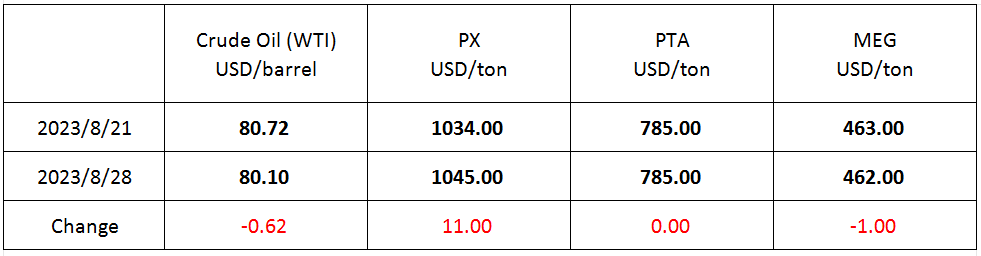

Market Trend (August 14th - August 28th, 2023)

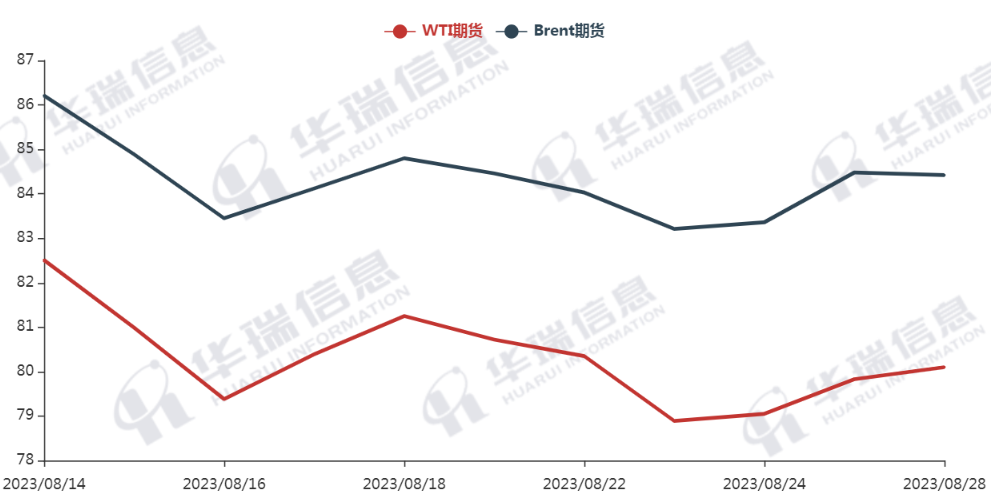

WTI/Brent (August 14th - August 28th, 2023)

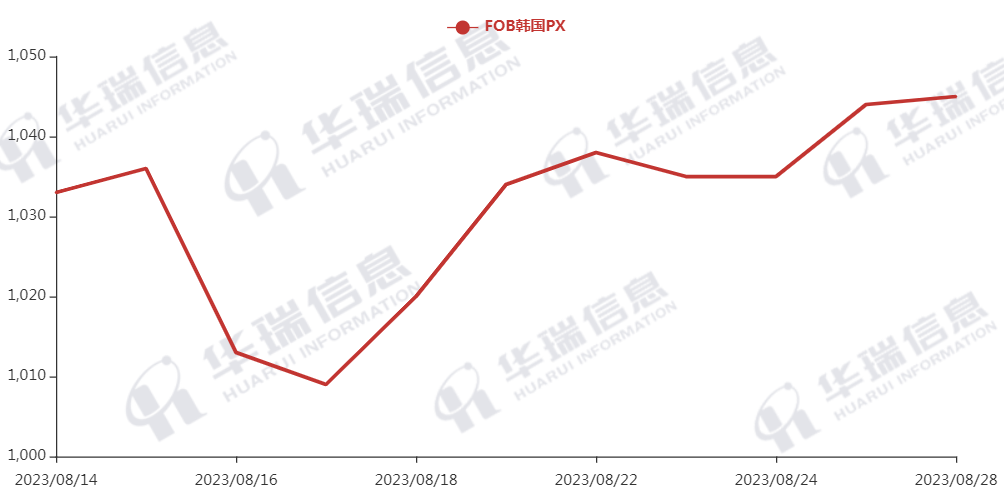

PX (August 14th - August 28th, 2023)

