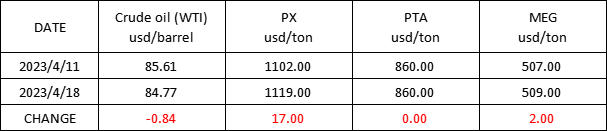

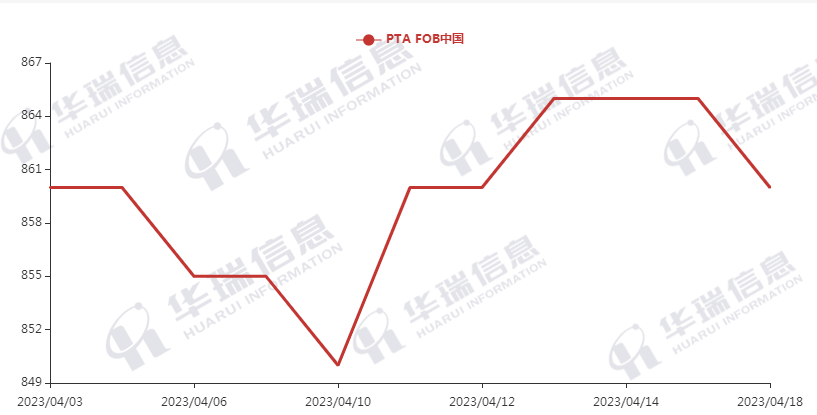

Market Trend(03RD Apr.,2023- 18TH APR.,2023)

WTI/Brent (03RD Apr.,2023- 18TH APR.,2023)

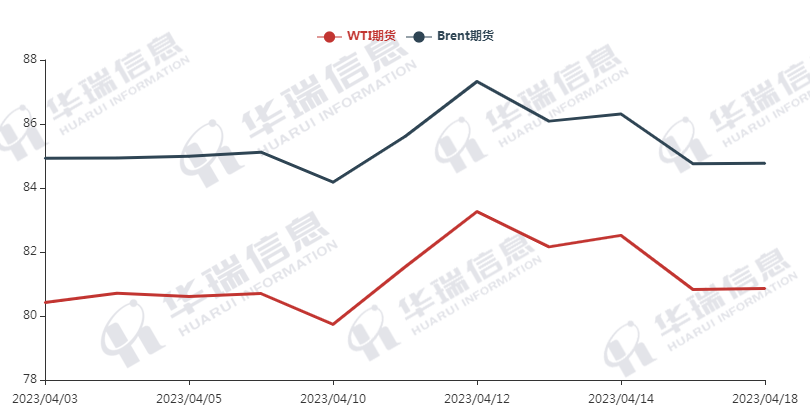

PX (03RD Apr.,2023- 18TH APR.,2023)

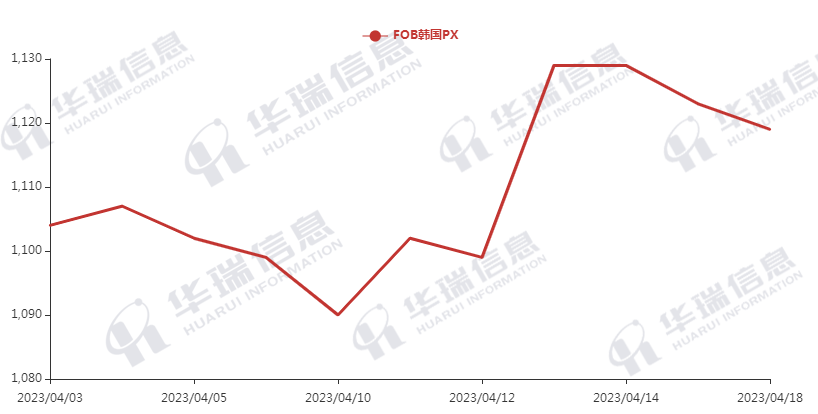

PTA (03RD Apr.,2023- 18TH APR.,2023)

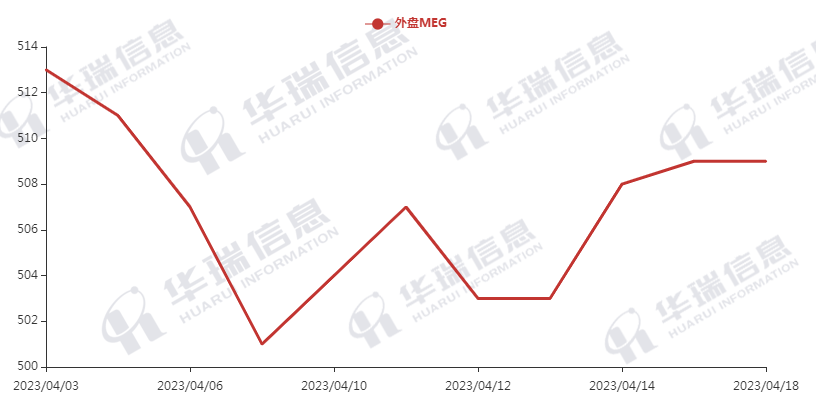

MEG (03RD Apr.,2023- 18TH APR.,2023)

1. Polyester filament

Recently, the Crude Oil, PX and PTA still keep the trend of fluctuating strongly in a high level, which is still a big support to the polyester raw material cost.

On production side, the operating rate of downstream is going down continuously, which restricts the demand. However, considering the high level cost and operation with loss, factories prefer to keep the price when cost fluctuates or increase prices when the Crude oil rises. The gamble between cost side and terminal demand will be a general phenomenon recently.

It’s expected that short-term polyester products tend to be range shocked. For long-term, need to focus on crude oil price, the trend of polyester raw material and the operation situation of upstream and downstream.

2. PSF

The PSF transaction was not bad, the production and sales reached 160% on Monday. The market price mainly keeps stable or rises slightly with the driving of high level cost side. The whole market keeps rigid-purchase. It is also recommended that you can purchase as per firm demand.

3. VSF

There is no big change in VSF market, and the price maintains stable. Due to the execution of previous orders, the current factory inventory has declined significantly. Partial factories hope to keep the rising trend because of tight supply. It’s suggested that you can purchase as per your firm order in case of any risks

4. Spandex

Currently, the Spandex stays in a customer-oriented market, the supply is sufficient and deal based on negotiation. Downstream mainly keeps watch-and-see attitude or purchase as per firm orders.

5. Nylon

CPL stopped sliding and turned stable on Monday, while the spot price increased suddenly because of the accidental shutdown of the northern factory. Then the normal-spinning chips follow to rise while the high-speed spinning one keeps general stable. It is suggested that you can purchased as per orders to avoid any risks.