Market Trend (Aug.5th - Aug.19th, 2024)

Market Trend

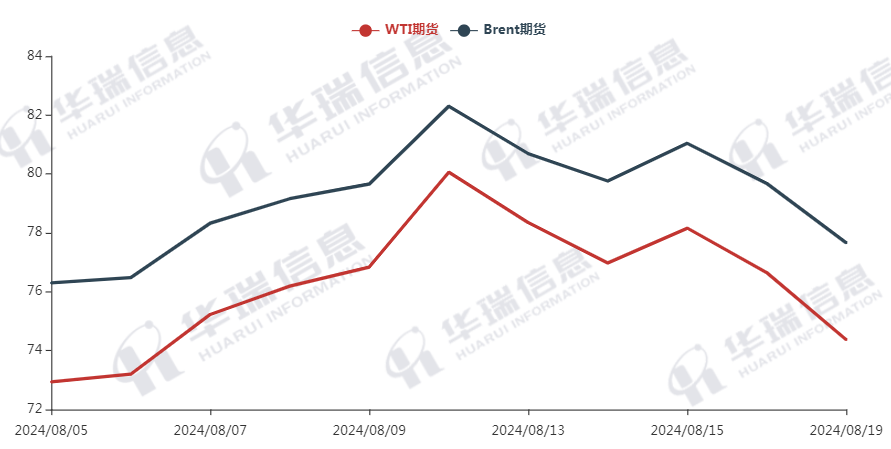

WTI/Brent ( August 5th - August 19th, 2024 )

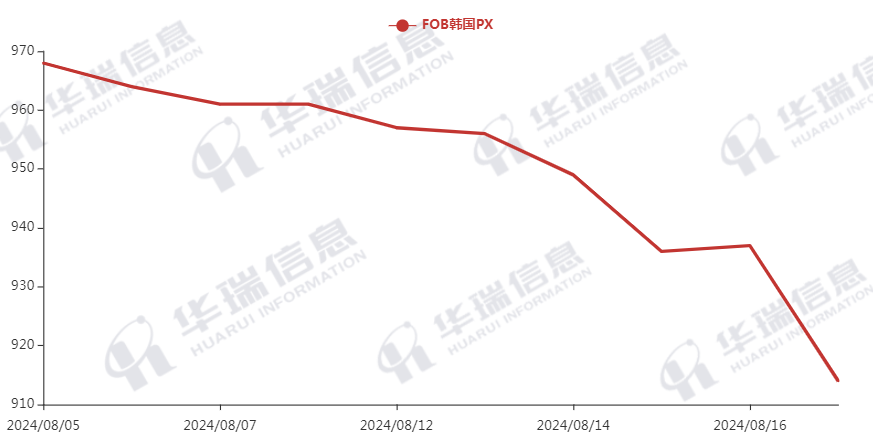

PX ( August 5th - August 19th, 2024 )

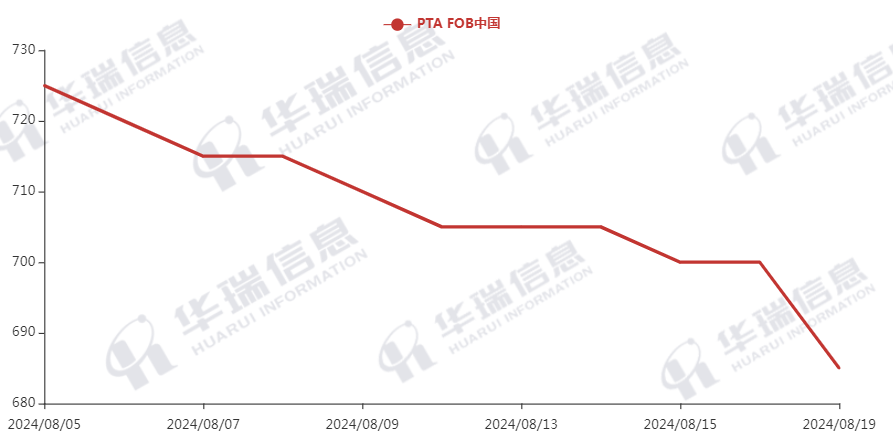

PTA ( August 5th - August 19th, 2024 )

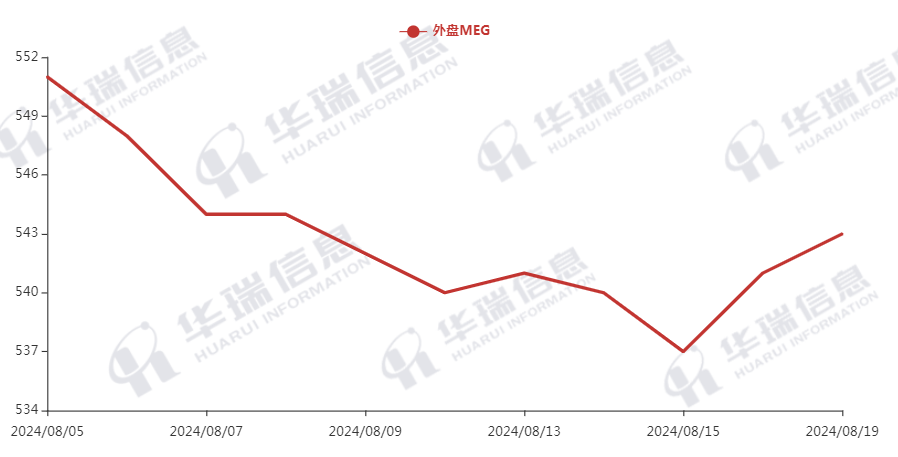

MEG ( August 5th - August 19th, 2024 )

1. Polyester Filament

Recently, international crude oil prices plummeted. Seasonal demand slowdown and the expectation of OPEC+ production cuts resuming in the fourth quarter pressured oil prices. Meanwhile, the cooling of geopolitical tensions provided limited support to oil prices, leading to a downward trend in the crude oil market.

On production side, after the rapid transfer of polyester filament inventory, providing some support for processing margins and operational loads. Orders from the weaving sector have started to increase, and with the rise in downstream operating rates, the social inventory of polyester filament is expected to deplete faster. In the short term, downstream stocking of polyester filament is sufficient and relative stabilization of costs.

2. PSF

The PSF market experienced a weak decline, with factory transactions remaining sluggish. However, futures and trades at low prices by traders were relatively better. In the spot market, early morning quotes remained relatively stable, with transactions being negotiated on an order-by-order basis.

3.VSF

The market for VSF remained relatively stable. As we approach September, market expectations are improving. However, there has been no significant change in fiber factory quotations. It’s recommended that maintain normal raw material inventory and continue to fulfill contracts as usual.

4. Spandex

The spandex market remained weak and stable. Most purchases were driven by immediate needs, with some thicker fabric orders following up locally. There was a slight increase in inquiries.It is recommended that buyers follow up based on orders and demand.

5. Nylon

Crude oil prices continue to decline, the price focus of the benzene market is running weak, while the price focus of CPL remains stable. The fundamentals of the chip market remain stable, with PA6 chip prices slightly increasing due to adjustments. Downstream demand is driven by immediate needs. Nylon filament prices have been partially adjusted upward. It is recommended that appropriately replenish inventory during low prices and temporarily observe when prices are high.