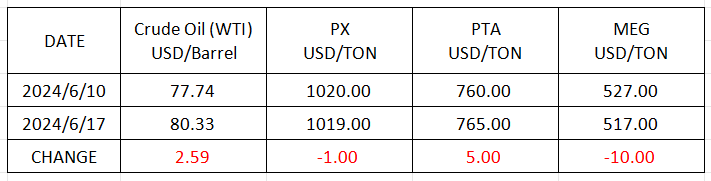

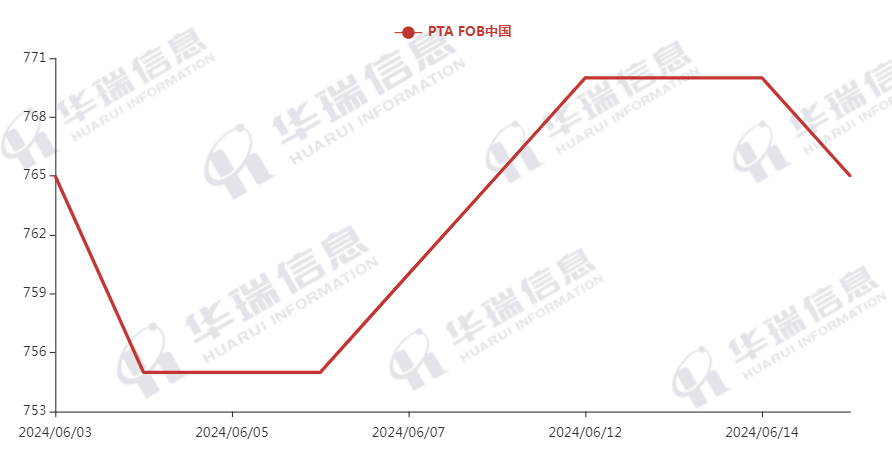

Market Trend (Jun.3rd - Jun.17th, 2024)

Market Trend

WTI/Brent ( June 3rd - June 17th, 2024 )

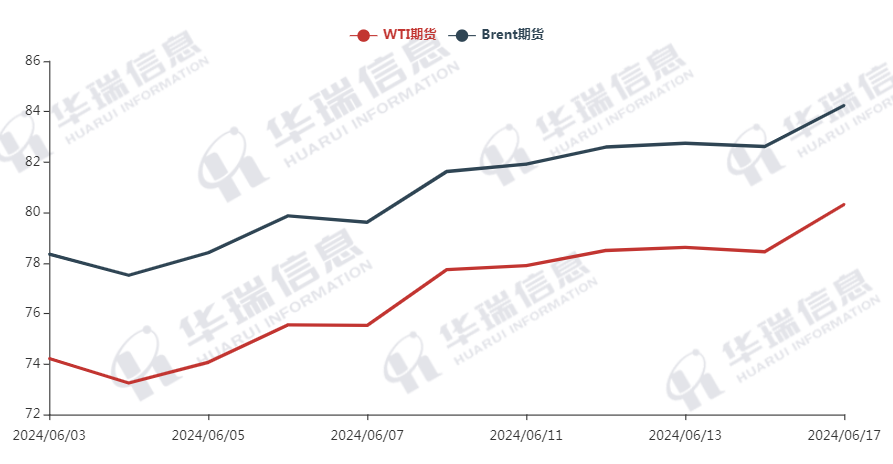

PX ( June 3rd - June 17th, 2024 )

