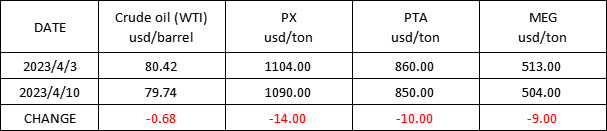

Market Trend(27TH MAR.,2023-11TH APR.,2023)

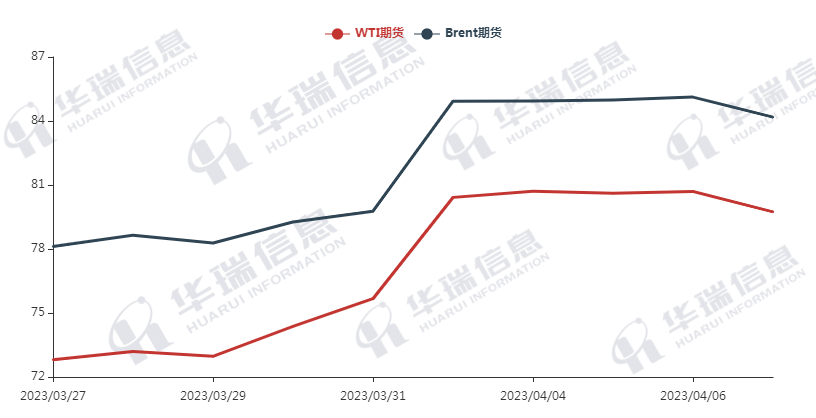

WTI/Brent (27TH MAR.,2023-11TH APR.,2023)

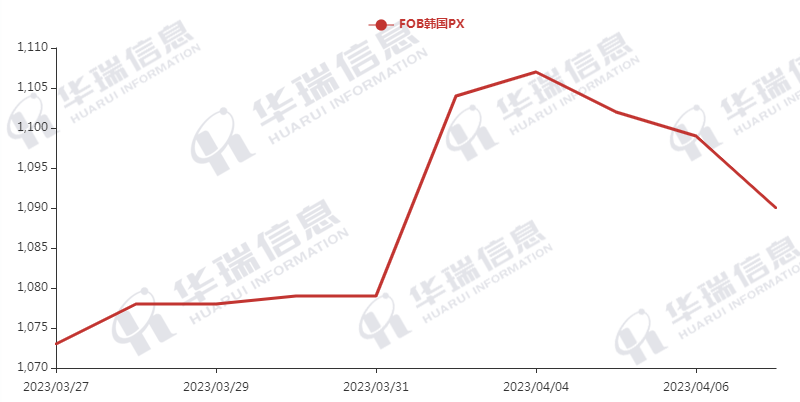

PX (27TH MAR.,2023-11TH APR.,2023)

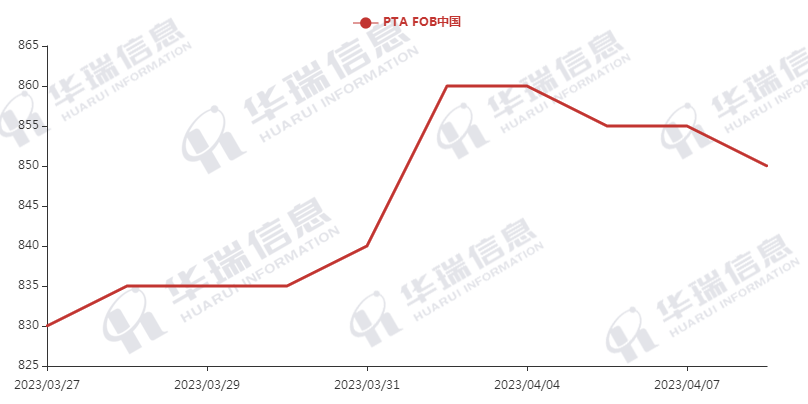

PTA (27TH MAR.,2023-11TH APR.,2023)

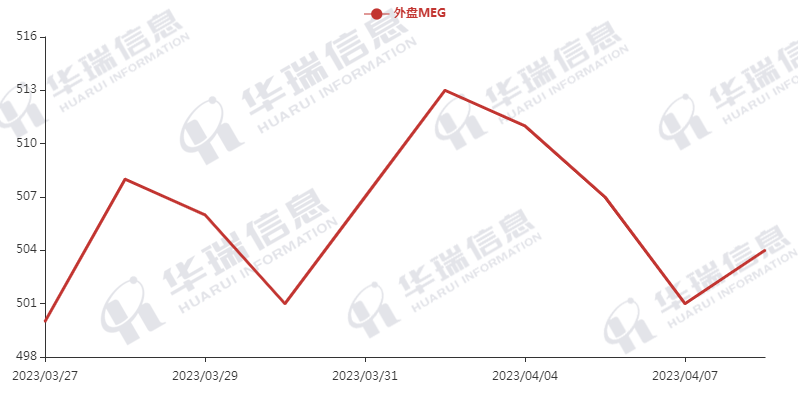

MEG (27TH MAR.,2023-11TH APR.,2023)

1. Polyester filament

Recently, the crude oil has been fluctuated strongly in a high level,which supports the polyester raw material cost side,while the terminal demand is not so strong, so it is like a gamble between upstream material cost and terminal demand.

On products side, the product prices follow crude oil trend to go up or keep stable because most of them still produce with a loss even if the downstream demand is limited. On the whole, the market keeps cautious and downstream mainly executes a rigid-purchase. For firm demand, the prices can be negotiated for the time being. For long-term, need to focus on crude oil trend, the situation of machines maintenance and terminal demand.

2. PSF

PSF market performed general but improved to some extent yesterday, the production and sales reached 102%. The crude oil fluctuates but PTA is not easy to drop, so the price is expected to tend to be stable and it can be negotiated based on orders. Focusing on the later trend of raw material.

3. VSF

The VSF market behaved stable, the production and sales was not bad yesterday. Due to the good performances of last week’s deal, the factories’ attitude is becoming active. Therefore, the VSF price maintains stable or go up slightly. The market remains cautious and keeps rigid-purchases.

4. Spandex

There is no significant change in spandex market and its price can be negotiated based on orders. It is recommended to purchase as per the urgency of your order or hoard up moderately to avoid any risks.

5. Nylon

Pure benzene price still kept range shocked and CPL performed general. For chips market, the normal-spinning one behaves general, while the production and sales of high-speed spinning is keeping good performance. Downstream mainly keeps watch-and-see attitude. It is recommended that you can purchase as per firm demand.