Market Trend (May.13th - May.27th, 2024)

Market Trend

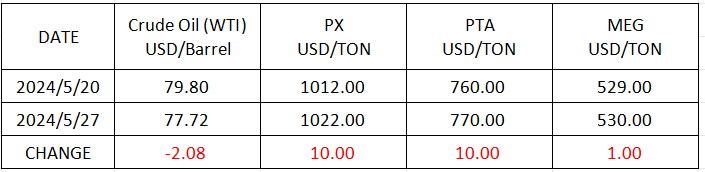

WTI/Brent ( May 13th - May 27th, 2024 )

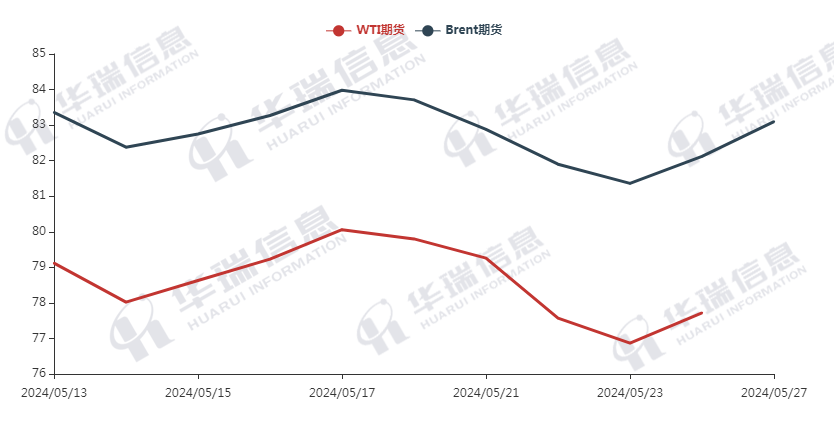

PX ( May 13th - May 27th, 2024 )

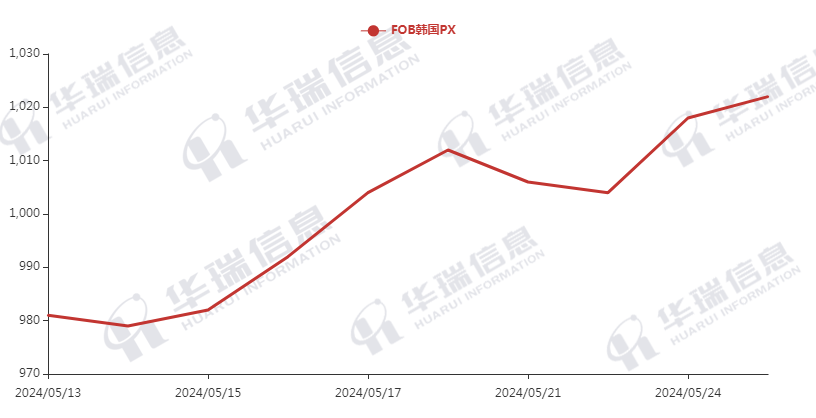

PTA ( May 13th - May 27th, 2024 )

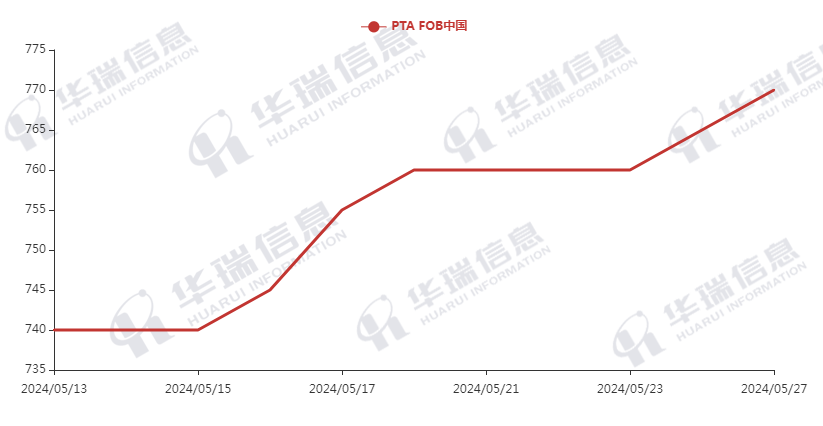

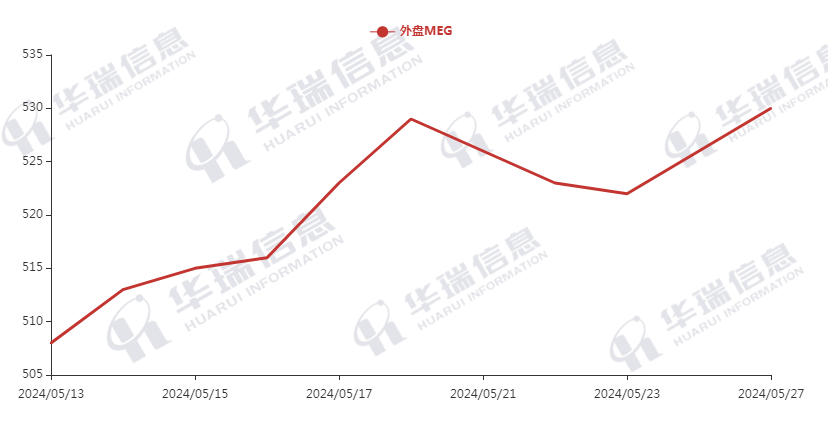

MEG( May 13th - May 27th, 2024 )

1. Polyester Filament

The Crude oil continued to rebound these two days. And the cost of polyester raw material followed accordingly.

On production side, it’s said that in June the mainstream factories will reduce production. Currently, supported by the cost and no inventory pressure, factories mainly maintained the prices and narrowed the negotiating space. In the meantime, the freight rates have sharply increased recently, which adds tension in global shipment. It’s still suggested that you can consider purchasing as per your actual situation to avoid any risks. In the long term, it’s necessary to pay attention to the trend of polyester raw material cost, polyester load, and the international situation.

2. PSF

The PSF market is general. Currently, factories’ quotations keep stable, and the transaction is mainly based on rigid demand.

3. VSF

Recently, the VSF market still remains stable. Due to factories have no inventory pressure, they still have positive attitude and good expectation on VSF market. It’s recommended that you can purchase as per orders to avoid any risks.

4. Spandex

The price of spandex fluctuated within a narrow range yesterday. Most of transactions are based on firm demand and factories ship goods actively at the end of the month. It’s recommended that you procure based on your orders.

5. Nylon

Recently, the pure benzene market continues to be strong, while the CPL price is generally stable. The deal of conventional spinning is stable. However, the high-speed spinning semi-dull chip is in short supply, and the spot price is higher than the contract price. It is recommended to purchase as per orders to avoid any risks.