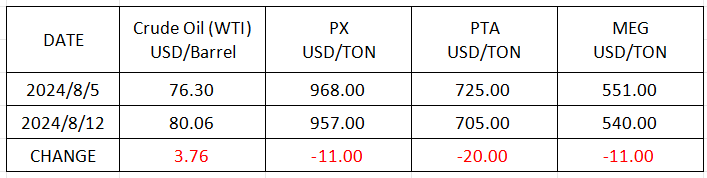

Market Trend (Jul.29th - Aug.12th, 2024)

Market Trend

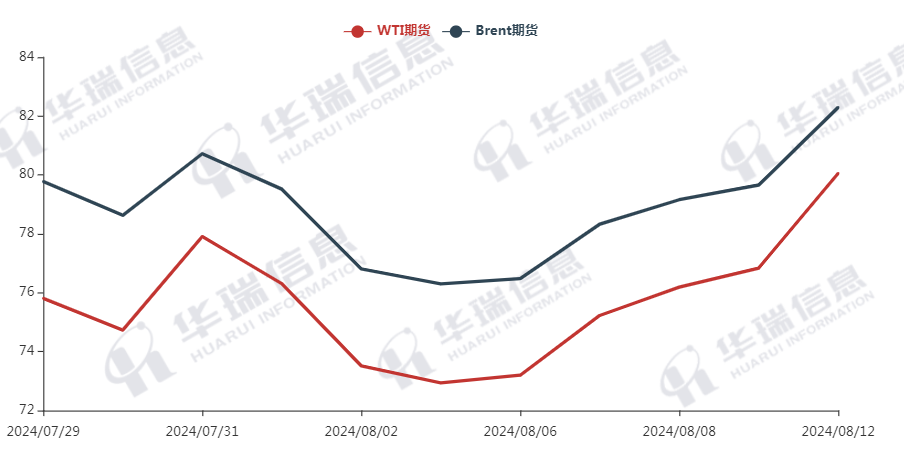

WTI/Brent ( July 29th - August 12th, 2024 )

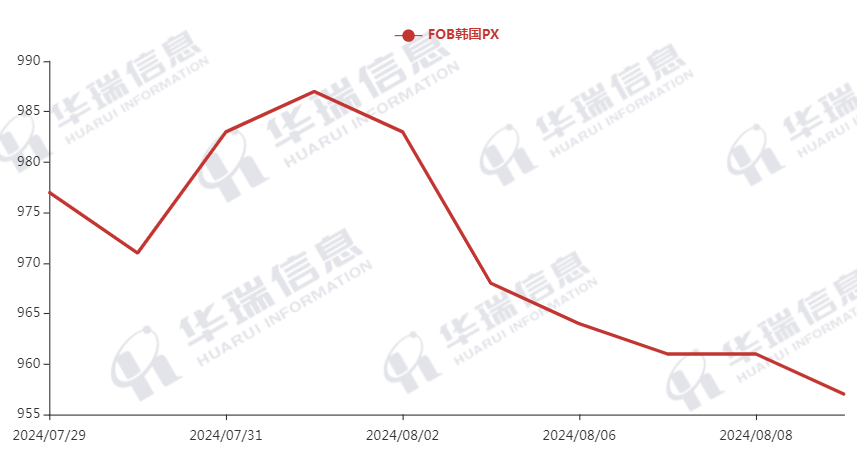

PX ( July July 29th - August 12th, 2024 )

