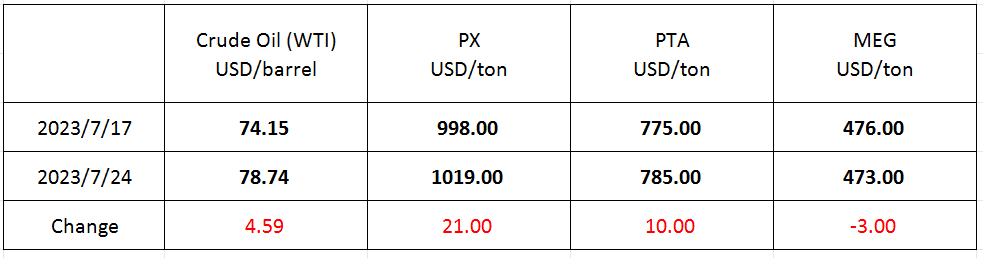

Market Trend(July 10th - July 24th, 2023)

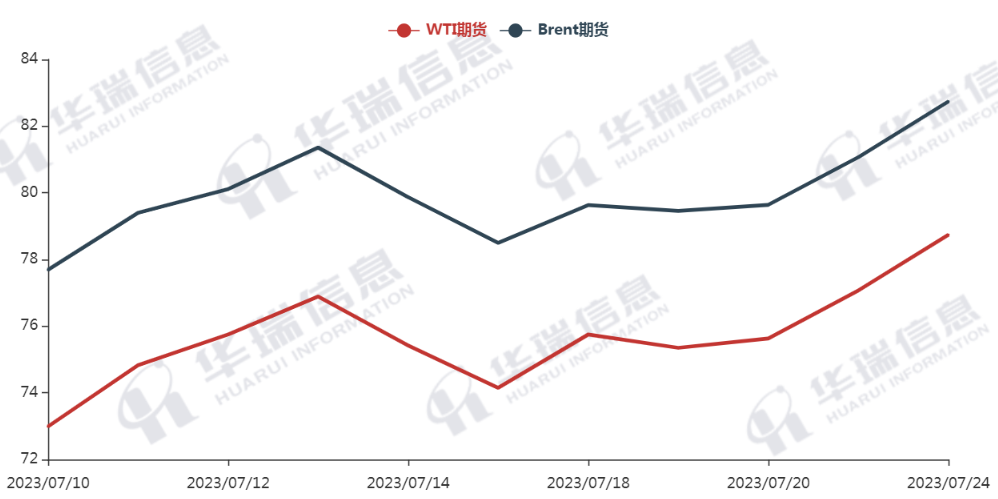

WTI/Brent (July 10th - July 24th, 2023)

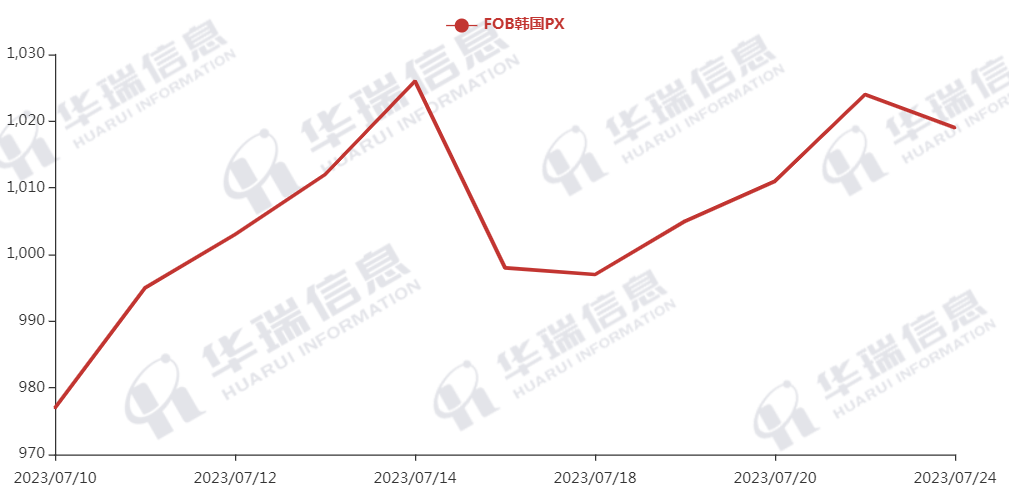

PX (July 10th - July 24th, 2023)

