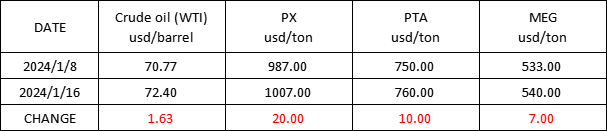

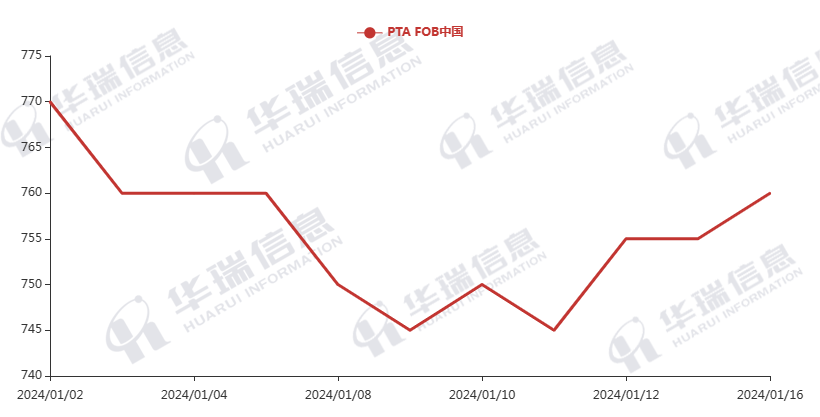

Market Trend (Jan. 2nd - Jan.16th,2024)

Market Trend

WTI/Brent (January 2nd - January 16th, 2024)

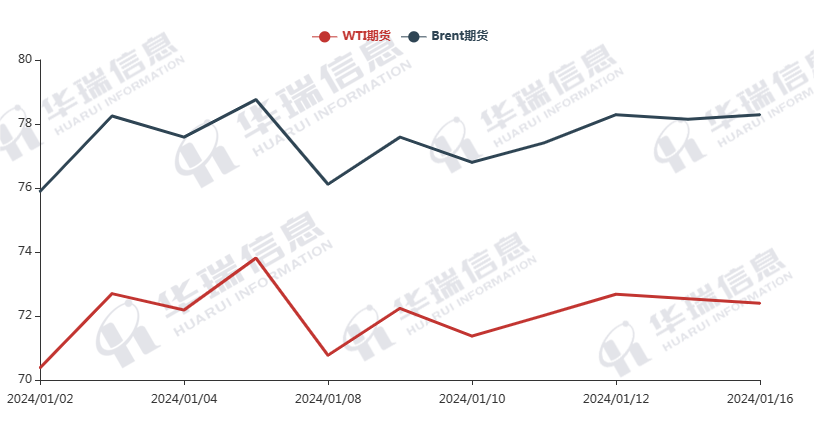

PX (January 2nd - January 16th, 2024)

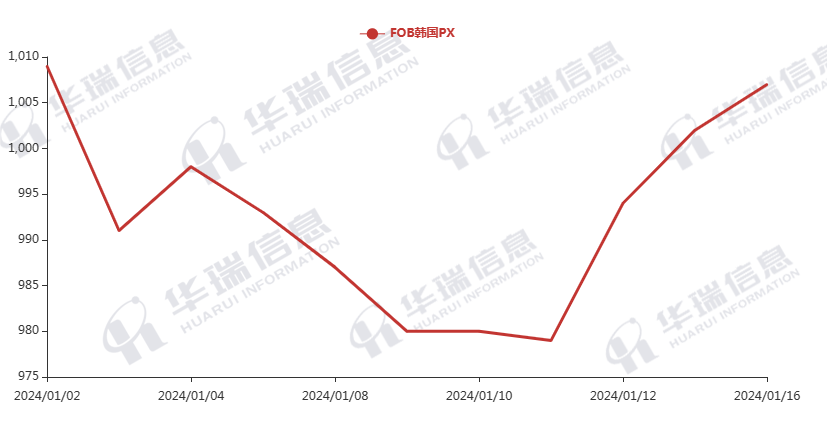

PTA(January 2nd - January 16th, 2024)

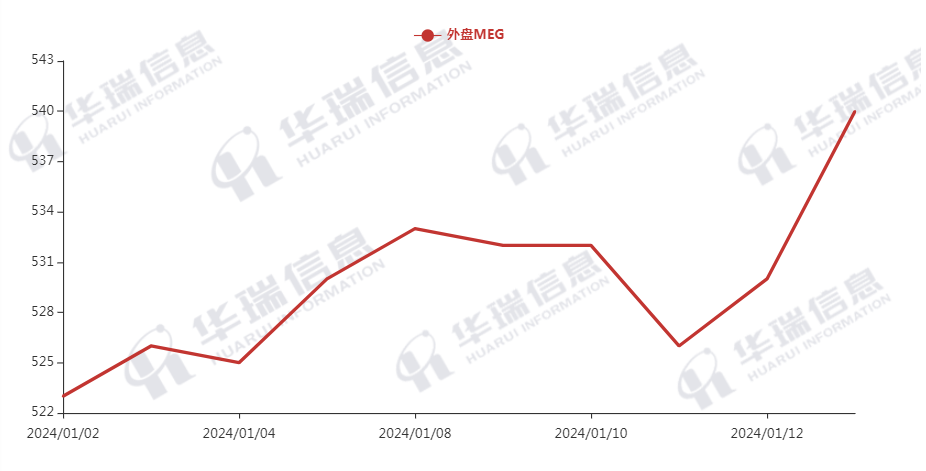

MEG (January 2nd - January 16th, 2024)

1. Polyester Filament

The situation in the Red Sea is still not optimistic. The Crude oil fluctuates vividly. The cost of polyester raw materials follow accordingly.

On production side, the production and sales has improved. Factories have no heavy inventory pressure. They mainly maintain the prices or increase according to the trend of crude oil. Due to the Chinese New Year is approaching, the workers have started to go back to their hometown gradually. Lack of labor will be a key factor to affect shipment, plus the prolonged transit time as the red sea situation is still unstable, so it’s suggested that you make purchasing plans in advance to avoid any risks.

It’s expected that the cost will keep rang shock. In the long term, it’s necessary to pay attention to fluctuations in raw material cost, polyester load, and the situation of downstream operation.

2. PSF

The deal of PSF has improved, factories narrowed the negotiating space. The futures of polyester raw material and PSF shocked strongly. Morning quotations increased by 200cny/ton. It’s suggested that you purchase as per your firm demand to avoid risks.

3.VSF

The mainstream VSF factories had one day promotion yesterday, and they have got one month orders. Currently, they mainly execute in-hand orders. There is no big change on other factories, and overall market keeps stable. It’s suggested that you can purchase as per your firm demand or keep some reasonable stocks.

4. Spandex

The spandex market is mainly driven by rigid demand. The transaction is based on negotiation. It’s recommended that you can purchase as per your firm orders.

5. Nylon

The price of benzene keeps strong, while the CPL behaves weak. The transaction of Conventional spinning chips is based on rigid demand, and the high-speed spinning chips mainly executed contract and overall keeps stable. It's recommended you can hoard up moderately when the price is acceptable.