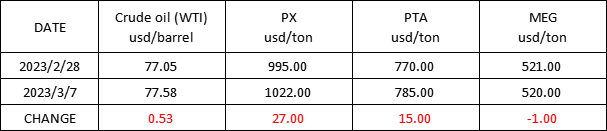

Market Trend(20TH FEB.,2023- 07TH MAR.,2023)

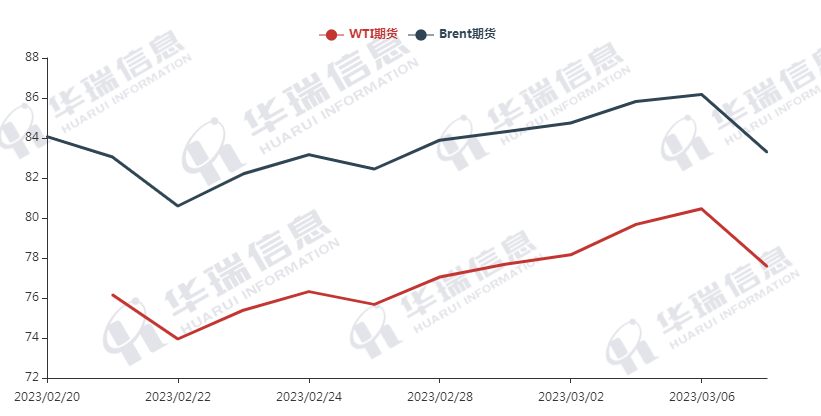

WTI/Brent (20TH FEB.,2023- 07TH MAR.,2023)

PX (20TH FEB.,2023- 07TH MAR.,2023)

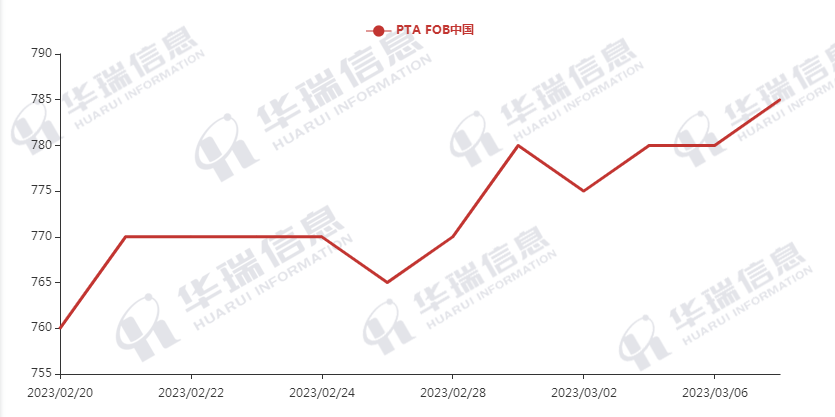

PTA (20TH FEB.,2023- 07TH MAR.,2023)

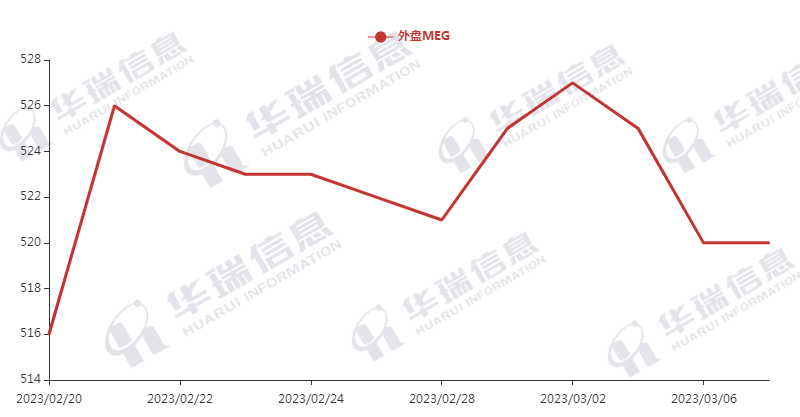

MEG (20TH FEB.,2023- 07TH MAR.,2023)

1.Polyester filament

Recently, the oil price trend is keeping strong fluctuation due to the recovery of China’s economy and Saudi Arabia’s increase in the official price of crude oil in Asia and Europe. The polyester raw materials followed to rebound, which supports the short-term cost side to a large extent.

On product side, influenced by crude oil trend, most factories increased prices 50-100 RMB/ton yesterday and kept stable this morning. On the whole, the market keeps cautious and downstream mainly executes a rigid-purchase. For long-term, need to focus on crude oil trend, the situation of machines maintenance and terminal demand.

2. PSF

The PSF sales performance was not bad and factories mainly delivered goods stably. The price of PSF futures followed Crude oil to range shock, which affects the spot prices. Most factories increased prices yesterday and maintained stable today. The market mainly keeps rigid-purchase or stock up moderately.

3. VSF

There is no significant change on the VSF market, the prices keep stable for the time being and factories mainly shipped in-hand orders. The market remains cautious and keeps rigid-purchases.

4. Spandex

Currently, the transaction in spandex market is general, because the supply is very tight and factories have no enough goods to sell. That’s why the current price of spandex remains in a high level. It is recommended to purchase as per the urgency of your order or hoard up moderately to avoid any risks.

5.Nylon

Pure benzene kept range shocked, then went strong again, which supports the downstream’s cost side. CPL spot price maintain stable. The High-speed spinning chips follow up the previous contract, while the normal spinning maintain price stability. Supported by the cost side, factories mainly keep the prices. It’s suggest that you can procure as per firm orders to avoid any risks.