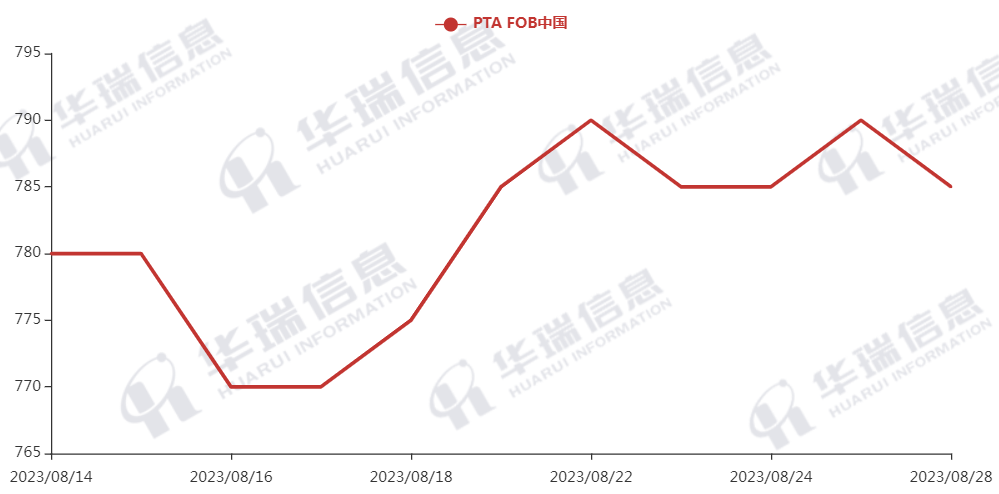

PTA (August 14th - August 28th, 2023)

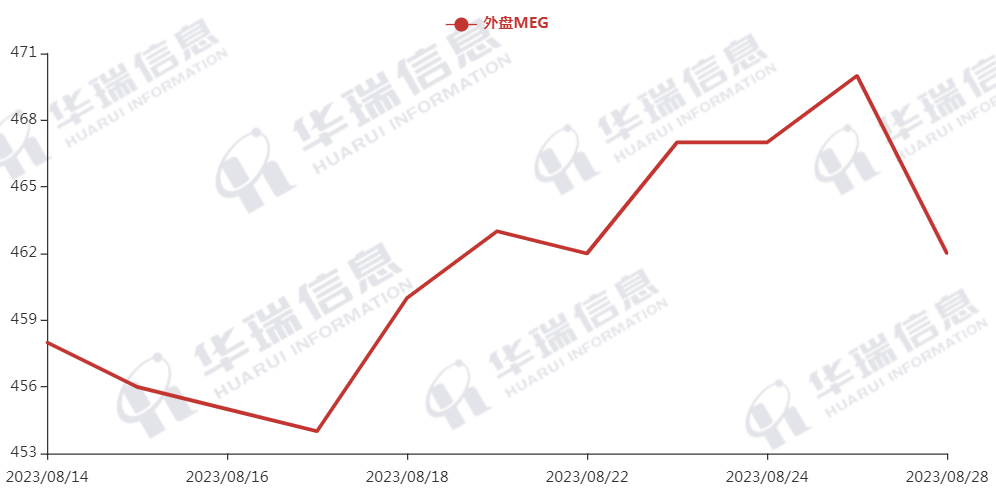

MEG (August 14th - August 28th, 2023)

1. Polyester Filament

On Monday, the Crude Oil fluctuated and had a flat end. The cost of polyester raw materials mainly remained stable.

On the production side, since the hot season is coming, the downstream has a growing demand. Factories’ operating rate has improved slightly, supporting the demand of polyester products. It’s expected that prices of polyester products will fluctuate within a certain range, in line with the cost side in the short term. In the long term, it’s important to pay attention to fluctuations in raw material prices, polyester load, and the situation of production and sales.

2. PSF

On Monday, deals in the PSF market were based on negotiation. Crude Oil futures in the night session went up slightly. Polyester raw materials and PSF futures had a strong

volatility. Spot quotations in the early trading kept stable. Generally, the market continues to fluctuate within a certain range. It’s suggested that you purchase as per your firm order.

3. VSF

The VSF market saw an intensive communication with the downstream during Shanghai Yarn Expo(8.28-8.30). Since the hot season is coming, the market has positive expectations for September. It’s recommended that you stock up properly within your risk tolerance range.

4. Spandex

Recently, the spandex market is mainly stable. It’s important to pay attention to the situation at Shanghai Yarn Expo(8.28-8.30) and the price trend. It’s suggested that you purchase as per your firm order and demand.

5. Nylon

The price of bulk commodities consolidated. The price of pure benzene continued to fluctuate. The trading of CPL gradually stabilized and it’s not easy for the price to either rise or fall. For the chips, the supply of spot goods at lower prices has decreased, but there wasn’t a good trading volume of spot goods at higher prices. Part of the downstream was still waiting and seeing. The semi-dull market was mainly stable. The nylon yarn market still focused on replenishment for the time being. It’s suggested that you stock up appropriately when prices are low.