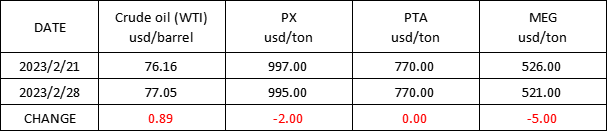

Market Trend(13TH FEB.,2023- 28TH FEB.,2023)

WTI/Brent (13TH FEB.,2023- 28TH FEB.,2023)

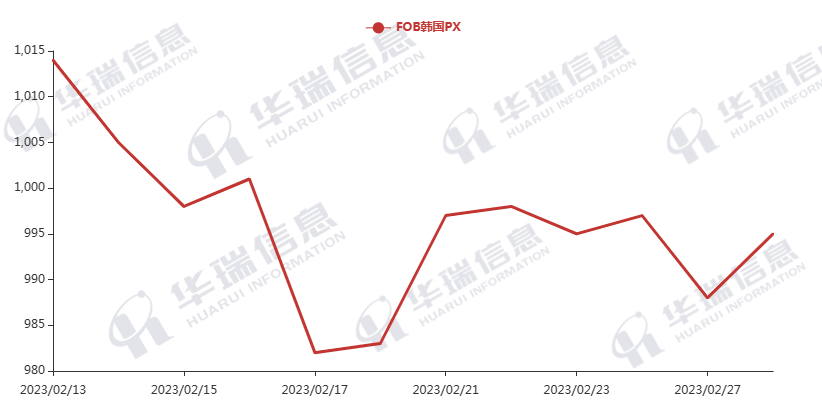

PX (13TH FEB.,2023- 28TH FEB.,2023)

PTA (13TH FEB.,2023- 28TH FEB.,2023)

MEG (13TH FEB.,2023- 28TH FEB.,2023)

1.Polyester filament

The Crude oil fluctuates widely, polyester raw material keeps range shock.

On production side, the downstream operating rate has reached to a high level recently. Supported by the recent rigid-demand and seasonal orders, the short-term supply and demand can maintain balance for the time being. The factories have no inventory pressure and keep prices stable. It’s expected the polyester product prices will follow cost to range shock. For long-term, need to pay attention to crude oil prices, the trend of upstream raw materials and the situation of terminal demand.

2. PSF

The PSF market was general yesterday. The futures of PSF and polyester raw materials rebounded again after the previous day’s slight declining,but there are no big changes in spot market this morning,most of factories keep the stable price. But if the PSF futures keep strong, downstream purchasing will be increased moderately.

3. VSF

The VSF market was general as well. Factories mainly execute previous orders. And currently, most factories’ inventory is within an acceptable range and have no pressure, so they keep the price in a relatively stable level.

4. Spandex

Due to the main raw material cost of Spandex rose, some mainstream factories increased by CNY1000/ton today. At present buying is dominated by rigid demand. It is suggested that you can purchase according to the order or hoard up moderately.

5. Nylon

Partial CPL maintenance devices will be gradually restored, which restrict CPL pushing up. However, due to the cost support,Chips maintain the stable price. Downstream mainly keeps watch-and-see attitude. It is recommended that you can purchase as per firm demand.