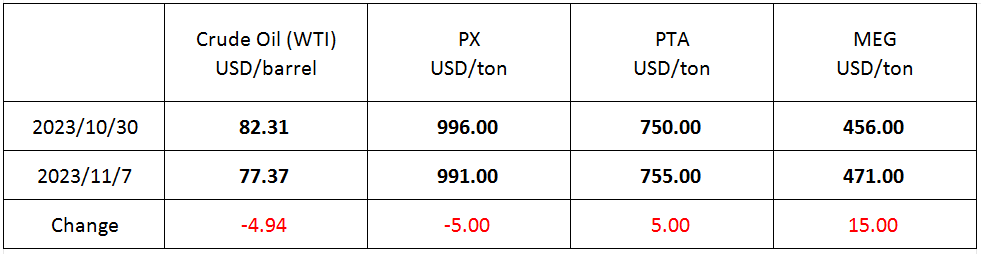

Market Trend (Oct. 23rd - Nov. 7th, 2023)

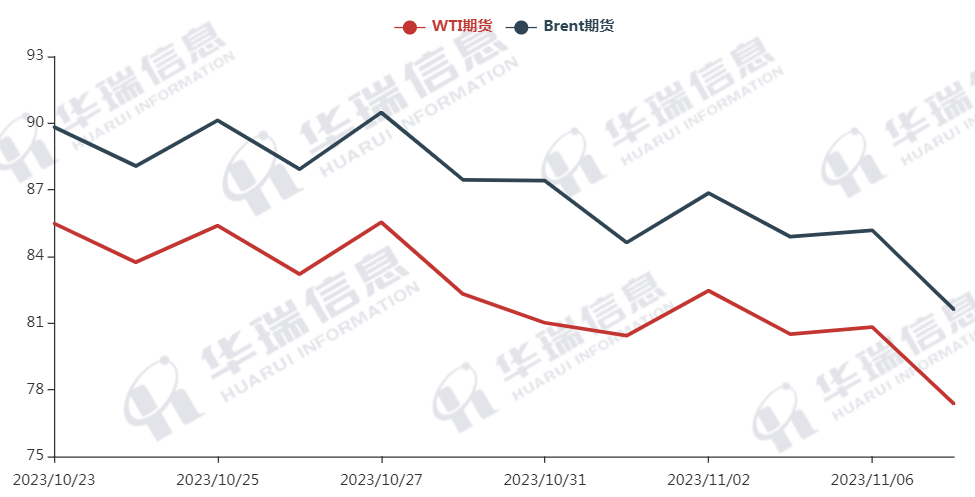

WTI/Brent (October 23rd - November 7th, 2023)

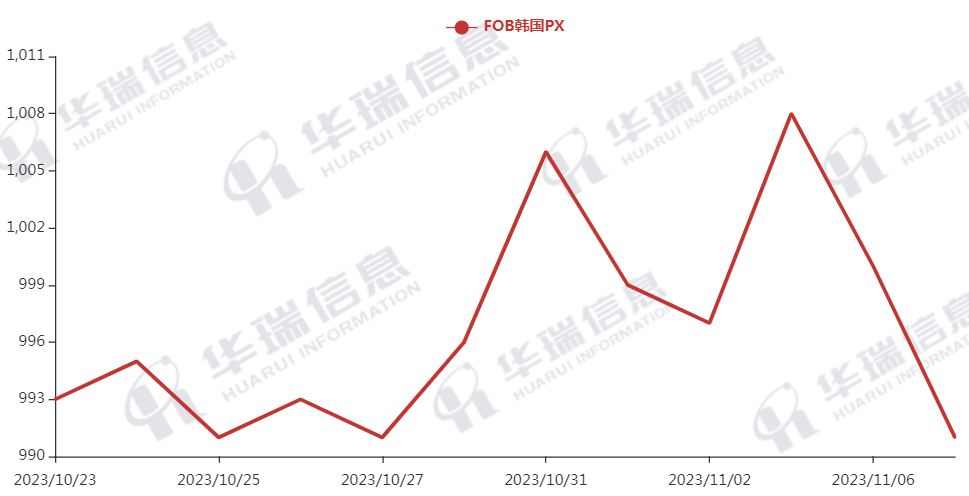

PX (October 23rd - November 7th, 2023)

