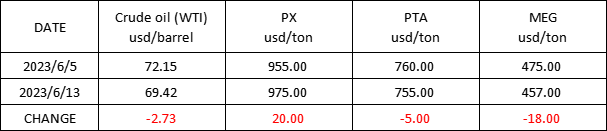

Market Trend(May 29th, 2023 - June 13th, 2023)

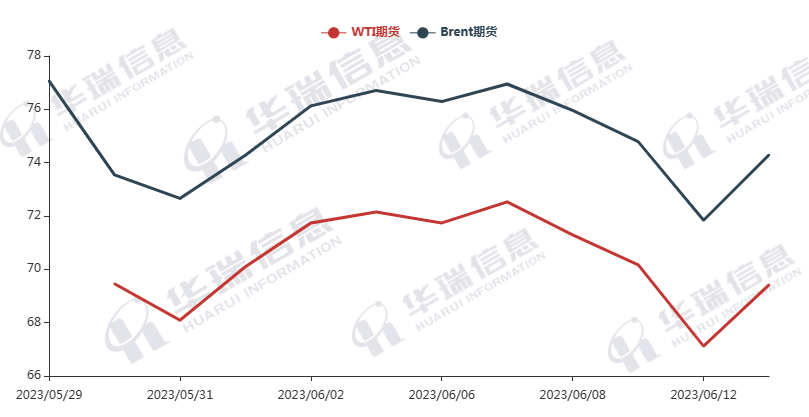

WTI/Brent (May 29th, 2023 - June 13th, 2023)

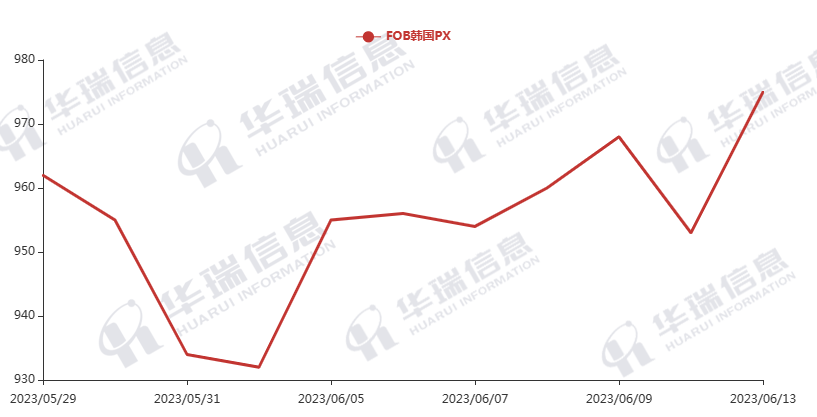

PX (May 29th, 2023 - June 13th, 2023)

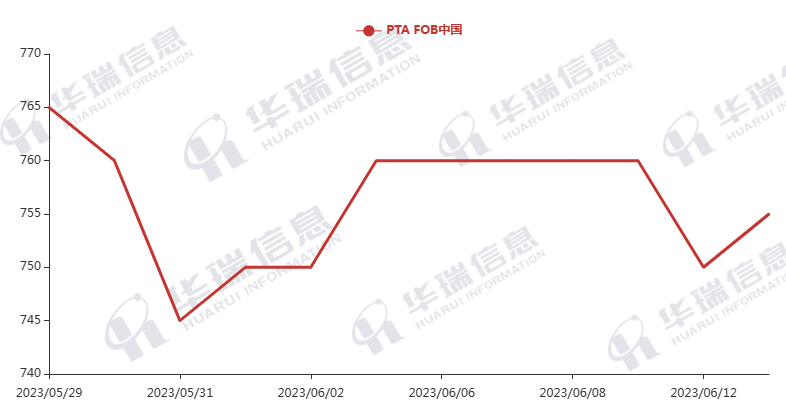

PTA (May 29th, 2023 - June 13th, 2023)

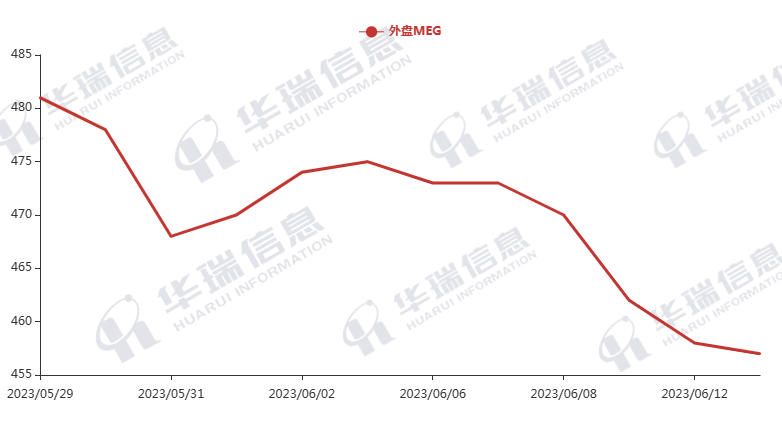

MEG (May 29th, 2023 - June 13th, 2023)

1. Polyester filament

Due to Goldman Sachs' expectation of lowering oil prices, the crude oil dropped on Monday. However, it rebounded on Tuesday as OPEC monthly Report shows that their oil production decreased by 464000 barrels per day in May, and they are optimistic about China’s economic recovery. The prices of polyester raw materials have a support for the time being.

On production side, since the terminal demand is limited, while the cost of polyester raw material has been supported, factories prefer to keep the prices. The market mainly keeps just-need purchase and maintains a cautious attitude. It is expected that the polyester market will be volatile in the short term. For the long term, it’s important to pay attention to fluctuations in raw material prices, polyester loads, and the situation of production and sales.

2. PSF

The PSF factories had promotion yesterday, most of downstream stock up moderately, then the transaction volume increased. So the average production and sales were pretty good, reaching 200%. Due to the night futures of crude oil rebounded and the PSF futures went up, factories narrowed the negotiating space and its quotations in the spot market in early trading were generally stable. The downstream has a wait-and-see atmosphere. So it is suggested that you purchase as per orders or hoard up moderately if the prices are at a relatively acceptable level.

3. VSF

The VSF market has entered a stable period, but there are still some factories who have tentatively raised prices as they have enough orders in hand. Most of the downstream enterprises have completed stocking last week and are currently in the process of picking up the goods. It’s best to keep a certain amount of raw materials in stock.

4. Spandex

The spandex market temporarily stabilized and adjusted. The prices of spandex have been adjusted to a level near historic bottoms, so the market hoards up moderately or purchases based on firm demand.

5. Nylon

Pure benzene in the domestic market fell sharply. The supply and demand of CPL are slightly tight in the short term and prices go up against the trend. There’s no obvious change in downstream. It’s advisable to follow the market trend in the short term. It is recommended that conventional spinning mills which meet high pressure reduce their output properly to avoid risk.