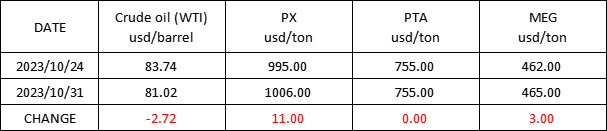

Market Trend (Oct. 16th - Oct. 31st, 2023)

WTI/Brent (October 16th - October 31st, 2023)

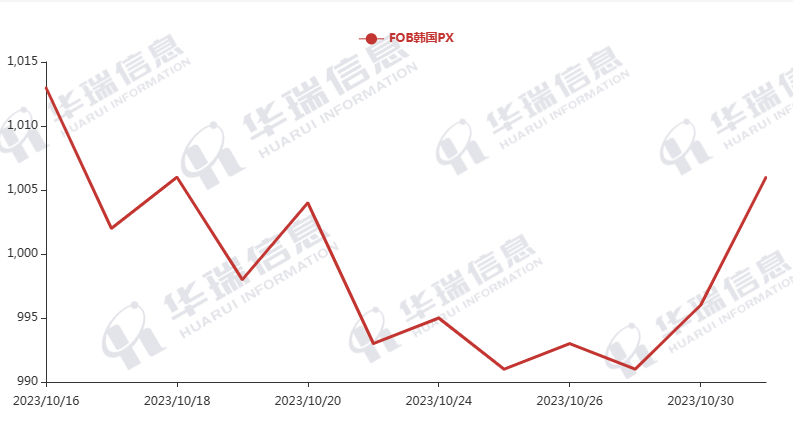

PX (October 16th - October 31st, 2023)

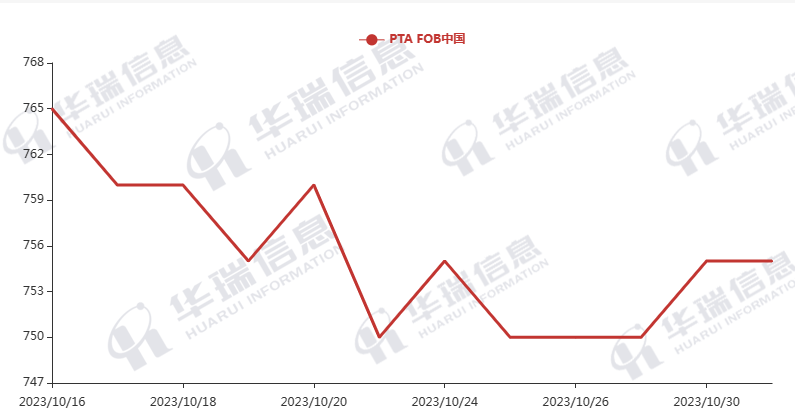

PTA (October 16th - October 31st, 2023)

MEG (October 16th - October 31st, 2023)

1. Polyester Filament

The Crude oil continued to fluctuate with a slight drop. The cost of polyester raw materials fluctuated.

On the production side, the production and sales was general. Factories mainly keep the prices stable but transaction is based on negotiation. Considering the Chinese New Year is coming, part of the downstream starts to make plans in advance to avoid the situation of tight production and shipment. It’s suggested that you make purchasing plans in advance based on the actual situation to avoid any risks. In the long term, it’s necessary to pay attention to fluctuations in raw material prices, polyester load, and the situation of production and sales.

2. PSF

On Monday, prices of PSF products increased slightly, while the overnight crude oil dropped, and the morning quotation overall keeps stable. Since the current situation of global politics is still unclear, so is the trend of PSF market. It’s recommended that you purchase as per your firm demand.

3. VSF

Recently, the VSF market was stable. Factories mainly execute in-hand orders. The downstream market was mainly waiting and seeing. It’s recommended that you keep a certain level of inventory.

4. Spandex

The spandex market was general recently. The transaction is based on negotiation. It’s suggested that you stock up as per your firm orders and demand.

5. Nylon

The price of pure benzene went up. For CPL spots, sellers were unwilling to sell at low prices. The price of high-speed spinning spot chips dropped, affected by the increase in supply and the demand reduction. Supported by the cost of raw materials, the price of nylon yarn remained stable, and deals were mainly based on firm demand. The price of PA66 continued to rise, but the trading volume wasn’t good. It’s recommended that you follow the market trend and stock up when prices are low.