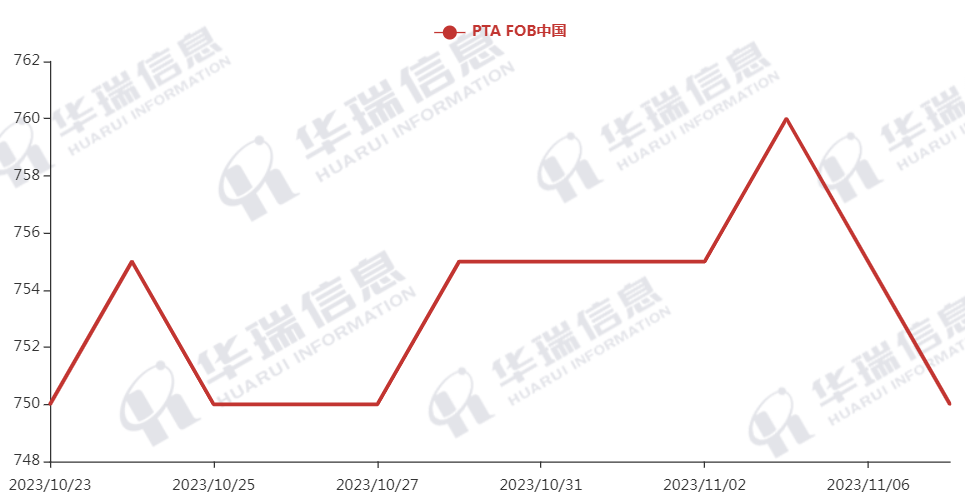

PTA (October 23rd - November 7th, 2023)

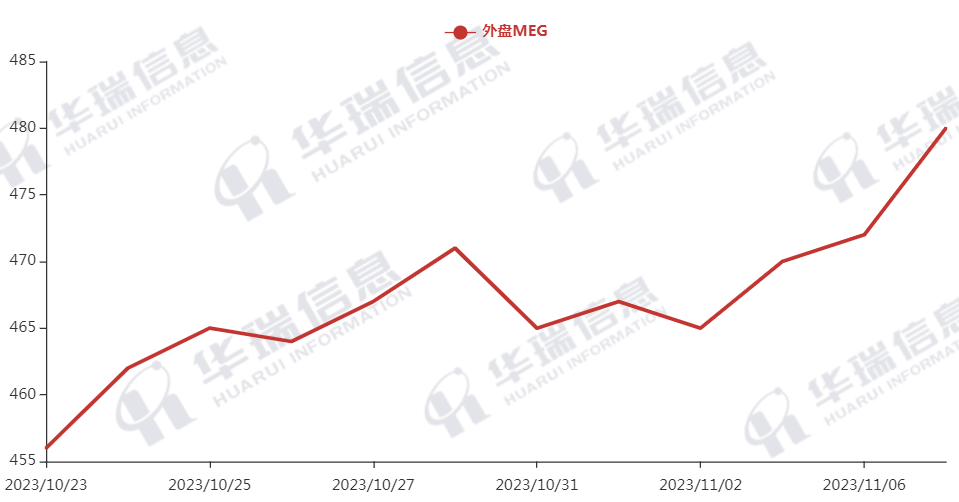

MEG (October 23rd - November 7th, 2023)

1. Polyester Filament

On Tuesday, Crude oil dropped slightly after a strong fluctuation. The cost of polyester raw materials fluctuated. On the production side, the production and sales performed general and transactions were based on negotiation. Considering that the Israeli-Palestinian conflict remains unresolved, the market is still unstable at the moment. It’s suggested that you make purchasing plans in advance based on your firm demand to avoid any risks. In the long term, it’s necessary to pay attention to fluctuations in raw material cost, polyester load, and the situation of production and sales.

2. PSF

Lately, the PSF market has been quiet in general. Morning quotations overall kept stable and transactions were based on negotiation. It’s suggested that you purchase as per your firm demand.

3. VSF

The VSF market remained stable. Factories mainly executed in-hand orders. The downstream market intended to stock up on a monthly basis. It’s recommended that you keep a certain level of inventory.

4. Spandex

The spandex market was general recently and transactions were mainly based on firm demand. It’s suggested that you purchase as per your firm orders and demand.

5. Nylon

The price of pure benzene went down slightly. The price of CPL spots remained stable and the trading volume was good. The price of high-speed spinning spot chips performed steadily. Conventional spinning spot chips had a tight supply and sellers might raise the price. The price of nylon yarn remained stable. It’s recommended that you follow the market trend and stock up when prices are low.