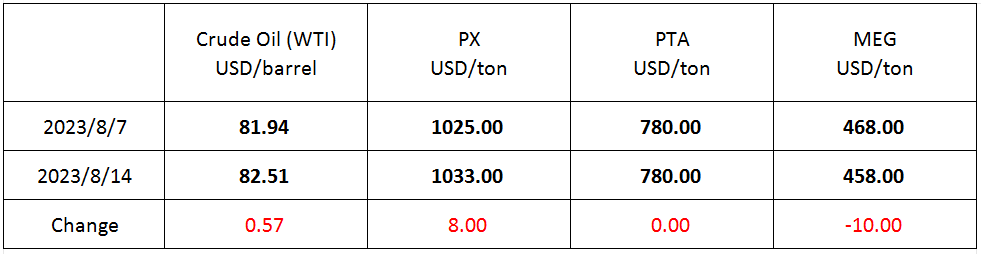

Market Trend (July 31st - August 15th, 2023)

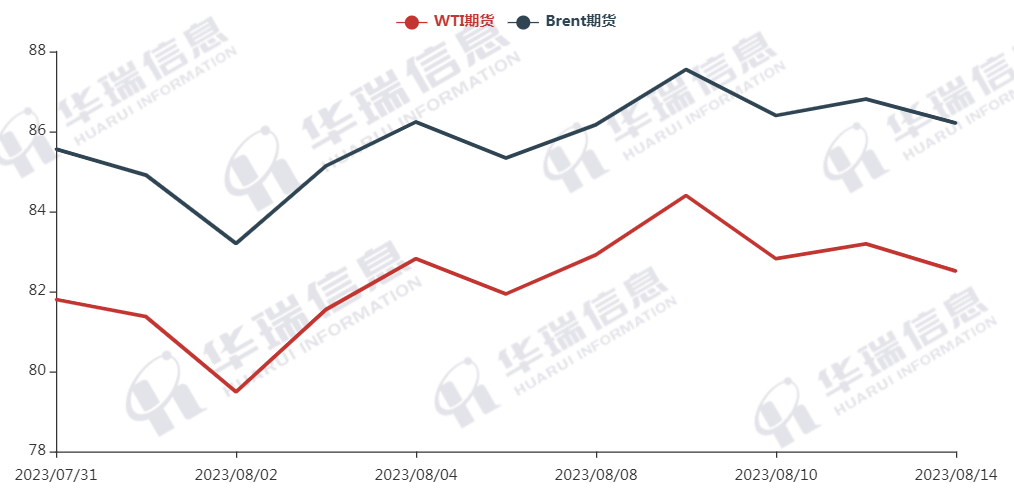

WTI/Brent (July 31st - August 14th, 2023)

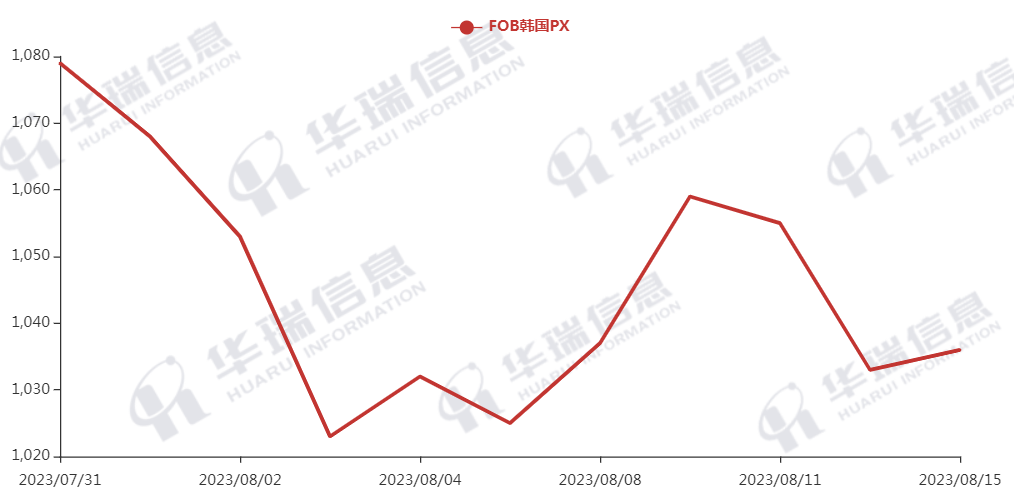

PX (July 31st - August 15th, 2023)

