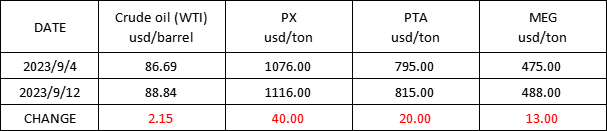

Market Trend (August 28th - September 12th, 2023)

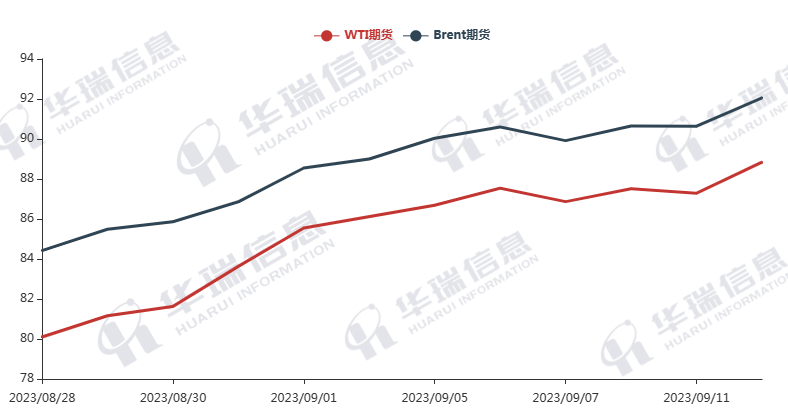

WTI/Brent (August 28th - September 12th, 2023)

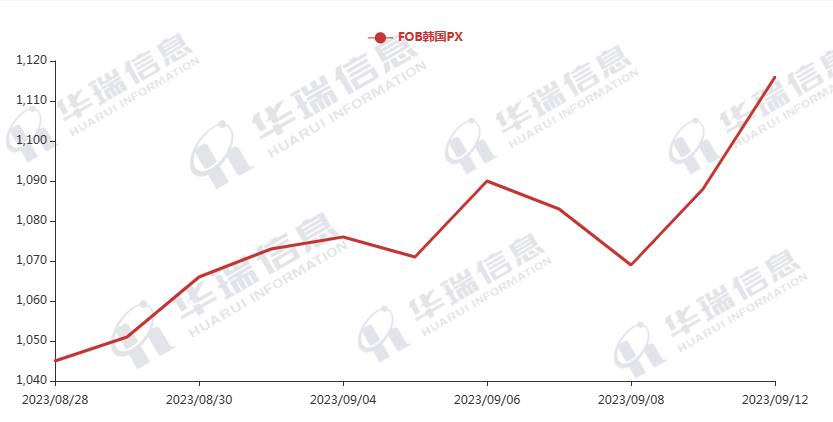

PX (August 28th - September 12th, 2023)

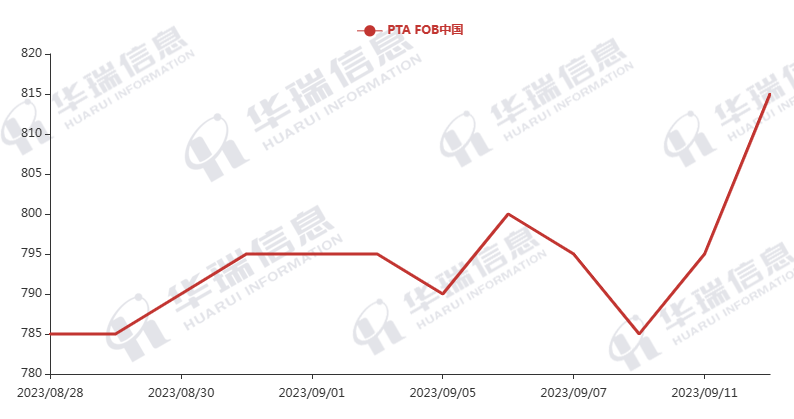

PTA (August 28th - September 12th, 2023)

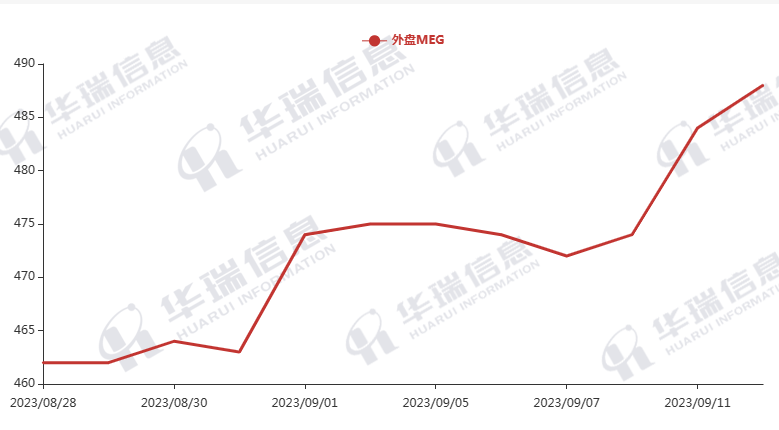

MEG (August 28th - September 12th, 2023)

1. Polyester Filament

The Crude oil keeps rising. At the moment, Crude oil still has a strong support from the macro environment. The cost of polyester raw materials remained strong accordingly.

On production side, affected by the rising raw materials, factories increased prices each day and most of them even increased twice in a day. And the production and sales were pretty hot yesterday,reaching the highest level at around 600%. During this hot season, the downstream is reducing their grey fabric inventory and increasing their demand for polyester products. The polyester market continues to reduce its overall inventory. Factories have a strong support from the cost side, so it’s easy for the price to go up but difficult for it to go down in the short term. It’s important to make a purchasing plan in advance. In the long term, it’s necessary to pay attention to fluctuations in raw material prices, polyester load, and the situation of production and sales.

2. PSF

The PSF market continued to remain strong. On Monday, the cost of PSF raw materials increased, causing the price of PSF products to rise.This trend is currently continuing. During the night trading session, Crude oil surged, and the futures of polyester raw materials and PSF went up sharply. Factories’ quotations in the morning session increased around 100cny/ton. It’s important to keep an eye on the trend of polyester raw materials and make a plan in advance.

3. VSF

The VSF market tended to be stable after rising, but continued to have a tight supply. It’s expected that the market will remain positive. It’s recommended that you stock up properly within your risk tolerance range.

4. Spandex

Supported by both the cost side and the downstream demand, the spandex market continued to remain strong. On the cost side, the price of PTMEG, the main raw material of spandex, increased by 1,000cny/ton. In the downstream market, there’s an increasing firm demand during this hot season. It’s suggested that you purchase as per your firm order and demand or stock up moderately.

5. Nylon

The nylon market has a strong support from the cost side. The price of pure benzene remained high. The price of CPL was increasing slowly. Chips factories were active in shipping goods, but the trading volume wasn’t as good as before because the downstream was waiting and seeing since prices of chip spot goods were high. The order quantity of nylon was satisfactory, but the recovery speed wasn’t as good as expected. The PA66 market rebounded to some extent. It’s suggested that you purchase as per your firm demand for the time being.