Market Trend (Sept. 26th - Oct. 10th, 2023)

WTI/Brent (September 25th - October 9th, 2023)

PX (September 25th - October 9th, 2023)

PTA (September 25th - October 9th, 2023)

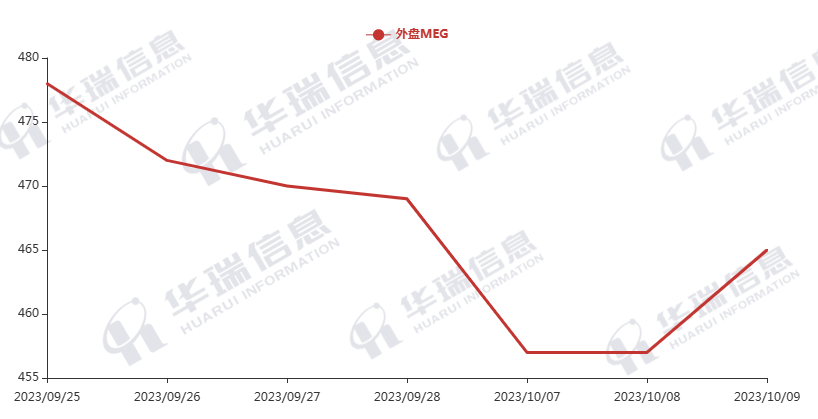

MEG (September 25th - October 9th, 2023)

The escalating Israeli-Palestinian conflict and Israel’s declaration of war have enhanced the hedging mode globally, which causes Crude oil to rebound.

1. Polyester Filament

On Monday, Crude oil went up. The cost of polyester raw materials increased accordingly.

The price of polyester products remained stable at the moment. In the short term, it’s expected that the cost side will fluctuate within a certain range, and the price of polyester products will follow the trend. In the long term, it’s necessary to pay attention to fluctuations in raw material prices, polyester load, and the situation of production and sales.

2. PSF

The production and sales of PSF was good, at an average level of 103%. Crude oil bounced back, offering support to the cost side. It’s expected that the downstream will increase their procurement volume in the short term. It’s important to pay attention to the trading volume this week.

3. VSF

The VSF market remained stable with a quiet atmosphere. The downstream was mainly waiting and seeing at the moment. It’s recommended that you keep a certain level of inventory.

4. Spandex

Recently, the spandex market remained stable. It’s suggested that you stock up as per your firm orders and demand.

5. Nylon

The price of CPL continued to drop, and the downstream remained cautious when purchasing. The cost of chips raw materials went down, causing the price of chips to fall as well, and the trading volume wasn’t good. The price quotation of nylon filaments stayed at a high level, and the downstream was mainly waiting and seeing. It’s recommended that you procure as per your firm demand.