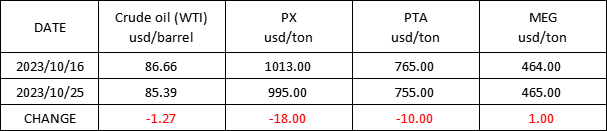

Market Trend (Oct. 9th - Oct. 25th, 2023)

WTI/Brent (October 9th - October 25th, 2023)

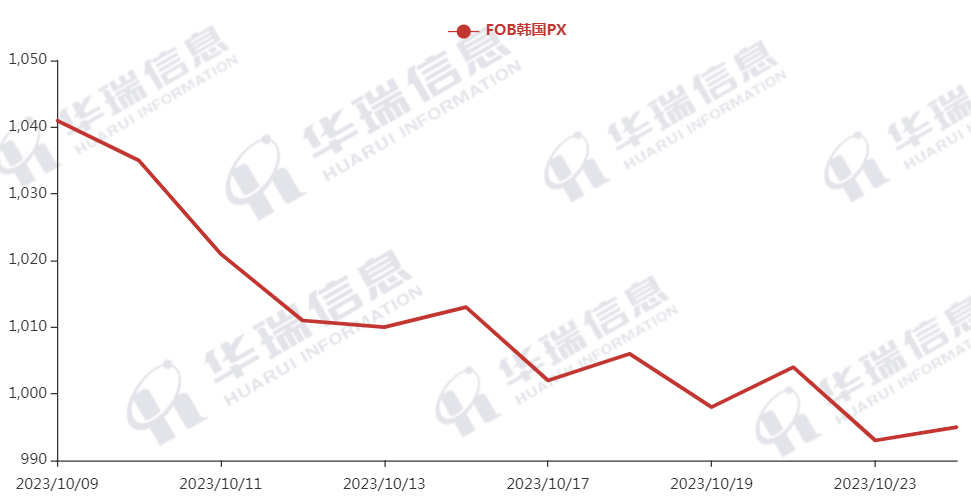

PX (October 9th - October 25th, 2023)

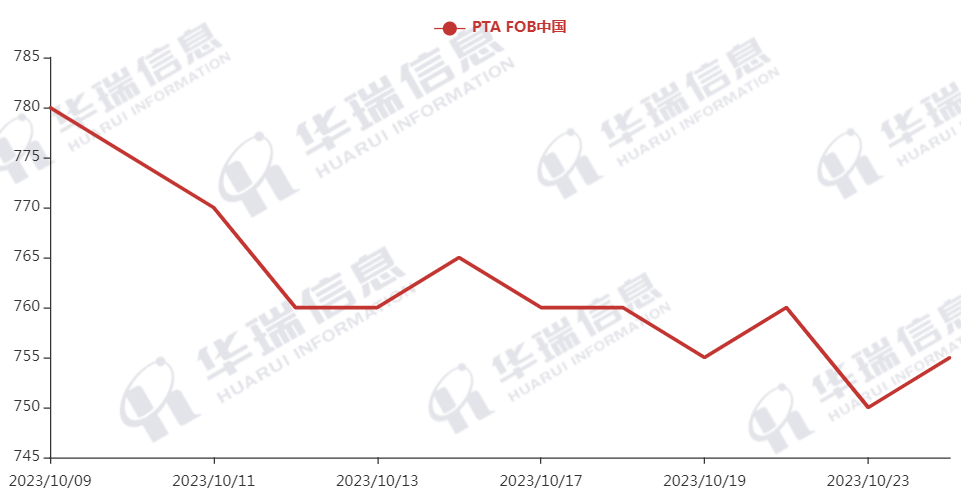

PTA (October 9th - October 25th, 2023)

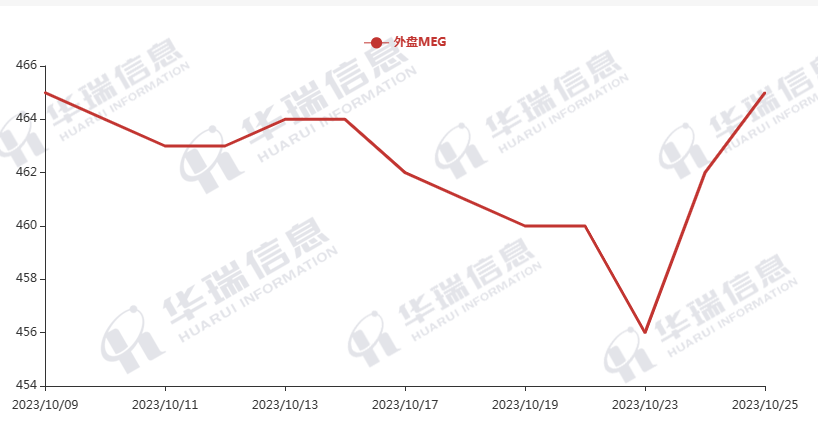

MEG (October 9th - October 25th, 2023)

1. Polyester Filament

The Crude oil fluctuates in a wide range. After dropping, it rebounded today. The cost of polyester raw materials follows to fluctuate.

On production side, the production and sales was not bad, especially yesterday afternoon, reaching around 200%. Regarding factories, they mainly maintain the prices but transaction is based on negotiation.

It’s expected that the cost side will fluctuate within a certain range, and the price of polyester products will follow the trend. In the long term, it’s necessary to pay attention to fluctuations in raw material prices, polyester load, and the situation of production and sales.

2. PSF

On Tuesday, the price of PSF products increased slightly and the trading volume improved.

During the night trading session, the futures of polyester raw materials and PSF increased sharply. Factories’ quotations in the morning session were stable for the moment and they focused on delivering to reduce inventory.

3. VSF

Recently, the VSF market remained stable with a quiet atmosphere. Factories had lots of orders in hand and continued to be active at shipping goods. It’s recommended that you keep a certain level of inventory.

4. Spandex

On Tuesday, the spandex market remained stable. Deals of bulk orders were based on negotiation. It’s suggested that you stock up as per your firm orders and demand.

5. Nylon

The price of pure benzene had strong fluctuation whereas the price of CPL remained stable. The trading of chips weakened slightly, but the price remained high. For high-speed spinning spot chips, factories’ inventory wasn’t high. The trading of nylon yarn remained stable. Supported by the cost of raw materials, the price of PA66 increased slightly. It’s recommended that you stock up when prices are low