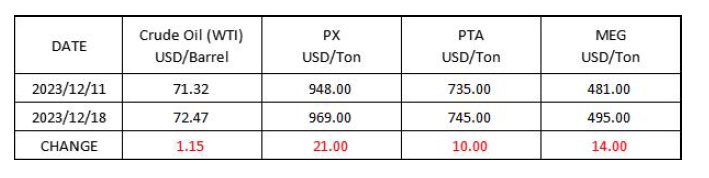

Market Trend (Dec. 4th - Dec. 18th, 2023)

WTI/Brent (December 04th - December 18th, 2023)

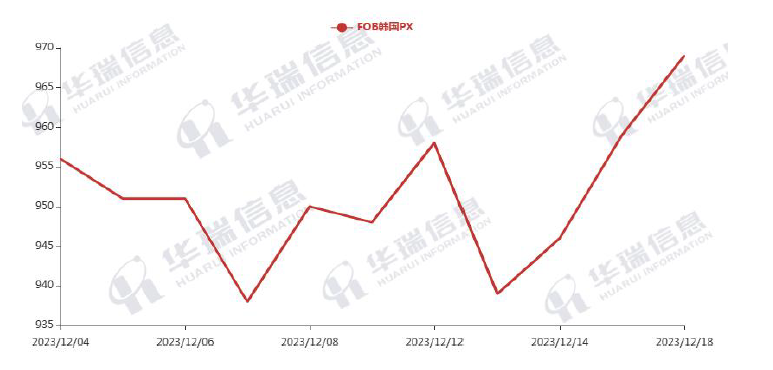

PX (December 04th - December 18th, 2023)

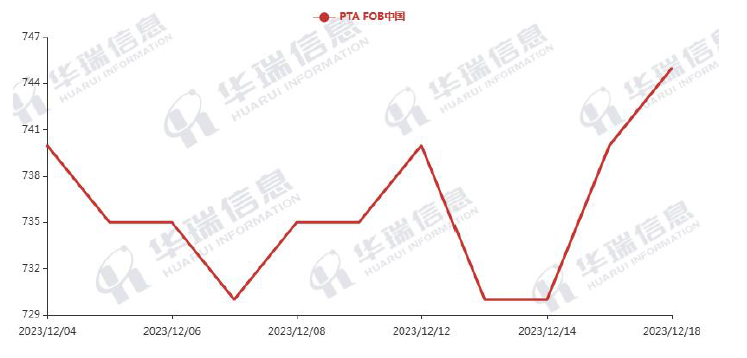

PTA (December 04th - December 18th, 2023)

MEG (December 04th - December 18th, 2023)

1.Polyester filament

After multiple attacks, the risks of Red Sea shipping have intensified. The Crude oil rebounded. The cost of polyester raw materials increased accordingly.

On product side, factories increased prices by 50-100cny/ton and narrow the negotiatingspace. In the meantime, factories have no inventory pressure currently and they keep high operating rate. The polyester filament market still has good support from the rigid- demand.

It’s expected that the cost will keep strong in the short term. It’s suggested that you make purchasing plans in advance to avoid unexpected risks. In the long term, it’s necessaryto pay attention to fluctuations in raw material cost, polyester load, and the situation of production and sales.

2. PSF

The PSF market performed general. Crude Oil in the night session went up, and the polyester raw materials and PSF futures increased accordingly. Morning quotations overall increased by 100cny/ton. It’s suggested that you purchase as per your firm demand or hoard up moderately.

3. VSF

The VSF market performed general.Currently, factories mainly execute in-hand orders. The transaction was based on firm demand. It’s recommended that you keep a certain level of inventory to avoid any risks.

4. Spandex

Currently the spandex market performed general. The transaction is based on negotiation. It’s recommended that you procure based on your orders and demand to avoid any risks like tight supply.

5. Nylon

Currently, the price of benzene keeps stable. The price of CPL rises slightly because of the bad transportation situation for the cold weather. Conventional spinning chips increase accordingly, while high-speed spinning chips remained stable. The supply is tended to be tight, It’s recommended that you keep a certain level of inventory to avoid any risks.