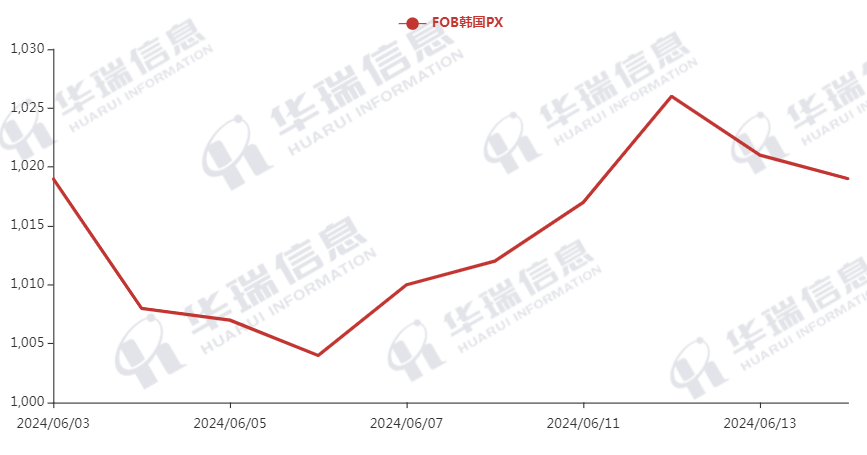

PTA ( June 3rd - June 17th, 2024 )

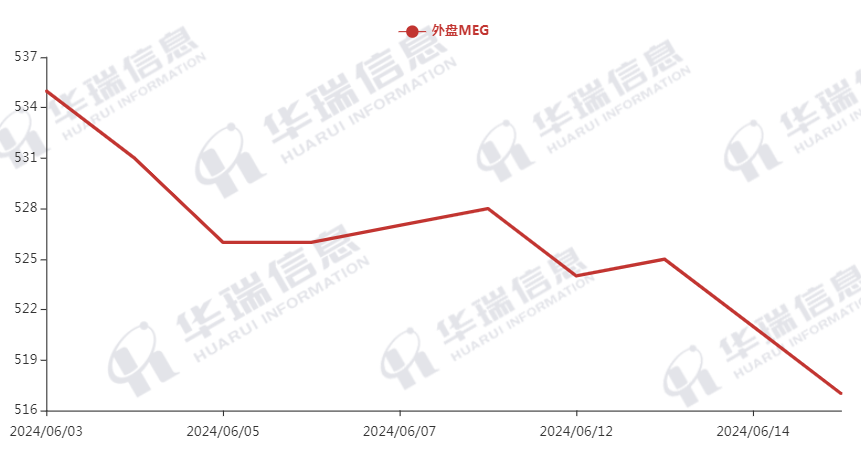

MEG ( June 3rd - June 17th, 2024 )

1. Polyester Filament

On Monday, international crude oil prices surged strongly. As Summer season’s coming, the market keeps positive and believes that the oil demand will increase,leading to increased speculative buying and a continuous rebound in oil prices. The cost of polyester yarn material followed accordingly and consolidated at a high level.

On production side, the mainstream factories have a strong willing to maintain prices, and most of them increased prices by 50-100cny/ton today and narrowed negotiating space or refused to negotiate price. Currently, the market transaction is based on rigid demand or keep a watch-and-see attitude because of high freight rate. It’s recommended that you can purchase as per in-hand orders or stock up some your regular items moderately when prices are acceptable.

In the long term, attention should be paid to news from large factory meetings, changes in downstream load and international news.

2. PSF

Yesterday, the PSF transaction was general. Overnight, the Crude oil rebounded to a seven-week high. Polyester raw materials such as PTA and PSF futures experienced a volatile rebound. In the early morning, spot prices mostly remained stable, and transactions were negotiated on a per-order basis.

3. VSF

The morning VSF market kept stable and whole atmosphere is tended to be positive. Partial factories still continue to sign orders even if they increased price. It’s recommended that maintain normal raw material inventory and replenish monthly usage during the promotion period.

4. Spandex

The spandex market kept stable and deal is based on negotiation. It’s recommended that follow up on purchases based on orders and demand.

5. Nylon

Pure benzene experienced narrow fluctuations at high levels. Both CPL and chips showed weakness this week. The conventional spinning price was adjusted downward and the high-speed spinning followed the CPL contract to reduce price. It is recommended to purchase as needed and consider moderate over-selling.