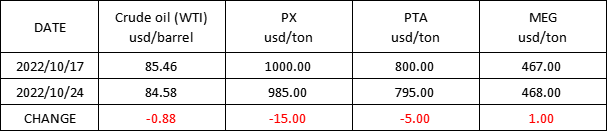

Market Trend ( 10TH OCT.,2022- 24TH OCT.,2022)

WTI /Brent ( 10TH OCT.,2022- 24TH OCT.,2022)

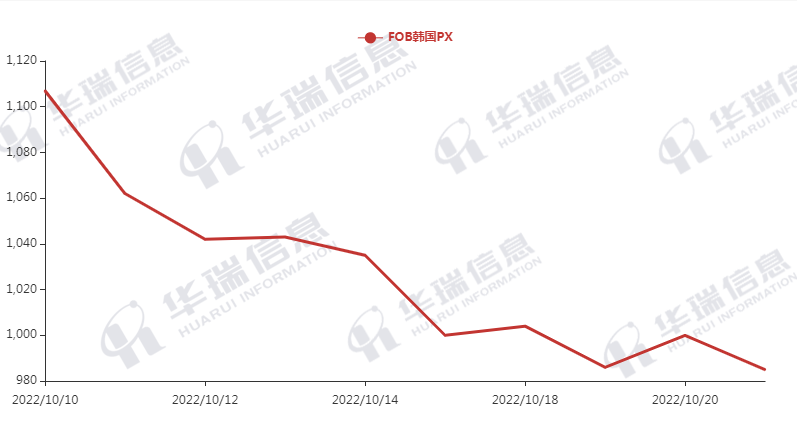

PX( 10TH OCT.,2022- 24TH OCT.,2022)

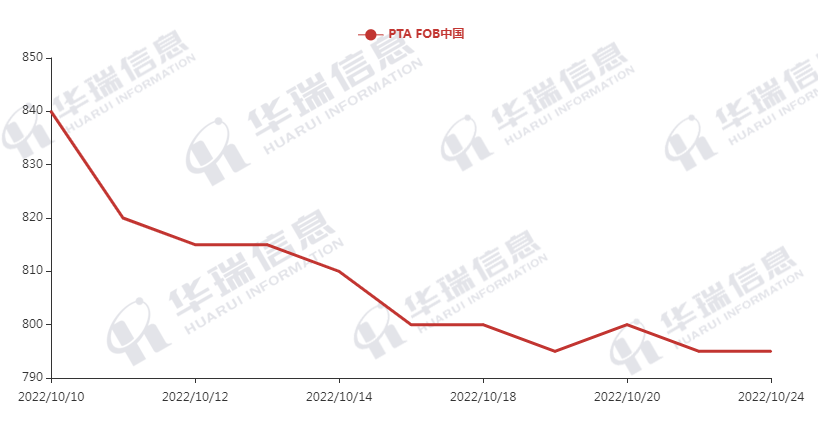

PTA( 10TH OCT.,2022- 24TH OCT.,2022)

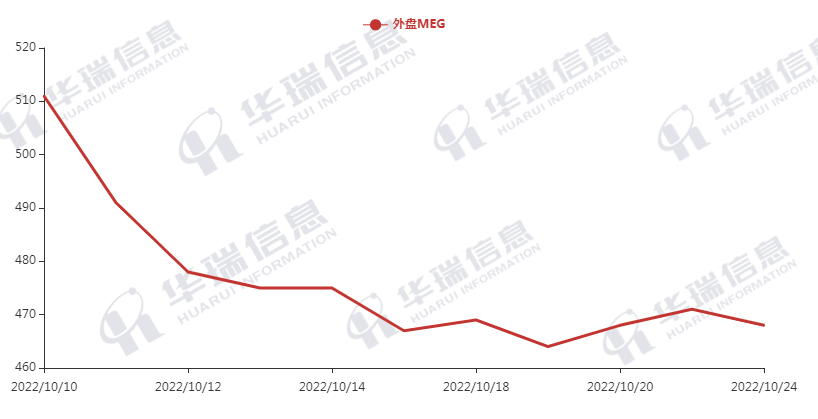

MEG( 10TH OCT.,2022- 24TH OCT.,2022)

1.Polyester filament

The overnight Crude oil rebounded slightly on Monday and then declined. Polyester raw material shocked weakly and the support of its cost side is limited.

One production side, factories sometimes have promotion to release inventory pressure and the deal mainly based on negotiation. In the meanwhile, more and more factories execute production reduction plan, which supports the cost to some extent. The whole market still keeps rigid purchasing rhythm.

It’s expected that the polyester products keep weak shock. For long-term, need to pay attention to the price of crude oil, polyester cost and terminal demand.

2.PSF

The PSF performance is general and price maintains stable, but it can be negotiated based on firm order.The market still keeps cautious and procures as per their firm demand.

3.VSF

There is no significant change on the VSF market, the prices keep stable for the time being and the transaction is based on negotiation. The market mainly remains cautious and keeps rigid-purchases.

4.Spandex

The spandex prices consolidate in a high level. For some hot sales items, they are still slowly pushing up. Downstream purchased as per firm demand or stock up moderately.

5. Nylon

There are small shock on Crude oil and pure benzene market. In the meanwhile, CPL spot prices is active and the price of transaction have a slightly improved. The normal spinning chips follow to rise while high-speed spinning one remain stable.It is suggested that you can purchase as per firm demand.