Market Trend(June 19th - July 3rd, 2023)

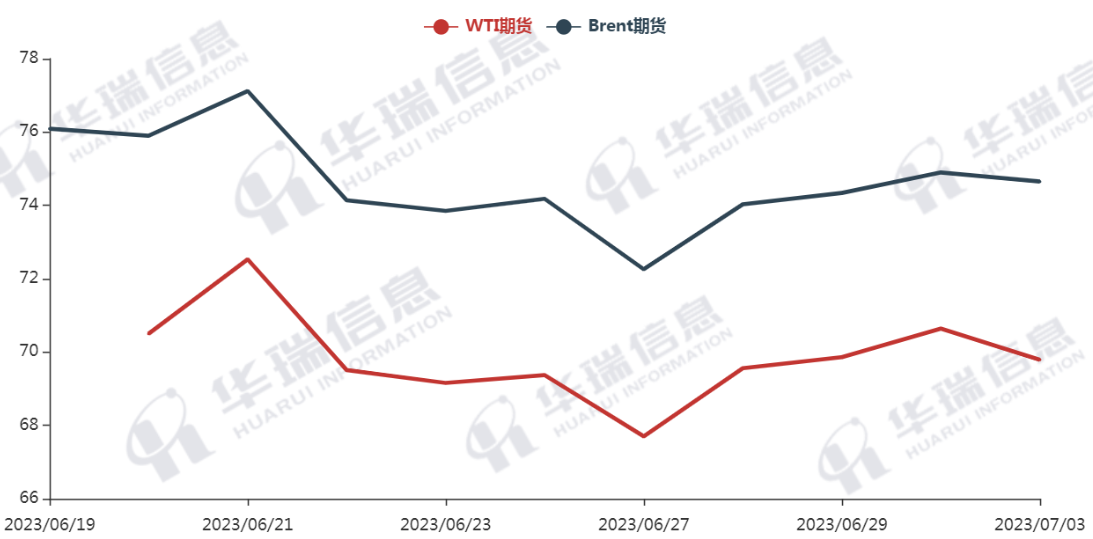

WTI/Brent (June 19th - July 3rd, 2023)

PX (June 19th - July 4th, 2023)

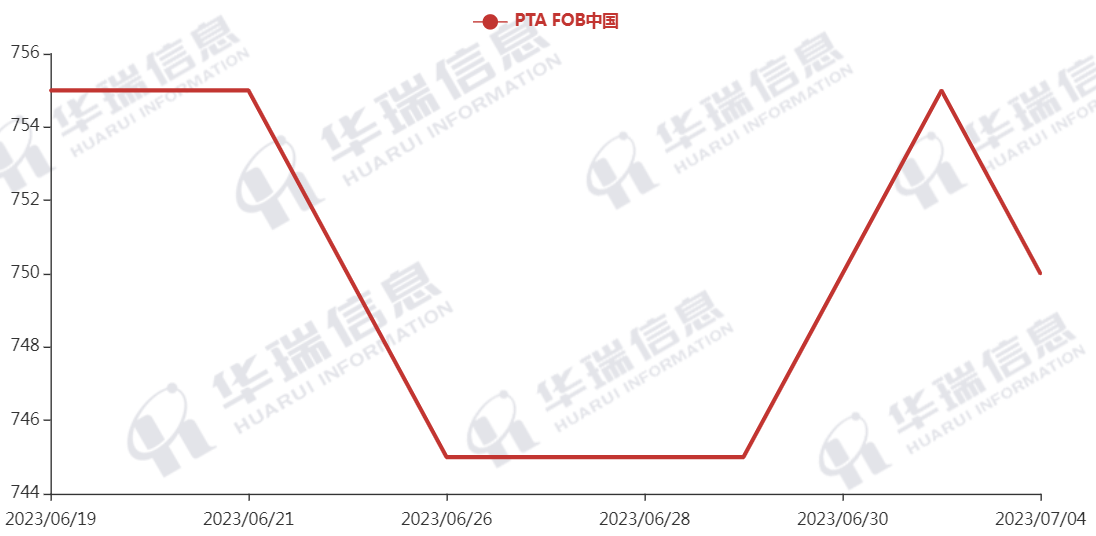

PTA (June 19th - July 4th, 2023)

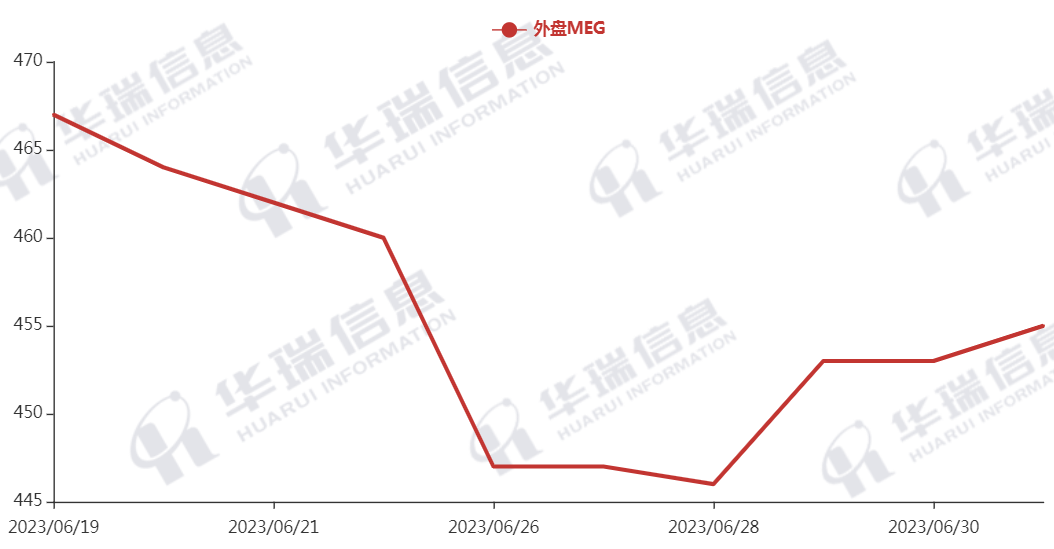

MEG (June 19th - July 3rd, 2023)

1. Polyester Filament

The Crude Oil prices still keep fluctuating. The cost of polyester raw materials remains volatile as expected in the short term and prices of polyester products still follow the trend of the cost and fluctuate within a narrow range.

Recently, there’s no significant change in the polyester market. At the end of last month, factories had centralized shipment. Now they have reduced their promotion and prices have gone up slightly. It is expected that prices of polyester products will fluctuate slightly along with the cost side in the short term. For the long term, it’s important to pay attention to fluctuations in raw material prices, polyester load, and the situation of production and sales.

2. PSF

On Monday, the PSF market saw slightly higher trade prices with a moderate sales volume. Crude Oil futures in the night session went up slightly and the PSF futures had a strong volatility. The spot quotations were temporarily stable in early trading. The market is likely to have stable deals and will continue to fluctuate within a certain range.

3. VSF

Yesterday, there was no evident adjustment in the high-end VSF market and the quotations mainly remained stable. The market keeps rigid purchase. It’s suggested that you purchase as per your firm demand.

4. Spandex

The price of main raw material PTMEG is still rising, which supports the production cost of spandex. While the downstream market doesn’t have a strong demand at the moment, factories mainly maintain stable prices lately. It is suggested that you purchase spandex as per orders and demand.

5. Nylon

The price of pure benzene went up while the price of CPL continued to drop narrowly. The chips market fell slightly as well. There was no obvious change in the chips downstream and the demand is gradually weakening. Generally, the downstream market purchased as per their firm demand.