Market Trend (July 3rd - July 18th, 2023)

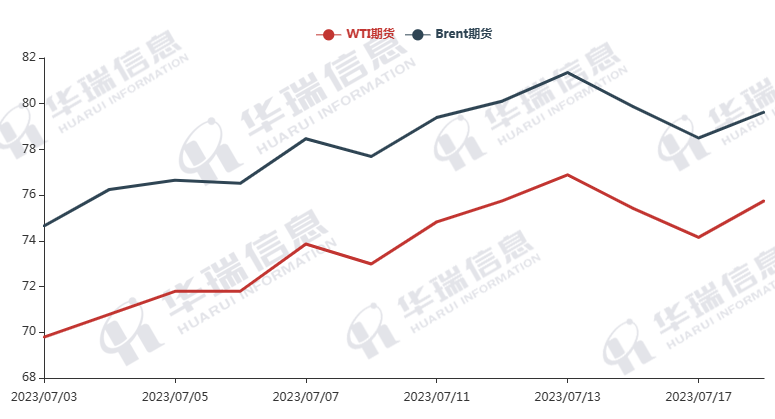

WTI/Brent (July 3rd - July 18th, 2023)

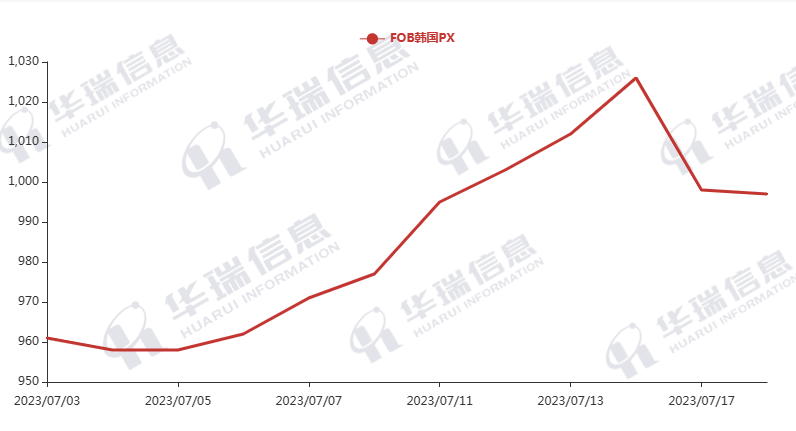

PX (July 3rd - July 18th, 2023)

PTA (July 3rd - July 18th, 2023)

MEG (July 3rd - July 18th, 2023)

1. Polyester Filament

The Crude Oil price continued to fluctuate. The cost of polyester raw materials also shows volatile trend. However, factories don’t have a high inventory pressure for the time being and mainly keep prices stable or follow the rising cost to increase. The market mainly stays in a digest stage. It’s expected that prices of polyester filament products will mainly remain stable in the short term. For the long term, it’s important to pay attention to fluctuations in raw material prices, polyester load, and the situation of production and sales.

2. PSF

The PSF market was general and discussed for sale. Quotations in the morning session were mainly stable and deals were made based on negotiation. The market mainly keeps a watch and see attitude and it’s also suggested that you purchase as per orders.

3. VSF

The VSF market generally keeps a relatively stable state recently. There was some fluctuation but it didn’t make a big difference to the market. It’s suggested that you purchase as per your firm demand.

4. Spandex

The prices of mainstream spandex products were stable yesterday. The supply is sufficient but some lot numbers behave tight state. Factories mainly maintain stable prices lately. It’s suggested that you purchase spandex as per orders or stock up moderately when the price stays at an acceptable level.

5. Nylon

The price of pure benzene consolidated at a high level. The supply and demand relationship of CPL tends to be balanced but there is currently no inventory pressure for sellers. The conventional spinning downstream market starts to gradually replenish. The high speed spinning ships as per order and has no stock pressure. It’s important to pay attention to the trend of bulk commodities.