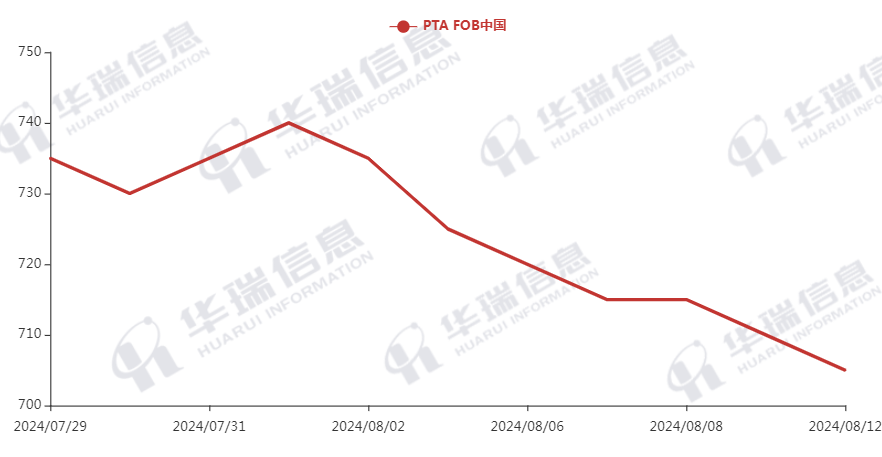

PTA ( July 29th - August 12th, 2024 )

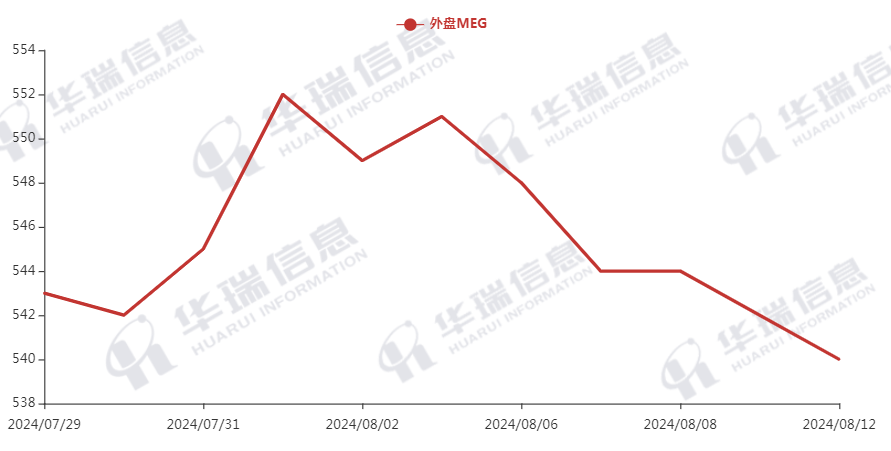

MEG ( July 29th - August 12th, 2024 )

1. Polyester Filament

Recently, geopolitical concerns have resurfaced, with gold, oil prices, natural gas, and US Treasury bonds jumping, and oil prices hitting their largest daily increase since October last year, which supports the cost of polyester raw material.

On production side, the production and sales was really good yesterday, reaching around 370% on daily average, which makes factories’ inventory pressure release. After a short-term increase in volume, prices may stabilize for a period or go up to some extent with the increasing cost. And in the medium term, continued attention will be paid to whether the dynamics of costs and demand change.

2. PSF

The PSF market quotes were mostly maintained, with negotiations on sales and a divergence in sales performance. Crude oil prices surged in the night session, and polyester raw materials as well as short-term PSF futures saw a slight increase.

3.VSF

VSF market atmosphere is calm, factories continue to ship goods as per in-hand orders, and the low-inventory pre-sale status supports the price and attitude to stabilize. It’s recommended that maintain a normal inventory of raw materials and replenish the monthly usage during promotional periods as usual.

4. Spandex

The spandex market behaved general as usual. The demand side for spandex is primarily driven by rigid negotiations. It is recommended that buyers follow up according to their orders and demand.

Following oil trend, the pure benzene market has a slight increase. The supply and demand of CPL are acceptable, with a slight downward adjustment in the price focus. Affected by cost, the high-speed spinning chips rose slightly, while the downstream kept watch-and-see attitude, and its spot transaction is based on negotiation. It is recommended to restock at low prices and to remain cautious about chasing high prices.