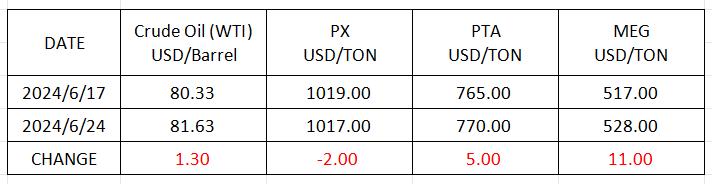

Market Trend (Jun.10th - Jun.24th, 2024)

Market Trend

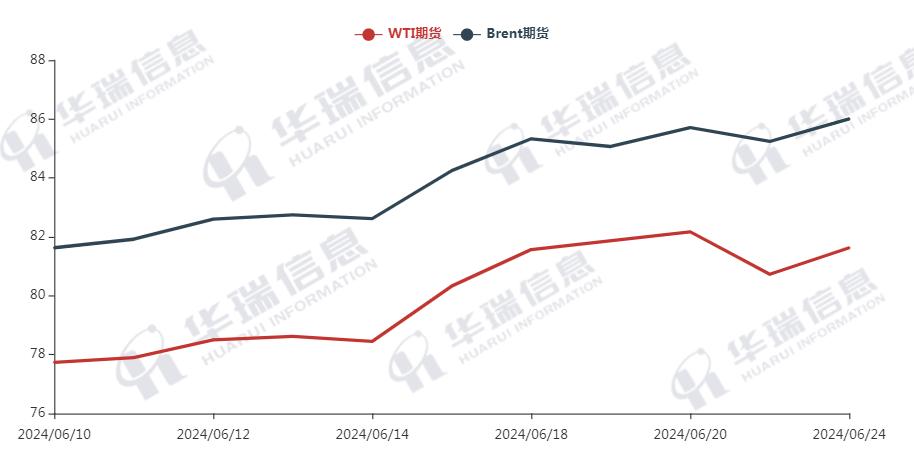

WTI/Brent ( June 10th - June 24th, 2024 )

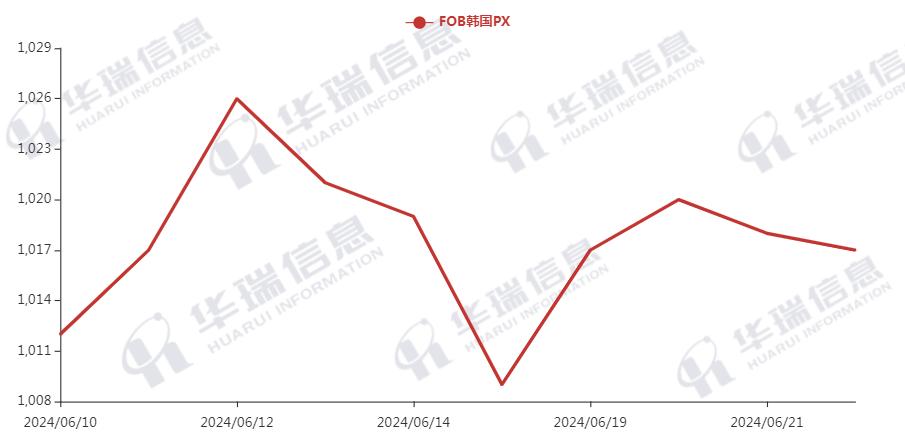

PX ( June 10th - June 24th, 2024 )

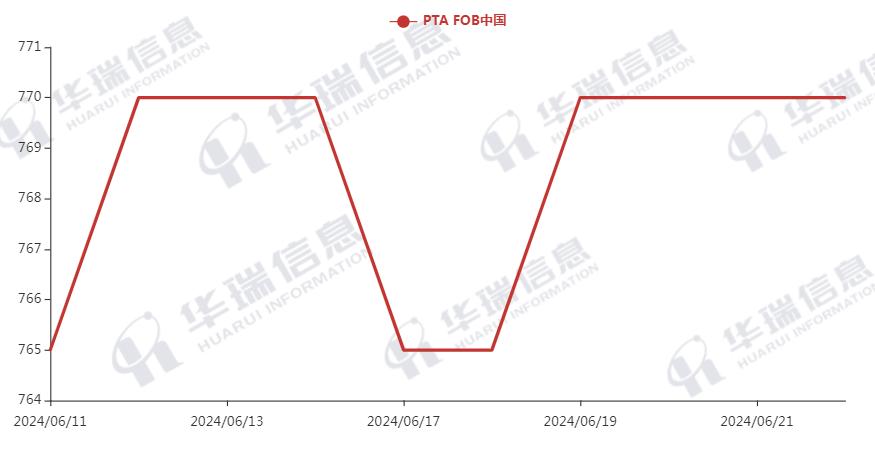

PTA ( June 10th - June 24th, 2024 )

MEG ( June 10th - June 24th, 2024 )

1. Polyester Filament

On Monday, international crude oil prices fluctuated upward. Expectations of demand, a weak US dollar, and geopolitical conflicts all contributed to the rise in oil prices, with US crude oil prices rising by more than 1%. Meanwhile, the currencies weakened against the US dollar, boosting the prices of commodities, including crude oil.

On production side, factories’ prices remained stable with some partial increases, and overall production and sales were good. After the meeting between the mainstream factories, they decided to reduce production again to keep prices and insisted on selling at a fixed price without negotiation. Driven by crude oil and production cuts, prices are expected to rise but not fall this week.

In the long term, attention should be paid to the reduction of production by major polyester factories and changes in downstream loads.

2. PSF

Yesterday, PSF prices continued to rise. Overnight, crude oil prices rose slightly, and polyester raw materials and PSF remained strong. The processing cost of PSF continued to widen, and downstream polyester spun yarns moderately followed the upward trend. It’s recommended that you can purchase as per orders or stock up moderately if the prices are in acceptable range.

3.VSF

Recently, the entire VSF supply chain has been improving, but the actual increase is still in a exploratory stage. It’s recommended that maintain normal raw material inventory and replenish monthly usage during the promotion period as usual.

4. Spandex

The spandex market was stable in negotiations. The transactions are based on rigid demand. It’s recommended that buyers follow up based on orders and demand.

5. Nylon

Pure benzene spot prices have fallen slightly. Under the cost pressure, the CPL price maintained stable, but the supply is sufficient. The Chips market is based on negotiation and the whole trend is tended to be weak.It is recommended to purchase according to demand.