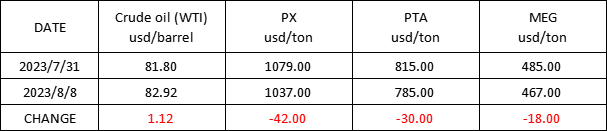

Market Trend (July 24th - August 8th, 2023)

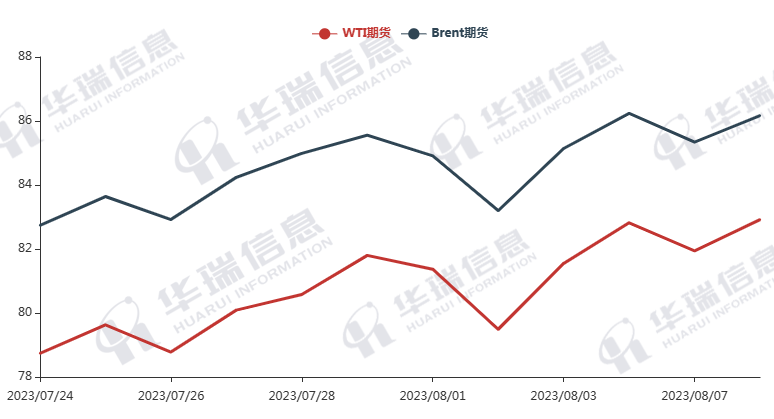

WTI/Brent (July 24th - August 8th, 2023)

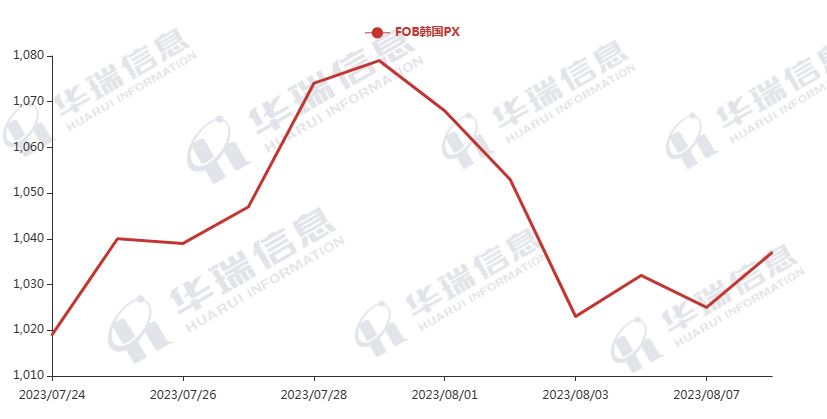

PX (July 24th - August 8th, 2023)

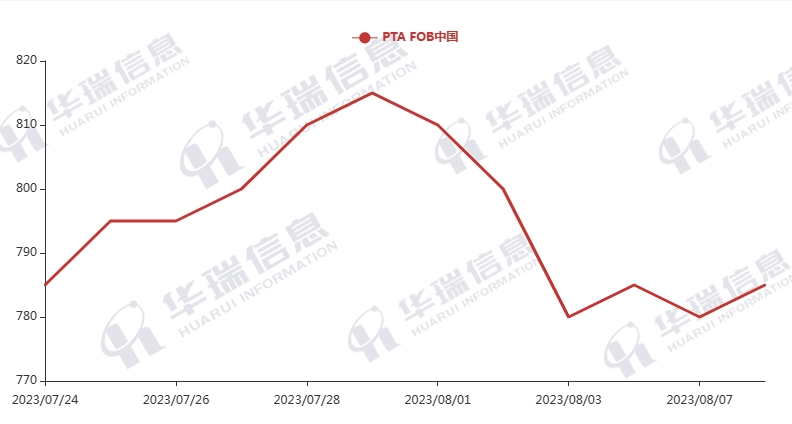

PTA (July 24th - August 8th, 2023)

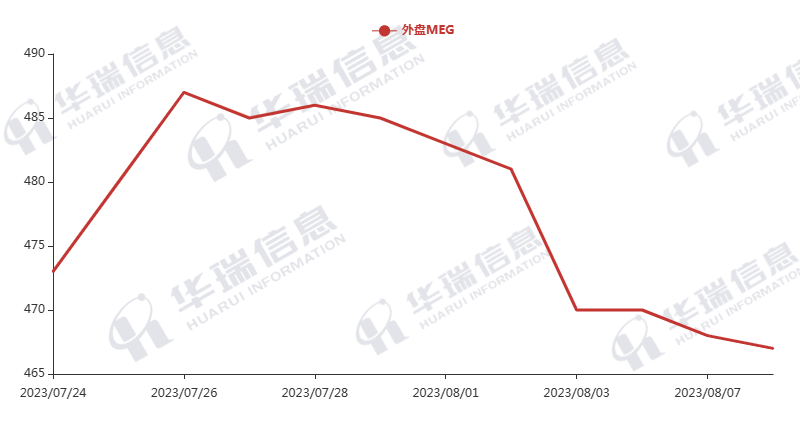

MEG (July 24th - August 8th, 2023)

1. Polyester Filament

The Crude Oil rebounded after a slight drop. The polyester raw materials followed the cost side to fluctuate.

Recently, the sales environment of autumn and winter clothing has improved. Many grey fabrics and cloth merchants plan to stock up, which offers support to the operation rate of texturing machines. Yesterday, the partial production and sales behaved not bad, reaching 300%. The market overall stays at a digestion stage.

It’s expected that the cost side will have a fluctuation in the short term, causing prices of polyester filament products to fluctuate accordingly. It’s important to pay attention to fluctuations in raw material prices, polyester load, and the situation of production and sales.

2. PSF

The PSF market had a not bad performance yesterday because of promotion. The production and sales improved. During the night trading session, Crude Oil futures rebounded, and the futures of polyester raw materials and PSF shock consolidated. Factories’ quotations in the morning session were mainly stable and deals were made based on negotiations. It’s important to keep a close eye on the market trend.

3. VSF

On Monday, prices of VSF products increased. The previous low-pricing policy has been canceled one after another, and the firm price has been rising steadily. The downstream market still has the intention to increase its stock. Partial factories have begun to show the situation of tight delivery to some extent. It’s recommended that you stock up moderately within your risk tolerance range.

4. Spandex

Last week, prices of spandex products increased by 500yuan/ton on average. On Monday, the spandex market saw mainly stable prices. A few factories increased their prices. At the moment, factories mainly offer stable prices to regular customers for them to stock up. It’s suggested that you purchase as per your firm order.

5. Nylon

The price of pure benzene continued to go up and had a tight supply. The transaction atmosphere of CPL and chips has eased. The downstream market was waiting and seeing since prices were high. The contract price has increased, causing high spinning chips to increase their prices accordingly. The market transaction was slowing advancing. It’s important to pay attention to the trend of bulk commodities and purchase as per firm demand.