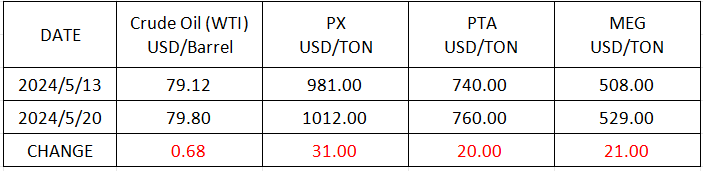

Market Trend (May.6th - May.20th, 2024)

Market Trend

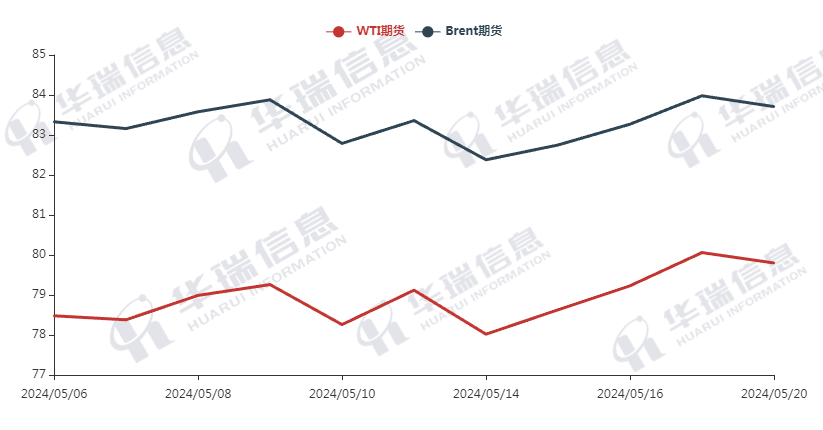

WTI/Brent ( May 6th - May 20th, 2024 )

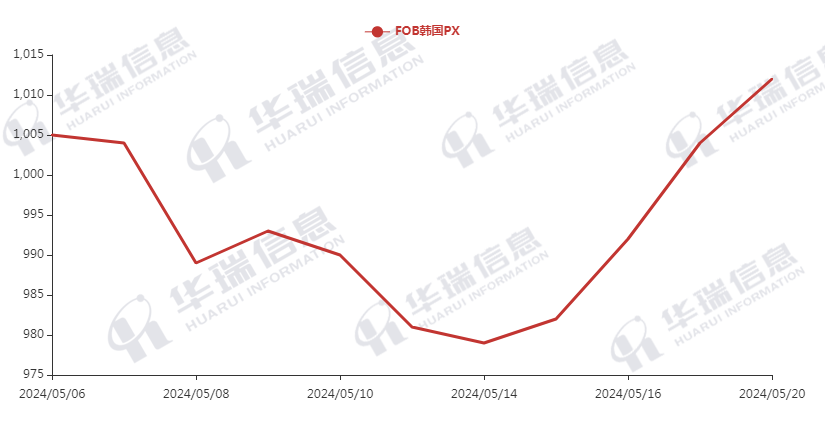

PX ( May 6th - May 20th, 2024 )

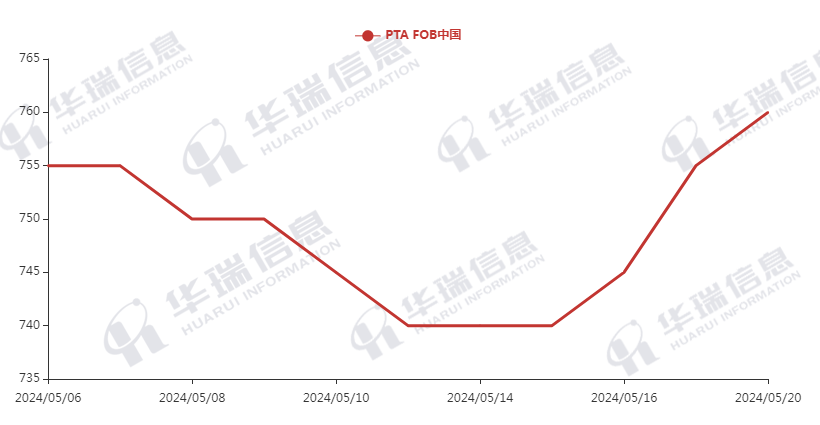

PTA ( May 6th - May 20th, 2024 )

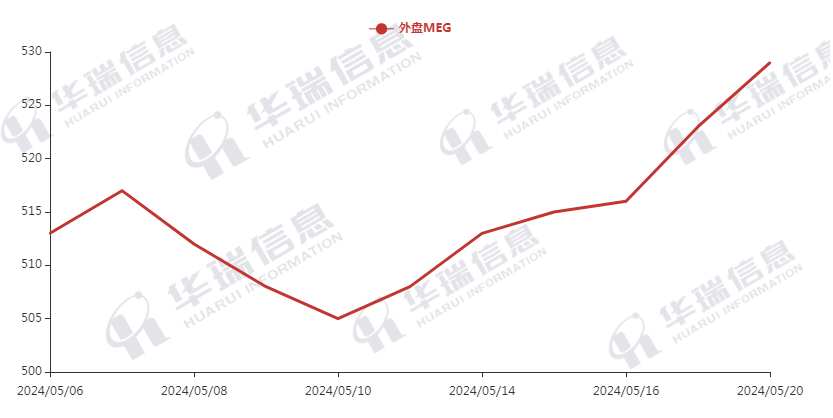

MEG( May 6th - May 20th, 2024 )

1. Polyester Filament

The Crude oil continued to fluctuate slightly. And the cost of polyester raw material followed accordingly.

On production side, most factories are running with loss and the loss is expending. So they mainly maintain the prices or increase a little bit if there is positive news in the market. Overall, the market deal is based on rigid demand.

It’s still suggested that you can consider purchasing as per your actual situation to avoid any risks. In the long term, it’s necessary to pay attention to the trend of polyester raw material cost, polyester load, and the international situation.

2. PSF

The price of PSF rose partially, the transaction is mainly based on rigid demand. The PSF futures consolidated with a rising trend, the spot price in the morning kept stable.

3. VSF

Recently, the VSF market keeps stable and there is no obvious change. It’s recommended that you can purchase as per orders to avoid any risks.

4. Spandex

The spandex market still performed general. The transactions are based on firm demand. It’s also recommended that you procure based on your orders.

5. Nylon

Recently, the pure benzene market is stable. The CPL price increased slightly in the spot market. The deal price of conventional spinning chips is stable, while the semi dull and full dull of high-speed spinning is increasing. It is expected that the prices are rising slightly. It is recommended to purchase moderately when the prices are acceptable.