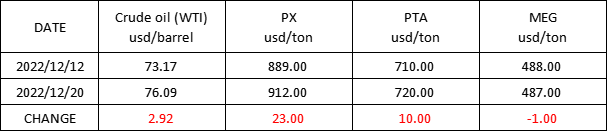

Market Trend (05TH DEC.,2022- 20TH DEC.,2022)

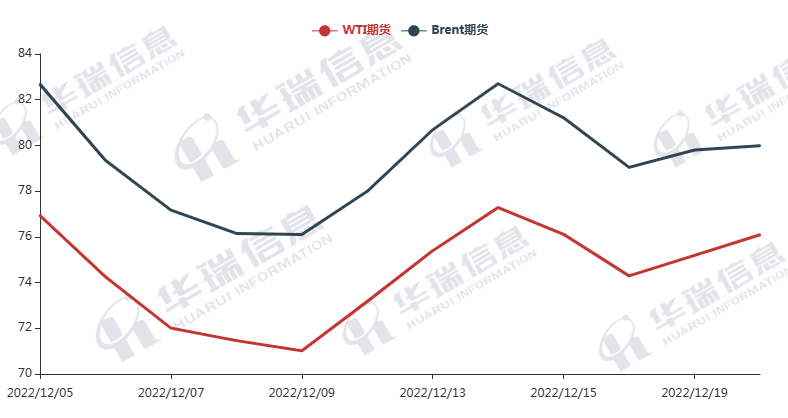

WTI /Brent (05TH DEC.,2022- 20TH DEC.,2022)

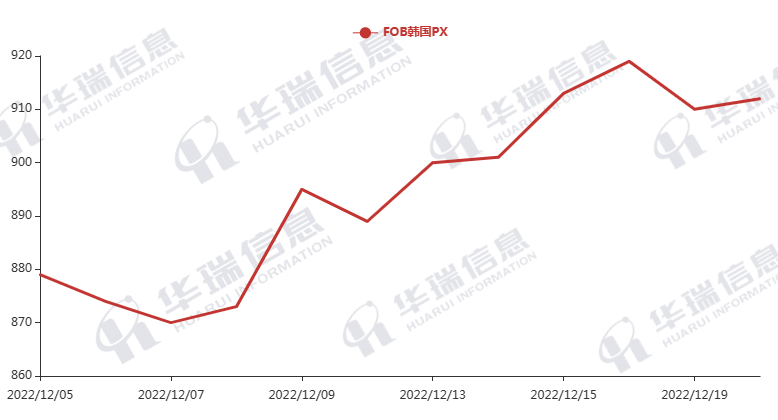

PX (05TH DEC.,2022- 20TH DEC.,2022)

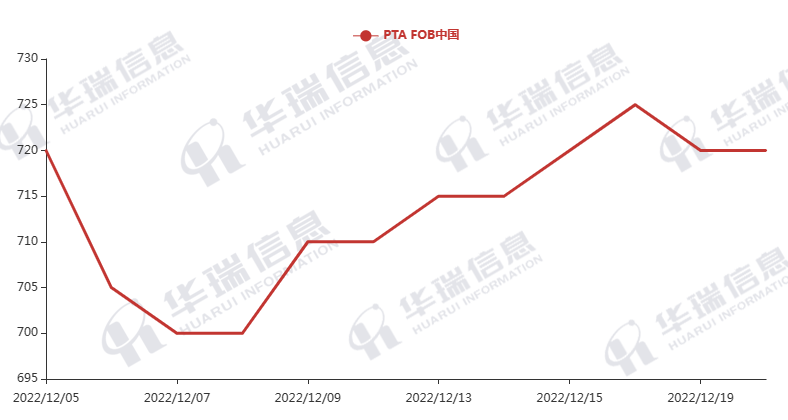

PTA (05TH DEC.,2022- 20TH DEC.,2022)

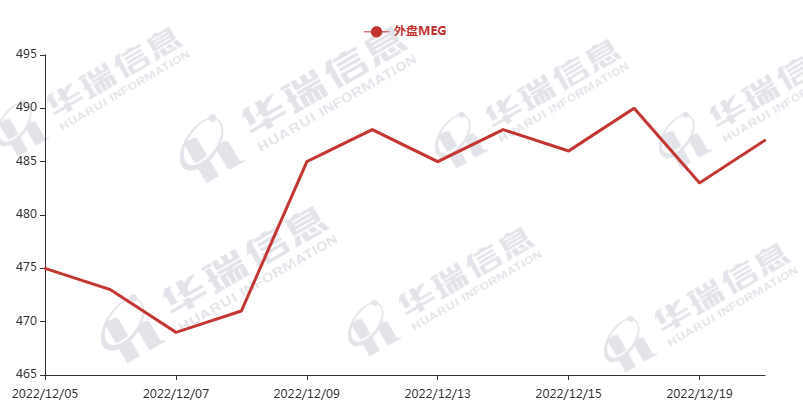

MEG (05TH DEC.,2022- 20TH DEC.,2022)

1. Polyester filament

The overnight crude oil rebounded yesterday, which supports the polyester raw materials cost side.

On production side, as the inventory pressure relieves moderately, the market mentality improves. Currently, the action of reducing or suspending production is still under processing,

factories mainly keep the price and reduce negotiating space.

It’s expected that polyester products prices keep range shock. For long-term, need to focus on the crude oil price, terminal demand and the situation of factories’ reduction of output.

2.PSF

The PSF market is relatively stable. But recently, the volatility of PSF futures have put a little pressure on its spot. The price went up several times last week and keep stable for the time being. On the whole, still need to pay attention to the impact of changes in polyester raw materials and epidemic on upstream and downstream operation. It’s suggested that you can purchase as per firm demand or stock up moderately for next year’s plan.

3.VSF

Recently, the VSF market has improved to some extent. After a large number of signing orders in VSF, the quotation has risen to varying degrees and there are still some orders under negotiating. In the meantime, with the relaxation of epidemic prevention measures, some workers are mainly influenced by physical factors and probably return to their hometown in advance. The holiday time may be advanced. It’s also suggested that you can purchase as per firm demand or stock up moderately for next year’s plan.

4.Spandex

The spandex market is overall general. But recently in China, the masks demand has been rising as the epidemic prevention measures relaxed, so some popular items have no negotiating space. It is recommended to purchase according to order requirements or hoard up moderately.

5. Nylon

Pure benzene price rebound recently ,the CPL's transaction was not bad yesterday. The chips market is sluggish on a whole, and its transaction volume is mainly concentrated at low price sources. The market is mainly based on watch-and-see attitude.