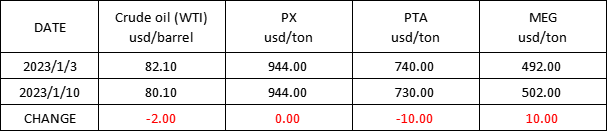

Market Trend(26TH DEC.,2022- 10TH JAN.,2023)

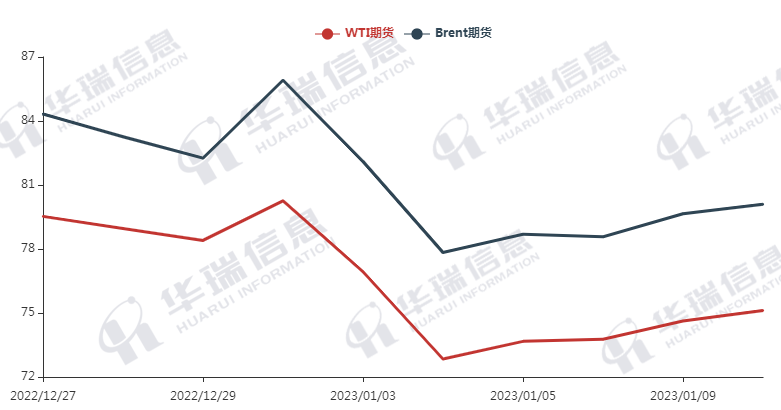

WTI /Brent (26TH DEC.,2022- 10TH JAN.,2023)

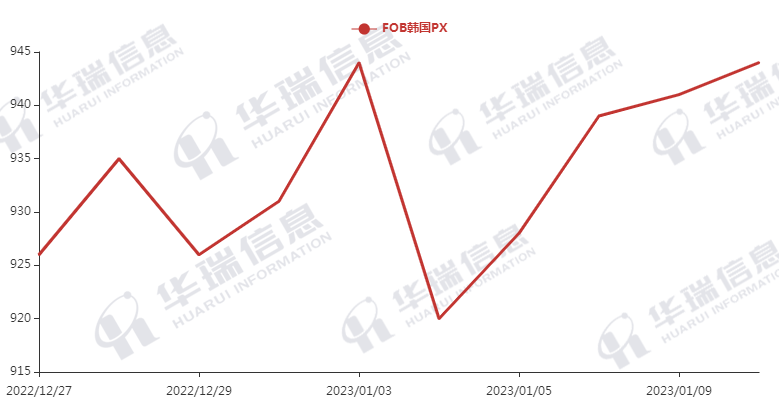

PX (26TH DEC.,2022- 10TH JAN.,2023)

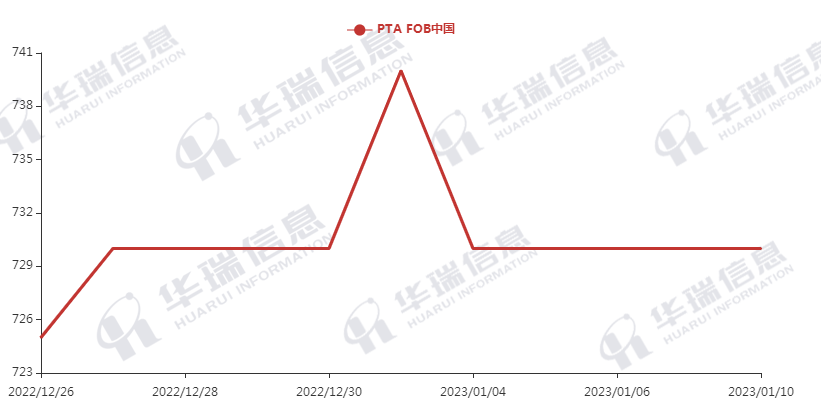

PTA (26TH DEC.,2022- 10TH JAN.,2023)

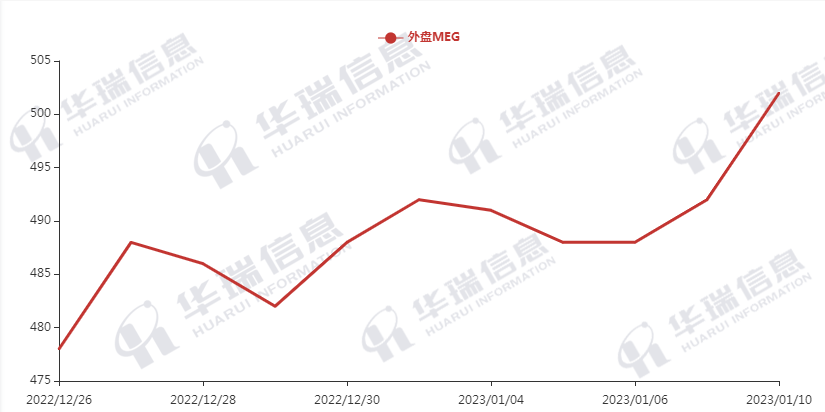

MEG (26TH DEC.,2022- 10TH JAN.,2023)

1.Polyester filament

The overnight Crude oil tended to be stable after rising, polyester raw material shocked weakly.

On production side, due to Chinese New Year is coming soon, the factories’ workshop basically stops production for holidays, which cause the atmosphere of trading in the market tends to be plain. But the production and sales was not bad these two weeks and there is still a demand for stocking in the downstream market, so the factories inventory is reduced and have no pressure.

It is expected that the short-term price will be range shocked.For long-term, need to pay attention to the crude oil price, the cost of polyester and production reduction plan.

2. PSF

The PSF market is general and its price mainly keeps stable after Monday’s rising.The downstream keeps a rigid-purchase or hoards up moderately before Chinese New Year.

3. VSF

Recently in downstream, the pick-up speeds of VSF have been expedited and some of them still have behavior of hoarding up. The viscose factories deliver goods actively. The market has entered the end of the closing stage gradually, it’s recommended that you can purchase as per your firm order to avoid any risks.

4. Spandex

The main raw material of spandex PTMEG rebounded, which supports the cost strongly. With the Covid is gradually under controlling, the prediction of high demand after New Year is strong and buyers have stocked up actively recently. The spandex factories have no inventory pressure and there is no space to negotiate price for some popular items. So it’s recommended that you can stock up moderately to avoid risks.

5. Nylon

Pure benzene market is running strongly and CPL spot price increases slightly, and Chips mainly follow CPL trend to go up. The market mainly behaves based on replenishment.