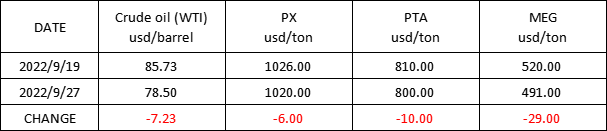

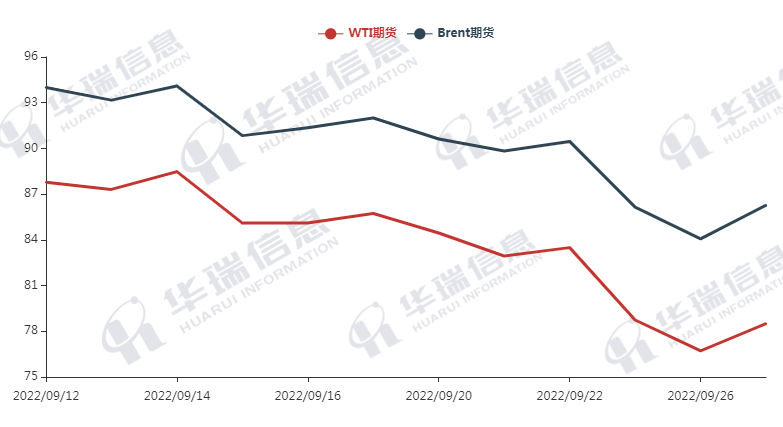

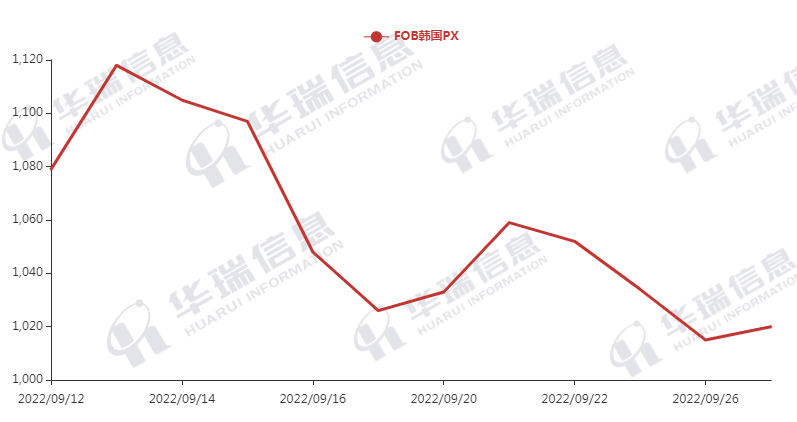

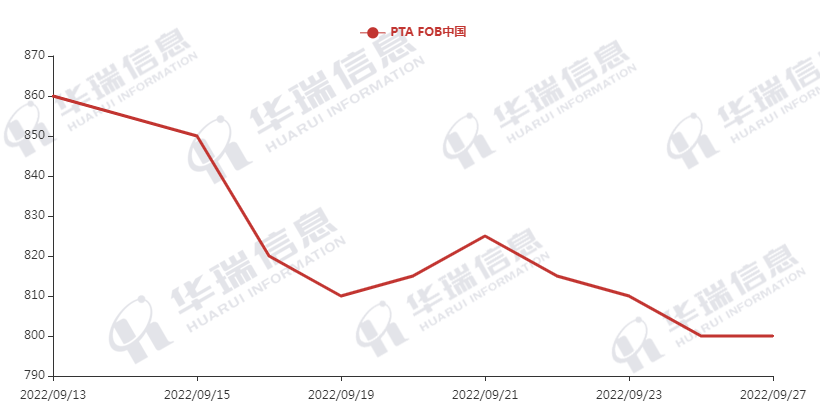

Market Trend ( 12TH SEP.,2022- 27TH SEP.,2022)

WTI /Brent ( 12TH SEP.,2022- 27TH SEP.,20

PX( 12TH SEP.,2022- 27TH SEP.,2022)

PTA( 12TH SEP.,2022- 27TH SEP.,2022)

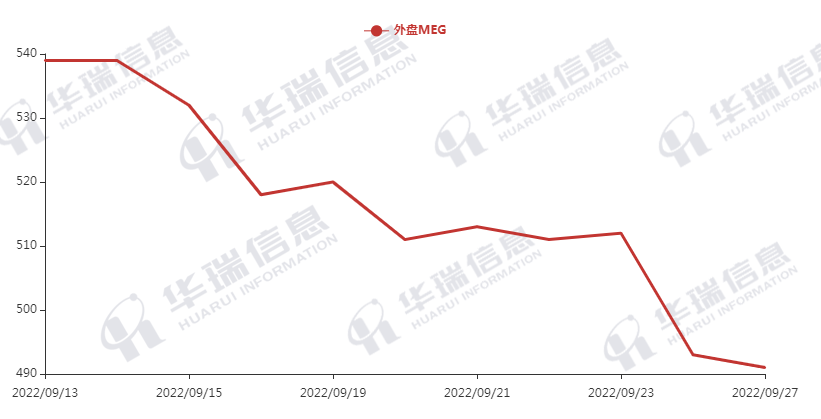

MEG( 12TH SEP.,2022- 27TH SEP.,2022)

Under the tide of global central bank interest rate hikes, the US index continued to climb and the market risk aversion increases, which deepen the concern of economic recession. Then international oil price declined. However, on Tuesday, the news of sabotage leak in Nordstream sent gas prices soaring, in the meantime, it’s said that Russia probably propose OPEC+ production cuts by 1million barrels per day, which makes crude oil rebounded.

1.Polyester filament

The overnight Crude oil rebounded, polyester raw material fluctuated.

Driven by factories’ promotion and downstream pre-holiday purchases, polyester production and sales picked up moderately yesterday. Currently, on product side,the prices overall keep stable and deal based on negotiation.

It’s expected the short-term market will keeps range shock. For long-term, need to pay attention to macro aspects and the operating rate of downstream.

2.PSF

The PSF market keeps stable after falling because the Crude oil rebounded. Downstream mainly procures as per their firm demand. But with the national holiday’s coming, there are clients make purchasing plans in advance to avoid risks.

3.VSF

The recent VSF market keeps weak shock and the transaction of orders based on negotiation. It’s recommended that you can purchase as per your firm order or keep reasonable inventory to avoid any risks.

4.Spandex

Yesterday’s spandex market was good, factories still shipped cargo actively.

On the whole, the mainstream market price of spandex remains stable and some of popular items have a trend to increase price. It is suggested that you can purchase according to the order.

5.Nylon

The pure benzene market continued to fall and CPL market moved down, and for chips and downstream market, they mainly maintain stable, while PA66 chips prices increased continuously.It’s also suggested that you can purchase as per order.