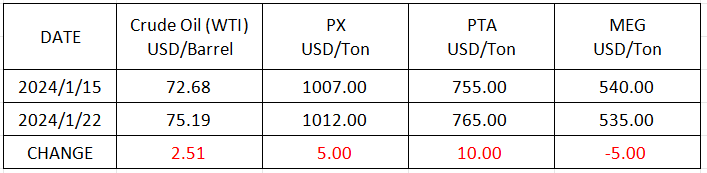

Market Trend (Jan. 8th - Jan.22nd,2024)

Market Trend

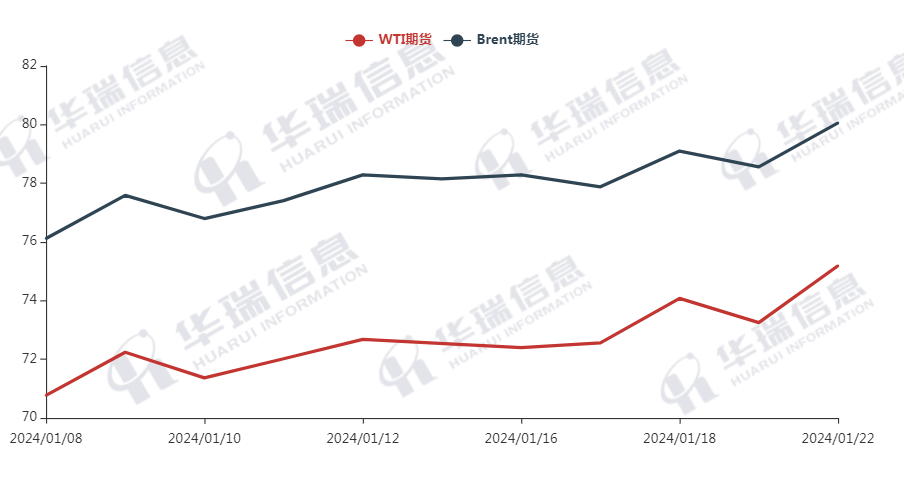

WTI/Brent (January 8th - January 22nd, 2024)

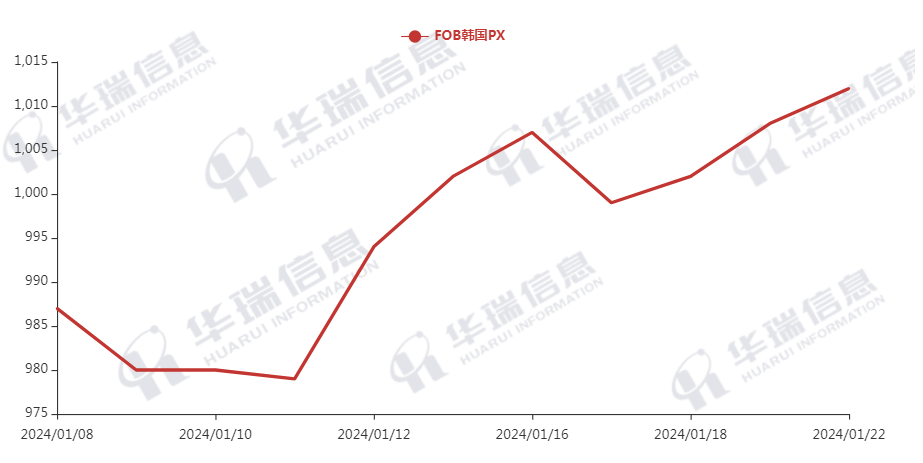

PX (January 8th - January 22nd, 2024)

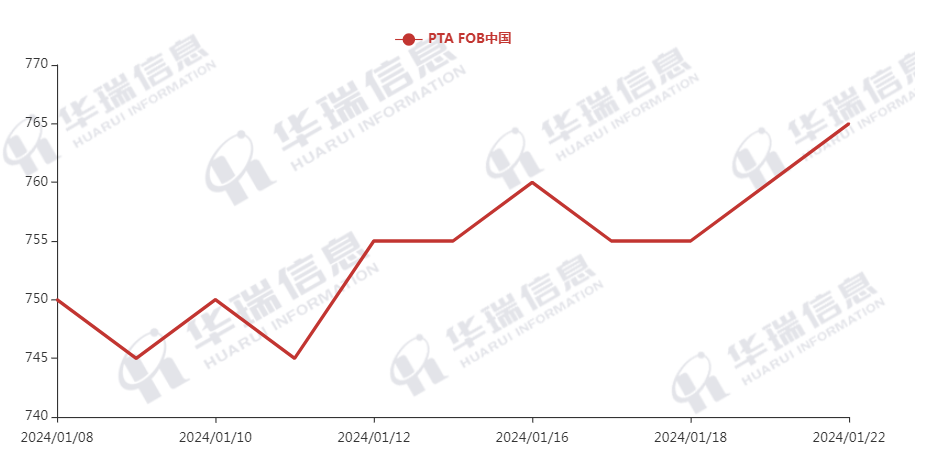

PTA(January 8th - January 22nd, 2024)

MEG (January 8th - January 22nd, 2024)

1. Polyester Filament

Ukrainian drone attack on port of Ust-luga in Russia has suspended its crude oil loading operations. Although the work has resumed, geopolitical risks continue to push up oil prices.The Crude oil increased sharply on Monday. The cost of polyester raw materials follow to increase.On products side, Polyester factories have raised prices for two consecutive days. And the production and sales was pretty good yesterday, reaching a maximum of 500%. They shipped goods actively.

Overall, factories narrowed negotiating price because the product prices have stayed in a bottom level. Currently, affected by the Red Sea issue, there is a demand for centralized shipment of export orders before Spring Festival. On the other hand, there also is a demand for Spring and Summer clothes. The export business has a good performance recently.It’s expected that the cost will keep strong shock. In the long term, it’s necessary to pay attention to fluctuations in raw material cost, polyester load, and the situation of downstream operation.

2. PSF

The transaction of PSF was general but most factories have enough in-hand orders. The night futures of oil increased sharply, the PSF futures also kept strong. Morning quotations rose 50-100cny/ton. It’s suggested that you can purchase according to your orders or hoard up moderately.

3. VSF

The VSF market overall behaves general. Factories mainly execute orders after getting enough orders last two weeks. Most downstream are preparing for holiday. It’s suggested that you can purchase as per your firm demand or keep some reasonable stocks.

4. Spandex

The spandex market is mainly driven by rigid demand. The transaction is based on negotiation. Some downstream hoarded up moderately before holidays.It’s recommended that you can buy as per your demand to avoid any risks.

5.Nylon

The price of benzene gone up, and sellers were reluctant to sell CPL with low price. The transaction of Conventional spinning chips is eased off, while the high-speed spinning chips mainly executed contract and the spot deal has improved. It's recommended you can hoard up moderately when the price is acceptable.