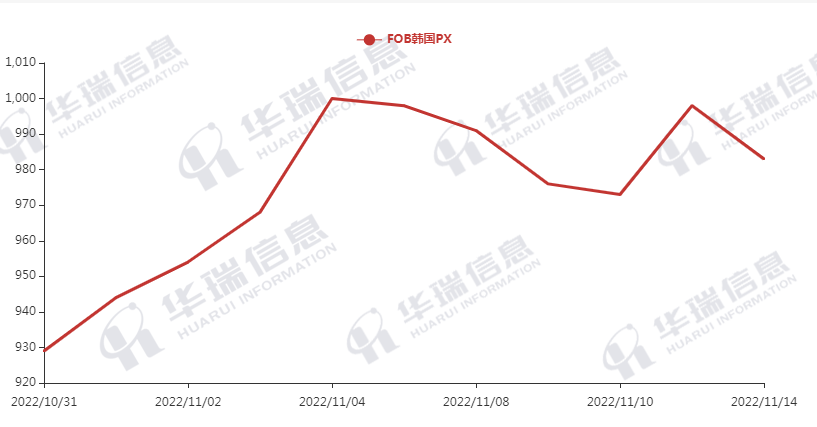

PX (31ST OCT.,2022- 14TH NOV.,2022)

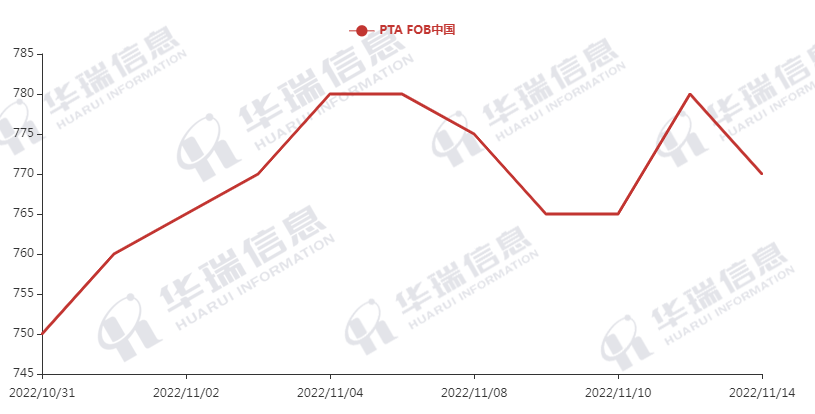

PTA (31ST OCT.,2022- 14TH NOV.,2022)

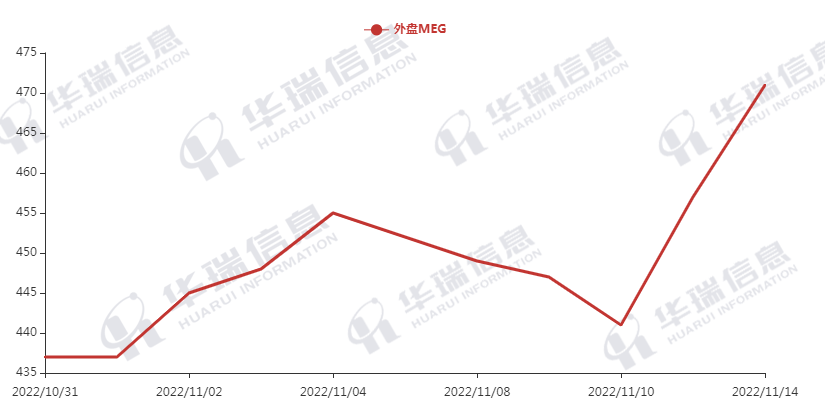

MEG (31ST OCT.,2022- 14TH NOV.,2022)

1. Polyester filament

Last Friday, the market continued to perform vigorously due to the slowdown of CPI growth in the US in October, the dollar index fell, and the US stock market strengthened. The Asian stock market and futures were also boosted by China’s introduction of an optimized epidemic prevention policy. At the same time, the OPEC+ lowered this year’s oil demand forecast for the fifth time this year because of the inflation and rising rate.

The overnight crude oil rebounded largely then declined, polyester raw material keeps range shock.

One production side, factories sometimes have promotion to release inventory pressure and the deal mainly based on negotiation. In the meanwhile, more and more factories execute production reduction plan, which supports the cost to some extent. The whole market still keeps rigid purchasing rhythm.

It’s expected that polyester products prices keep fluctuating. For long-term, need to pay attention to the crude oil price, the cost of polyester and production reduction plan.

2. PSF

Yesterday, the PSF transaction was general. The PSF night futures fluctuated slightly, but its spot price mostly maintain stable. It is suggested that you can purchase as per firm demand to avoid any risks.

3.VSF

There is no significant change on the VSF market. The downstream market is still sensitive to price and keeps just-needed purchases, and factories mainly execute orders in hand.

4.Spandex

The spandex market is general and the price can be negotiated based on firm demand. It is recommended to purchase according to order requirements.

5. Nylon

Pure benzene price continues to make a small rise. Under the tight CPL supply, its transaction price continues to rise slowly, whereas the chips price has not risen significantly, and its transaction is still dominated by just need.