Market Trend(15th May,2023- 29th May,2023)

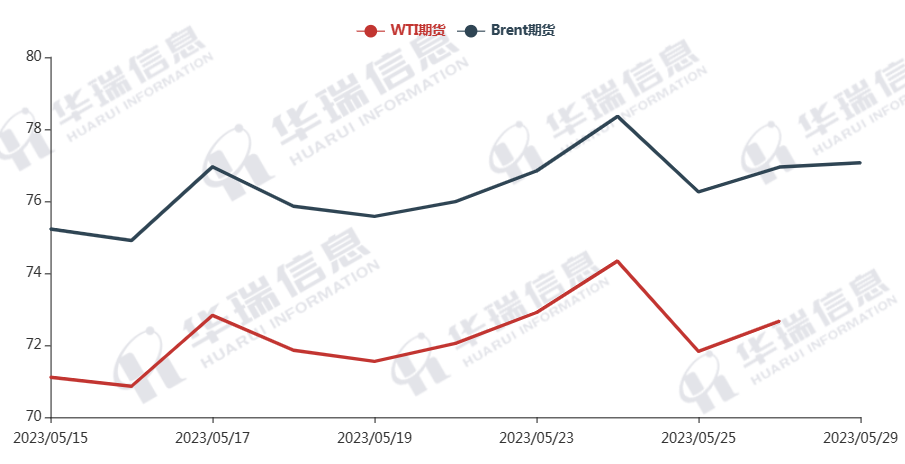

WTI/Brent (15th May,2023- 29th May,2023)

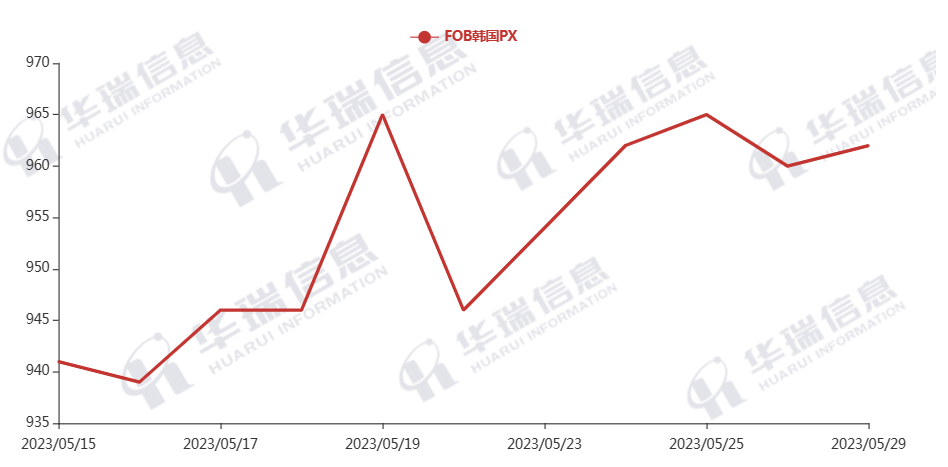

PX (15th May,2023- 29th May,2023)

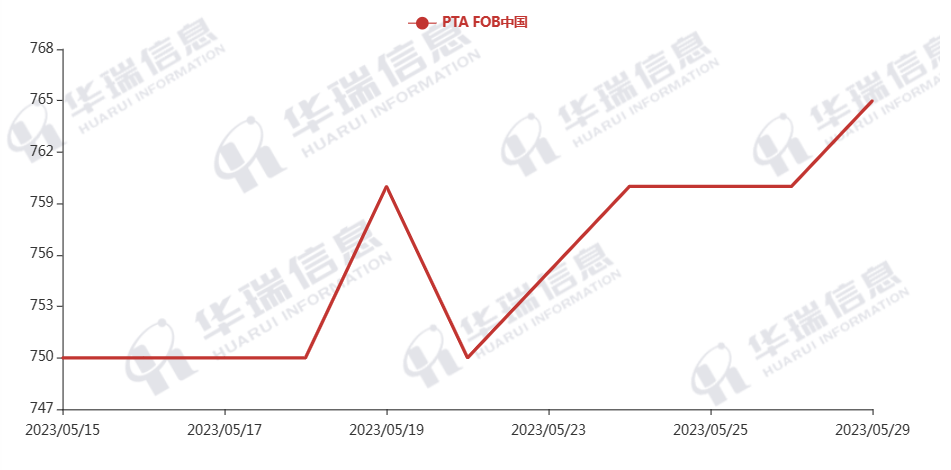

PTA(15th May,2023- 29th May,2023)

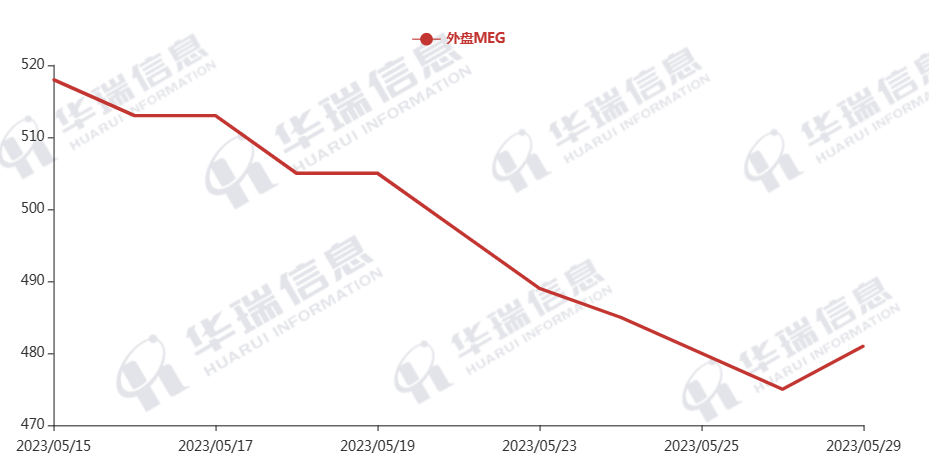

MEG (15th May,2023- 29th May,2023)

1. Polyester filament

The Crude oil have up and down for a period, the polyester raw materials cost follow to fluctuate.

On production side, after a period of low market trend, the macro market atmosphere has eased. Specifically reflected that the polyester raw material continues to rebound and the recent production and sales recovered, which cause the price of the product raised. The factories increased the price by 50-100CNY/TON yesterday then kept stable today.

It’s expected that short-term polyester products tend to be range shocked. For

long-term, need to focus on crude oil price, the trend of polyester raw material and the

operation situation of upstream and downstream.

2. PSF

The PSF futures keeps range shocked recently. Driven by the raw materials PTA and PX, the PSF market price kept stable today after rising. The firm order can be based on negotiation, and the market keeps rigid-purchase.

3. VSF

The VSF market overall keeps stable and factories still ship goods steadily. The factories’ in-hand orders have been scheduled to the end of June and their inventory still in the low level, so most of them are willing to increase prices. It’s suggested that you can purchase as per your firm order in case of any risks.

4. Spandex

The spandex market performs general. The downstream keeps cautious and purchases according to orders. It’s also suggested that you can buy moderately as per firm demand.

5. Nylon

Chemicals continued to rise slightly, in the meanwhile the spot of pure benzene dropped first and then rebounded. However CPL kept weakly shock due to the chips price did not significantly improved.

Crude oil (WTI) | PX | PTA | MEG | |

2023/5/22 | 72.05 | 946.00 | 750.00 | 497.00 |

2023/5/29 | 72.67 | 962.00 | 765.00 | 481.00 |

CHANGE | 0.62 | 16.00 | 15.00 | -16.00 |