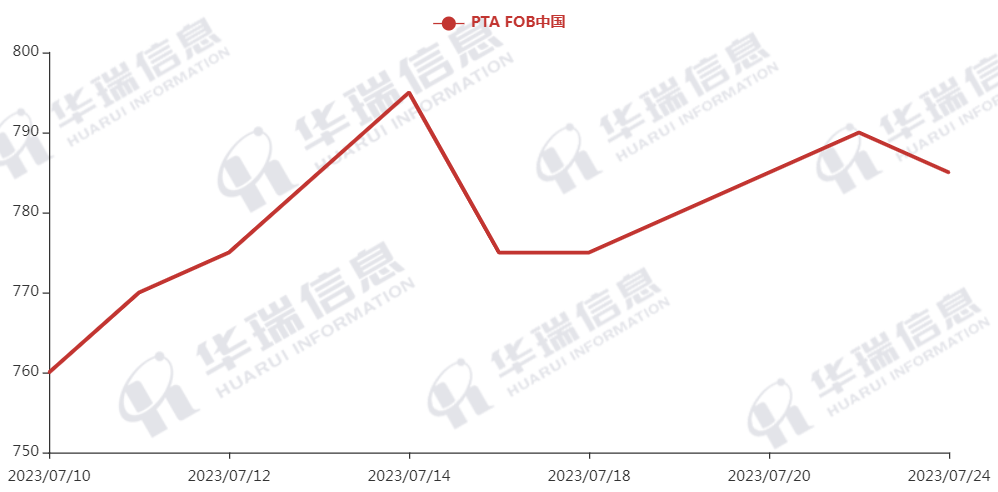

PTA (July 10th - July 24th, 2023)

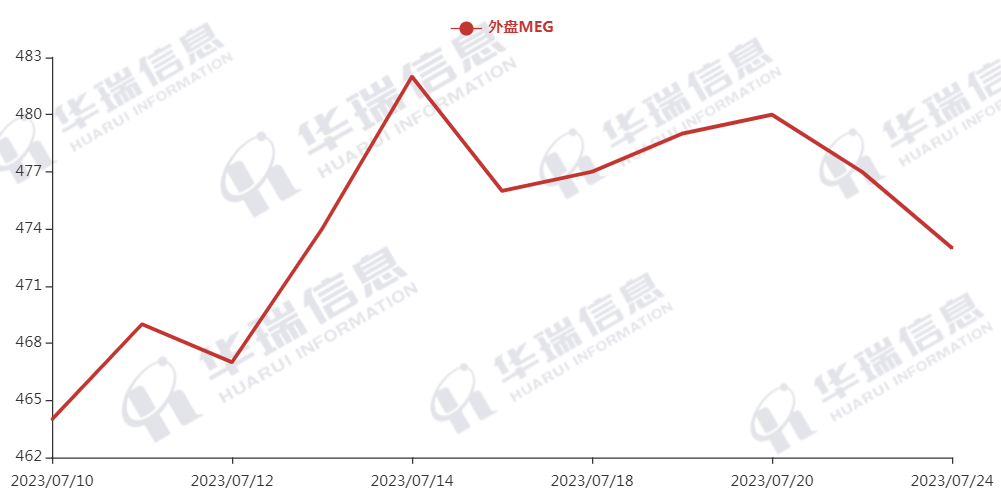

MEG (July 10th - July 24th, 2023)

1. Polyester Filament

Affected by the expected tightening of supply,the sentiment in the Crude oil market has been positive recently. The Crude oil soared sharply. The short-term cost of polyester raw materials increased accordingly.

At the moment, factories mainly keep prices stable or increased slightly with the rising cost. In the meantime, factories don’t have high inventory pressure, so it’s expected that prices of polyester filament products won’t drop and be easy to go up in the short term. Furthermore, the shipment will be definitely influenced by the recurrent typhoon in the next two or three months, so it’s necessary to take this factor into consideration and make a reasonable purchasing plan in advance.

2. PSF

The PSF market is expected to see a rise in the short term. Crude oil futures during the night trading session rose sharply. Quotations in the morning session were mainly stable, but it’s expected that transaction prices will be higher. The downstream market is expected to stock up, which may boost the sales of yarn. It’s important to keep a close eye on the market trend.

3. VSF

The VSF market has been relatively stable lately. On Monday, the market was generally general. But factories’ overall performance in July was better than expected and there wasn’t a significant increase in inventory. It’s suggested that you purchase as per your firm demand or stock up moderately if the price stays at an acceptable level.

4. Spandex

On Monday, prices of spandex products mainly maintain stable. A few lot numbers have a tight supply, and there’s no space for negotiation. It’s suggested that you purchase spandex as per orders or stock up moderately when the price is at an acceptable level.

5. Nylon

The price of pure benzene remained consolidated at a high level. Driven by the cost, the price of CPL continued to go up, and the transaction gradually followed up. The conventional spinning market saw a high transaction price but the trading volume wasn’t satisfactory. Under the cost pressure, sellers were reluctant to sell at a low price. The high speed spinning market ships as per firm order. The downstream market still had a stable kick-off. Generally, the supply and demand of nylon products are relatively balanced. It’s important to pay attention to the trend of bulk commodities and purchase as per firm demand.