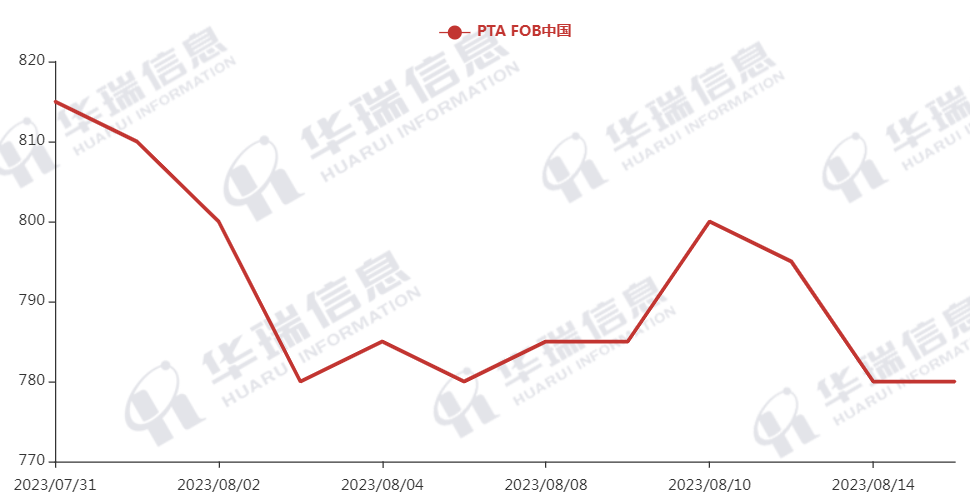

PTA (July 31st - August 15th, 2023)

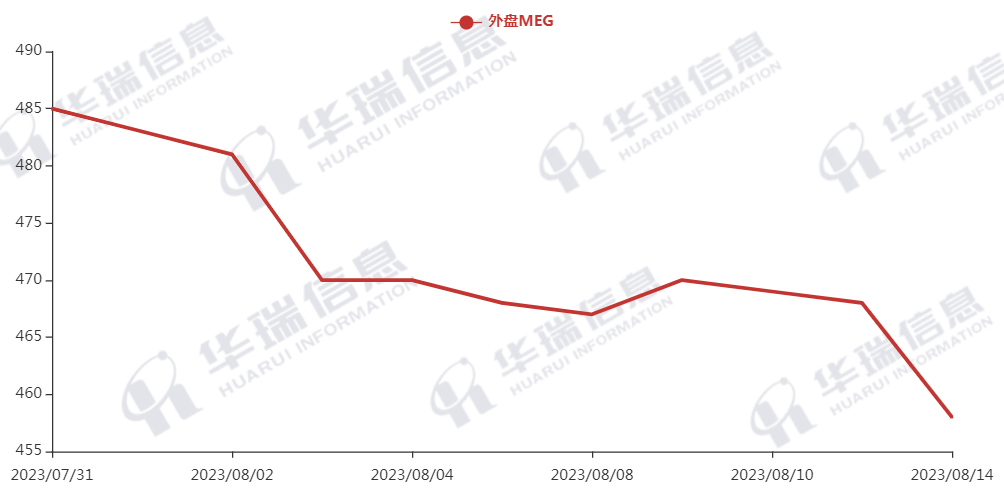

MEG (July 31st - August 14th, 2023)

1. Polyester Filament

The Crude Oil had a weak fluctuation these days. The cost of polyester raw materials fluctuated accordingly.

On production side, since the overall inventory pressure wasn’t high, the factories mainly keep prices stable, and transactions are based on negotiation.

It’s expected that the cost side will fluctuate in a narrow range in the short term. For long-term, it’s important to pay attention to fluctuations in raw material prices, polyester load, and the situation of production and sales.

2. PSF

The PSF market had an ordinary performance but improved slightly on Tuesday. During the night trading session, Crude Oil futures dropped slightly while the futures of polyester raw materials and PSF tended to be strong and consolidated. Factories’ quotations in the morning session were mainly stable and deals were made based on negotiations. At the moment, the downstream market has a wait-and-see atmosphere. It’s important to keep a close eye on the market trend.

3. VSF

The VSF market was mainly stable with a rise. Some factories increased the prices while others are expected to raise the prices this week. The previously low prices were canceled gradually. At the moment, because factories have no pressure on inventory and some of them launched centralized maintenance, the average prices tend to be increased. It’s recommended that you stock up moderately within your risk tolerance range.

4. Spandex

Recently, prices of PTMEG and pure MDI have gone up a lot, leading to a rise in the cost of spandex raw materials. On Monday, prices of some spandex products increased by 1,000yuan/ton. It’s suggested that you purchase as per your firm order and demand.

5. Nylon

The price of pure benzene fell slightly. The nylon raw material market dropped. The downstream market was mainly waiting and seeing as prices were falling. Part of spot chips also lowered the prices, following the trend of the raw materials. The contract prices were temporarily stable. The downstream yarn market was generally stable and purchased as per demand. It’s important to pay attention to the trend of bulk commodities. For the procurement side, it’s better to wait and see.