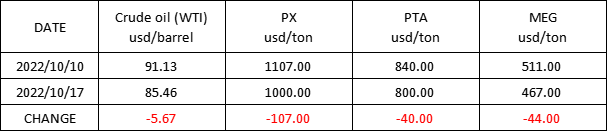

Market Trend ( 03RD OCT.,2022- 18TH OCT.,2022)

WTI /Brent ( 03RD OCT.,2022- 18TH OCT.,2022)

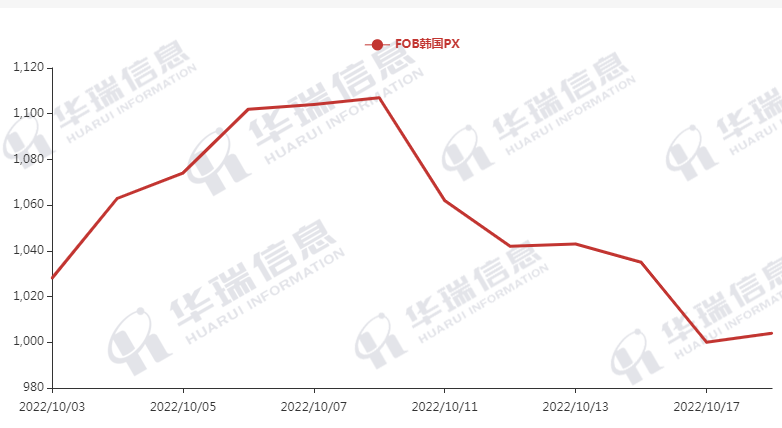

PX( 03RD OCT.,2022- 18TH OCT.,2022)

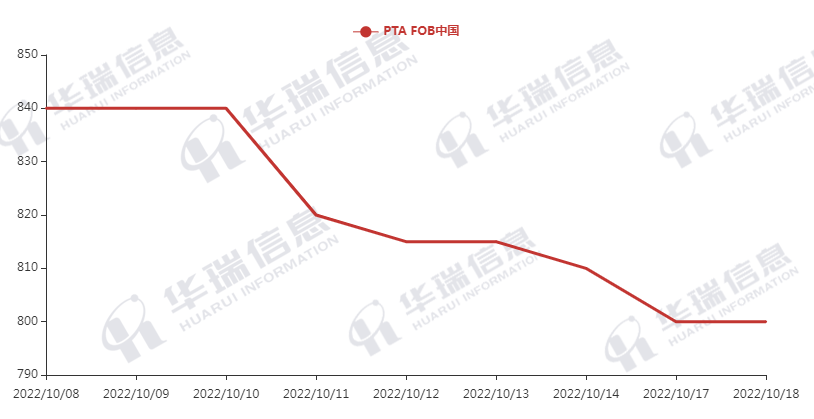

PTA( 03RD OCT.,2022- 18TH OCT.,2022)

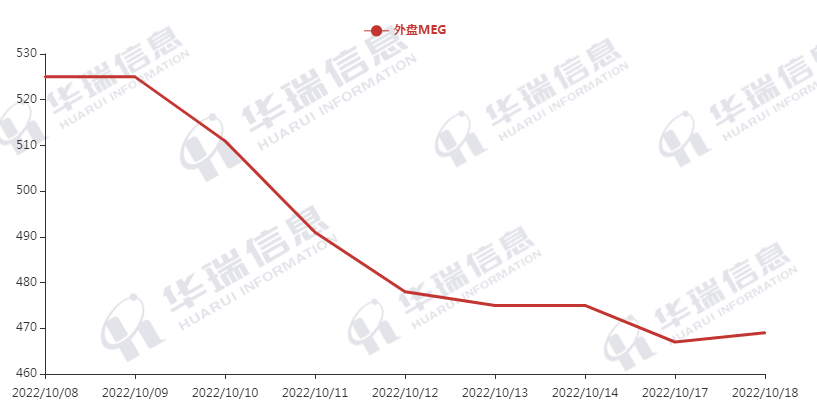

MEG( 03RD OCT.,2022- 18TH OCT.,2022)

On Monday, the new British finance minister withdrew most of the tax reduction measures taken by Prime Minister Truss, which cooled the risk aversion somewhat. In addition, the bank of America released stable quarterly financial report. The rare good news support oil prices. However, recession is still the current market theme. The market overall remains cautious and oil prices have become volatile.

1.Polyester filament

The overnight Crude oil declined, polyester raw material fell after rebounding and the support of its cost side is limited.

One production side, factories mostly had promotion for polyester filament yarn, the market concentrated on replenishment to some extent, which makes yesterday’s production and sales increased, reaching more than 200%. And today, the prices mainly keep stable, but they still maintain the way of negotiation if there is a firm order.

It’s expected that the polyester products keep weak shock. For long-term, need to pay attention to the price of crude oil, polyester cost and terminal demand.

2.PSF

Driven by the rise of PSF futures and factories’ promotion, the PSF sales was not bad yesterday. However, the night futures of oil fell, which restricts rising cost. The market still keeps cautious and procures as per their firm demand.

3.VSF

There is no significant change on the VSF market, the prices keep stable for the time being and the transaction is mainly based on negotiation. The market mainly remains cautious and keeps rigid-purchases.

4.Spandex

The spandex prices increased by 1000-2000cny/ton for low inventory and rising cost. For some hot sales items, they are still slowly pushing up. Downstream purchased as per firm demand or stock up moderately.

5.Nylon

Crude oil prices fell back to pre-National Day levels and Pure benzene market have no significant change. In the meanwhile, CPL spot prices continued to fall under the weak market demand. The Chips and downstream market temporarily maintain stable. It is suggested that you can purchase as per firm demand.