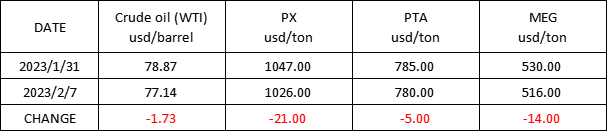

Market Trend(23RD JAN.,2023- 08TH FEB.,2023)

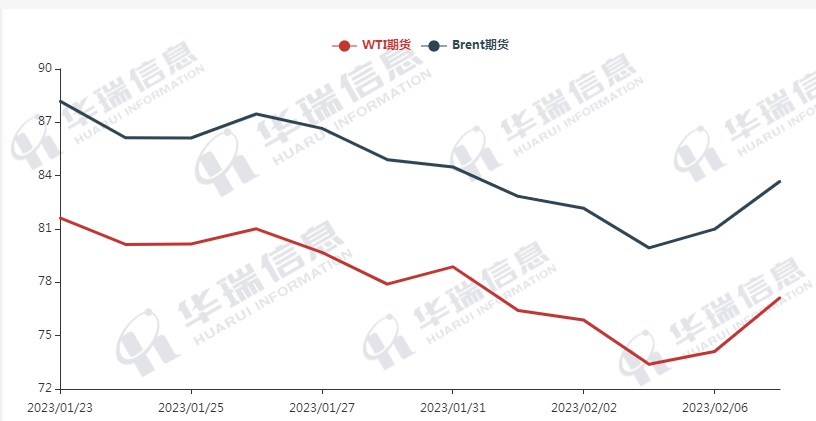

WTI (23RD JAN.,2023- 08TH FEB.,2023)

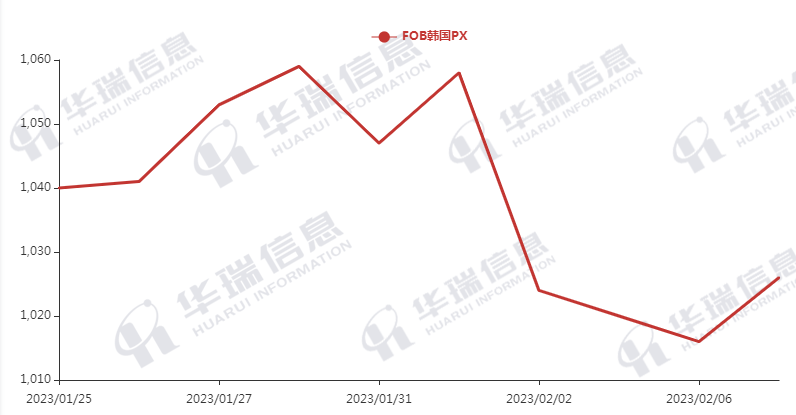

PX (23RD JAN.,2023- 08TH FEB.,2023)

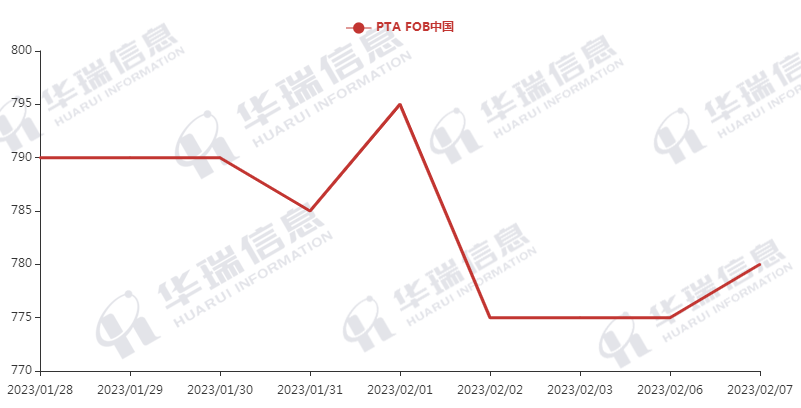

PTA (23RD JAN.,2023- 08TH FEB.,2023)

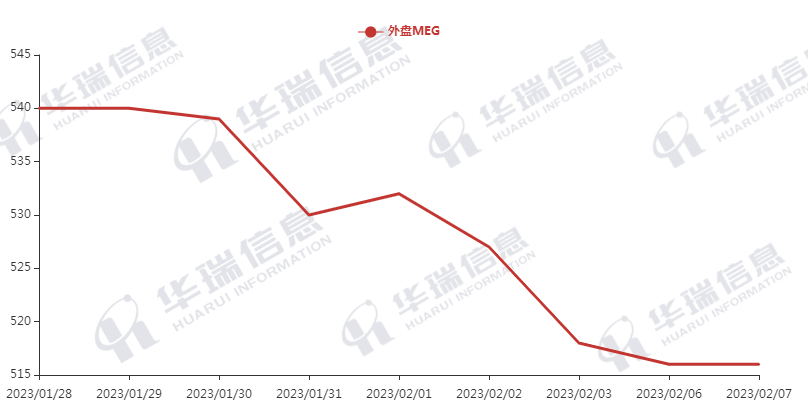

MEG (23RD JAN.,2023- 08TH FEB.,2023)

1. Polyester filament

The overnight Crude oil rebounded sharply, which largely supports the polyester raw materials cost.

Regarding products, the prices are mainly keep stable for the time being and market is general because downstream still not resumes work completely, and most of them have replenished to some extent before holiday. The market takes wait-and-see attitude. It’s expected that the products prices keep range shock. For long-term, still need to pay attention to the crude oil price, the cost of polyester and the resumption situation of work.

2. PSF

The PSF transaction was improved yesterday due to its rising futures, its cost was supported. Influenced by Crude oil, the negotiation space on PSF spot continues narrowing. It’s suggested that you can purchase as per your firm demand or arrange a plan in time.

3. VSF

There is no big change on VSF market,but the actual transaction price are slowly rising because downstream hoards up as usual and factories have enough orders. It’s recommended that you can consider to maintain a certain stock of material to avoid risks.

4. Spandex

The price of spandex main raw material PTMEG has increased significantly, which causes spandex prices moving up. Some factories have a large order in the early stage,which is still being gradually delivered, so factories have no big pressure and keep prices in a high level. It’s recommended that you can purchase as per your firm order or stock up moderately.

5. Nylon

Pure benzene has fallen, and CPL price still maintains at a relatively high level due to the tight supply. Chips spot transaction is general, which restricts the raw material price to some extent. High-speed spinning and filament price increased with the rising raw material but its actual deal is general.