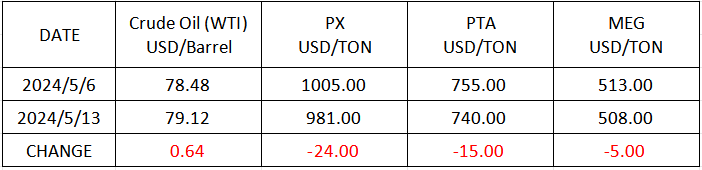

Market Trend (Apr. 29th -May. 13th,2024)

Market Trend

WTI/Brent ( April 29th - May 13th, 2024 )

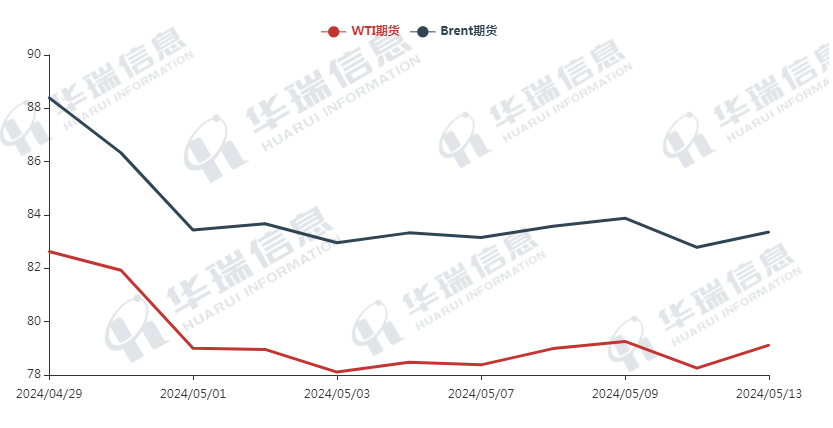

PX ( April 29th - May 13th, 2024 )

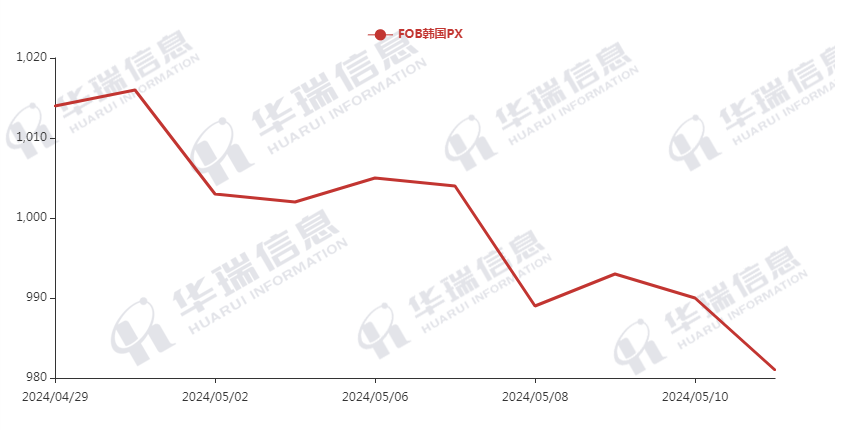

PTA ( April 29th - May 13th, 2024 )

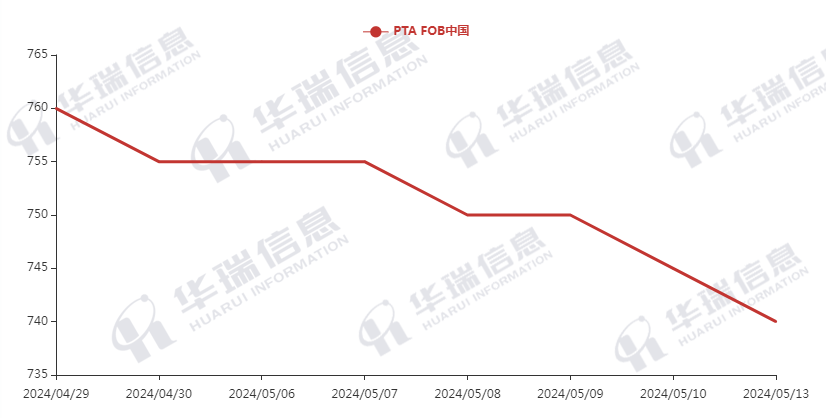

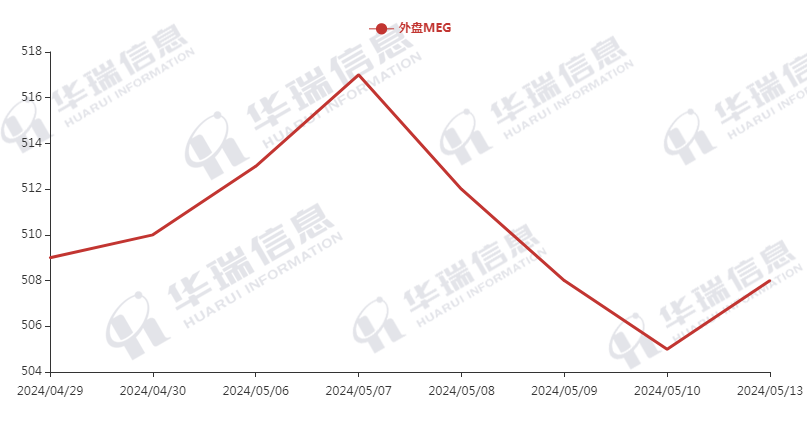

MEG( April 29th - May 13th, 2024 )

1. Polyester Filament

The Crude oil continued to fluctuate slightly. And the cost of polyester raw material followed accordingly.

On production side, considering the healthy development of upstream and downstream, some mainstream polyester factories planned to add extra 10% range on production reduction on the basis of the shutdown and load reduction. In the mean time, a set of 1.6 million PX devices in East China is expencted to shut down in the near future due to an accident, and time of preliminary maintenance is currently planned for about 30days, which support the cost of polyester yarn. Most factories maintained the prices and deal is based on negotiation.

It’s still suggested that you can consider purchasing as per your actual situation to avoid any risks. In the long term, it’s necessary to pay attention to the trend of polyester raw material cost, polyester load, and the international situation.

2. PSF

The PSF market behaves general and the transaction is mainly based on rigid demand. The short-term futures of polyester raw materials and PSF remained volatile in night session, while the factories’ quotations kept stable.

3. VSF

Recently, the VSF market keeps stable and there is no obvious change. After the concentrated transactions last week, factories mainly execute in-hand orders. It’s recommended that you can purchase as per orders to avoid any risks.

4. Spandex

The spandex market performed general. Most of transactions are based on firm demand. It’s also recommended that you procure based on your orders.

5. Nylon

Recently, the pure benzene market is stable. The CPL price increased slightly in the spot market. The deal of conventional spinning and high-speed spinning chip is stable. Factories mainly execute in-hand orders. It is recommended to purchase moderately when the prices stay at a low level.