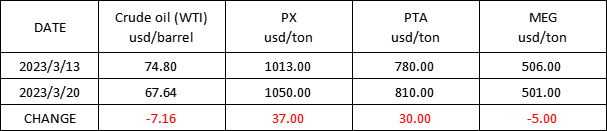

Market Trend(6TH MAR.,2023- 21ST MAR.,2023)

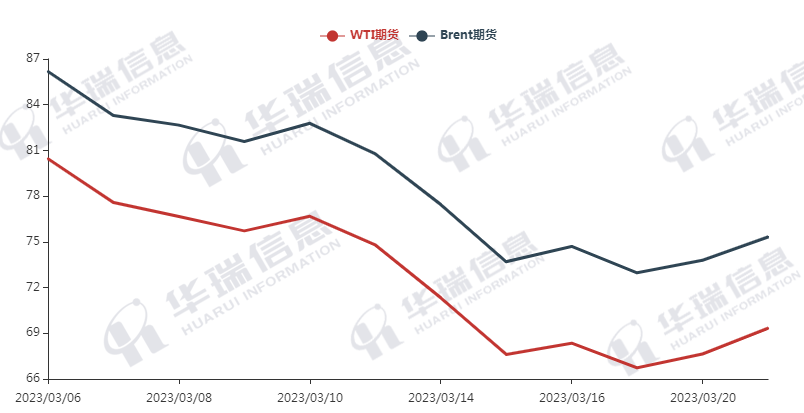

WTI/Brent (6TH MAR.,2023- 21ST MAR.,2023)

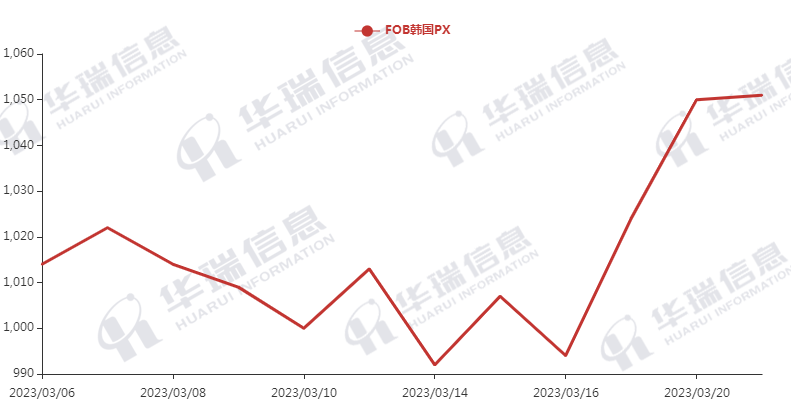

PX (6TH MAR.,2023- 21ST MAR.,2023)

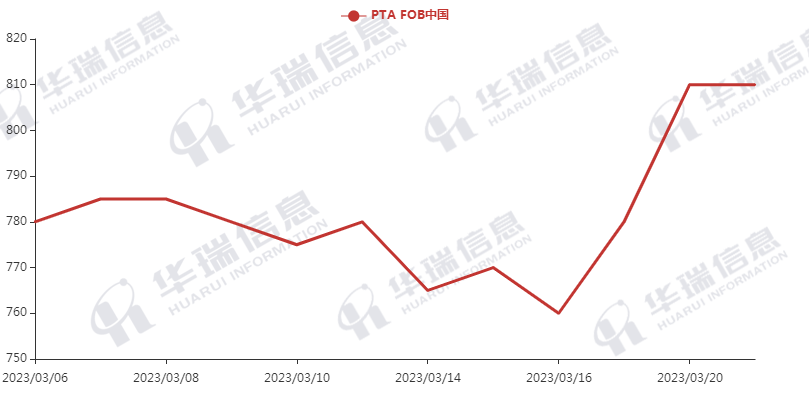

PTA(6TH MAR.,2023- 21ST MAR.,2023)

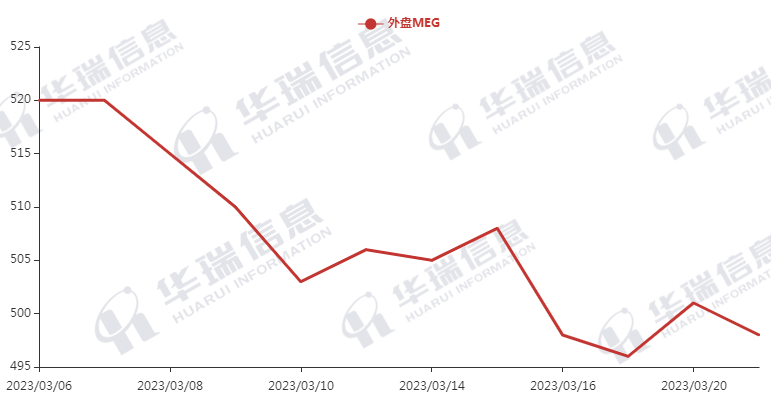

MEG (6TH MAR.,2023- 21ST MAR.,2023)

1. Polyester filament

The current Crude oil shocked slightly, while PX and PTA increased sharply. This is due to an increase in the maintenance of PTA and PX devices in March, furthermore, the domestic market has improved to some extent and the downstream also stock up moderately because of their low level inventory, which supports the polyester cost side to a large extent.

On production side, the production and sales was good, reaching around200%. Driven by the cost, factories have increased by 150-200 RMB/ton since Monday. It’s expected the polyester product prices will strong shock. For long-term, need to pay attention to crude oil prices, the trend of polyester raw materials and the situation of terminal demand.

2. PSF

Due to the raw material side rose sharply, the PSF spot price followed to increase. Influenced by the increasing intention of factory’s production reduction and the rising PSF futures, their cost side have been supported in the short run. It’s suggested that you can purchase as per firm order or hoard up moderately to avoid any risks.

3. VSF

The VSF market was mild. Currently, most factories’ inventory is within an acceptable range and have no pressure, and mainly execute previous orders, so the price stays in a relatively stable level.

4. Spandex

As the cost end of spandex is still supported, its spot price still keeps stable. The transaction mainly based on negotiation. It is recommended that you can purchase according to the order.

5.Nylon

The Pure benzene spot rebounded slightly, and the spot dealing price of CPL shocked in a low level. For chips market, it mainly maintain the previous trend, which shows the high speed spinning chips performs better than normal spinning.