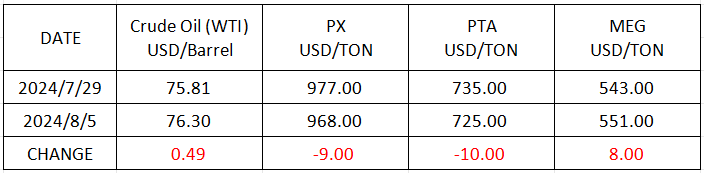

Market Trend (Jul.22nd - Aug.5th, 2024)

Market Trend

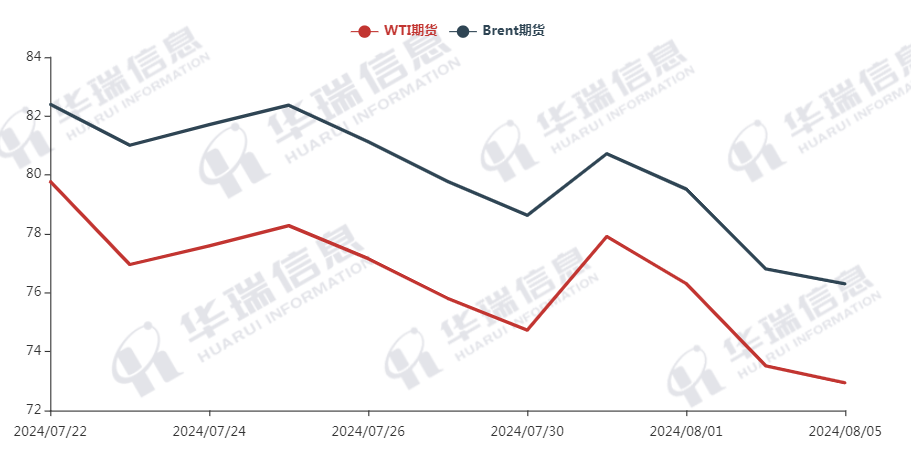

WTI/Brent ( July 22nd - August 5th, 2024 )

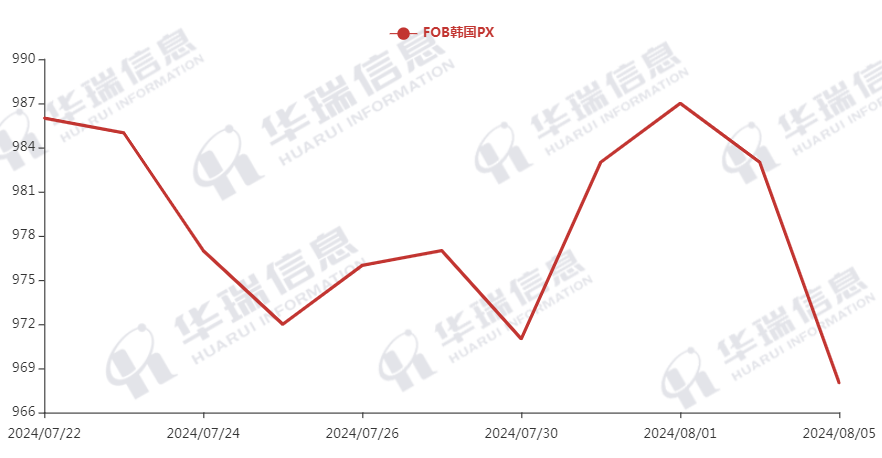

PX ( July 22nd - August 5th, 2024 )

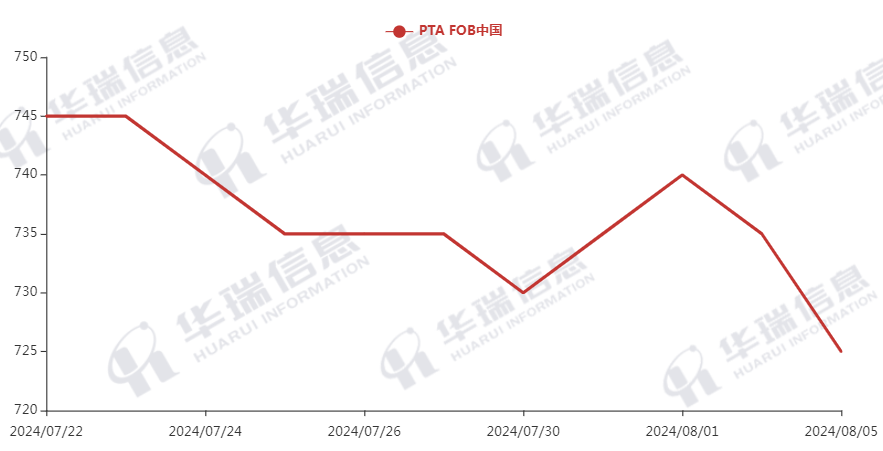

PTA ( July 22nd - August 5th, 2024 )

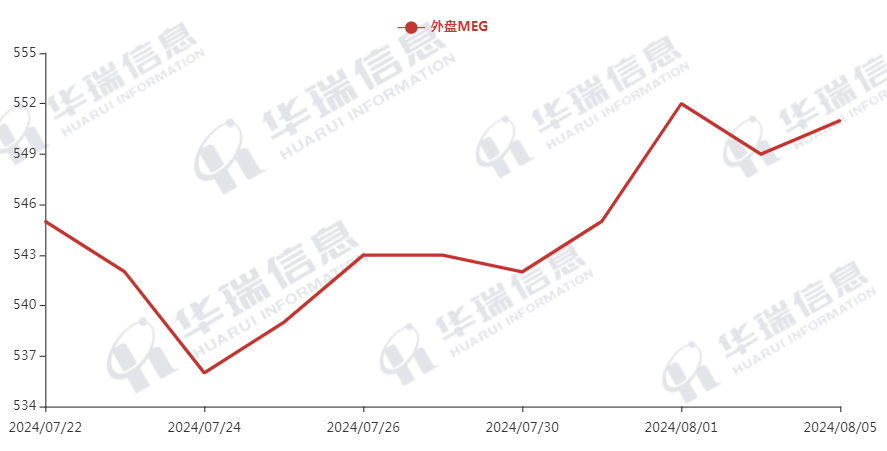

MEG ( July 22nd - August 5th, 2024 )

1. Polyester Filament

Currently, the global situation is uncertain, the market panic sentiment rise and down. the international crude oil prices fluctuated with a decline trend. The cost of polyester raw material has weak performance.

On production side, most factories kept prices, but the deal prices of firm orders can be negotiated. The whole market transactions are mainly based on rigid-demand and downstream may wait for occasional promotion from some factories.

2. PSF

The PSF market behaved general. The night section in crude oil rebounded slightly. Morning spot prices for PSF were mostly stable, with attention focused on the extent of raw material adjustments.

3. VSF

The morning market for VSF was relatively firm, with discount policies for high-end fibers being gradually canceled. The factories have obtained enough orders so the prices have rebounded to some extent.It’s recommended tha maintain normal raw material inventory and replenish monthly usage during promotional periods as usual.

4. Spandex

The spandex market remained general. Purchases were made in small quantities based on immediate needs. In the short term, spandex may experience slight adjustments in the bottom range. It is recommended that buyers follow up based on orders and demand.

5. Nylon

Following oil trend, the pure benzene dropped slightly. The supply-demand relationship for CPL remains stable, with prices holding firm. The demand for filament is weak, but mainstream enterprises maintain stable production. The nylon 66 industry chain is relatively weak, with prices continuing to decline. It is recommended to restock at low prices and to remain cautious about chasing high prices.